Market Dynamics: Bitcoin ETFs vs. Gold ETFs

In a significant turn of events, spot bitcoin exchange-traded funds (ETFs) experienced their largest daily outflow yesterday, with investors withdrawing nearly $1 billion. In stark contrast, spot gold ETFs are witnessing notable inflows, presenting a potential advantage for gold-backed cryptocurrencies.

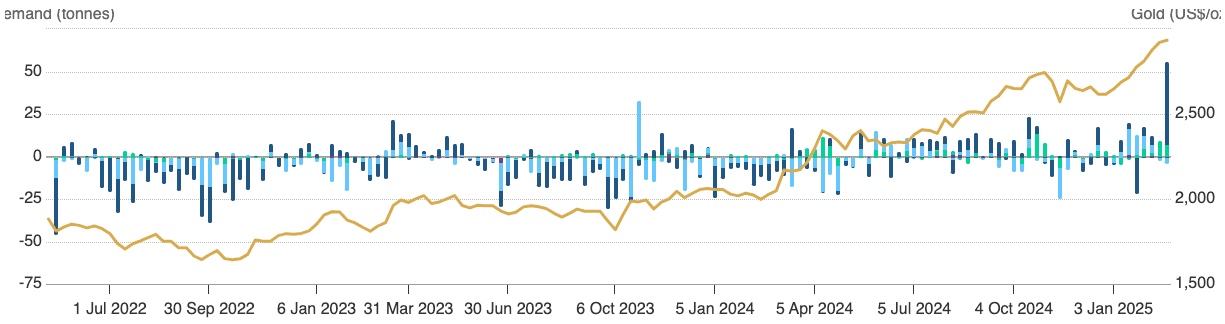

According to recent data from the World Gold Council, physically-backed gold ETFs recorded their most substantial weekly inflow since March 2022, amassing 52.4 tons of gold, equivalent to approximately $4.9 billion. This surge in demand has primarily been driven by North American investors. Currently, total gold ETF holdings stand at 3,326 tons, valued at around $314 billion.

Gold ETF demand has shown resilience in the face of market fluctuations. Despite some recent declines, the price of gold has surged by nearly 11% in 2025 alone and has risen 43% year-over-year, currently trading at an impressive $2,910 per ounce. Analysts attribute this upward trend to escalating geopolitical tensions and uncertainties surrounding potential tariffs announced by former President Trump.

Moreover, gold-backed cryptocurrencies such as Paxos Gold (PAXG) and Tether Gold (XAUT), designed to mirror the price of the precious metal, have outperformed the broader cryptocurrency market, which has seen a 26% increase year-over-year, as measured by the CoinDesk 20 Index. This performance has sparked heightened interest and demand for these digital tokens.

Recent data from RWA.xyz indicates that over $25 million worth of commodity-backed tokens were minted this month, marking the highest monthly volume since December 2022. In contrast, around $12 million worth of tokens were burned during the same period, highlighting a dynamic market environment.

As demand for gold continues to rise steadily, the supply landscape remains relatively stagnant. The World Gold Council reports that mining production in the fourth quarter of the previous year dipped by approximately two tons compared to the previous quarter, while both hedging and recycling activities increased. Overall, tracked supply experienced a modest growth of around 1% year-over-year.