Gold prices rose to a new high in two weeks in Europe as the US dollar softened early Monday morning, adding to cautious optimism. So what to expect now? Here are analyst Ross J. Burland’s predictions for this week…

The rise of precious metal

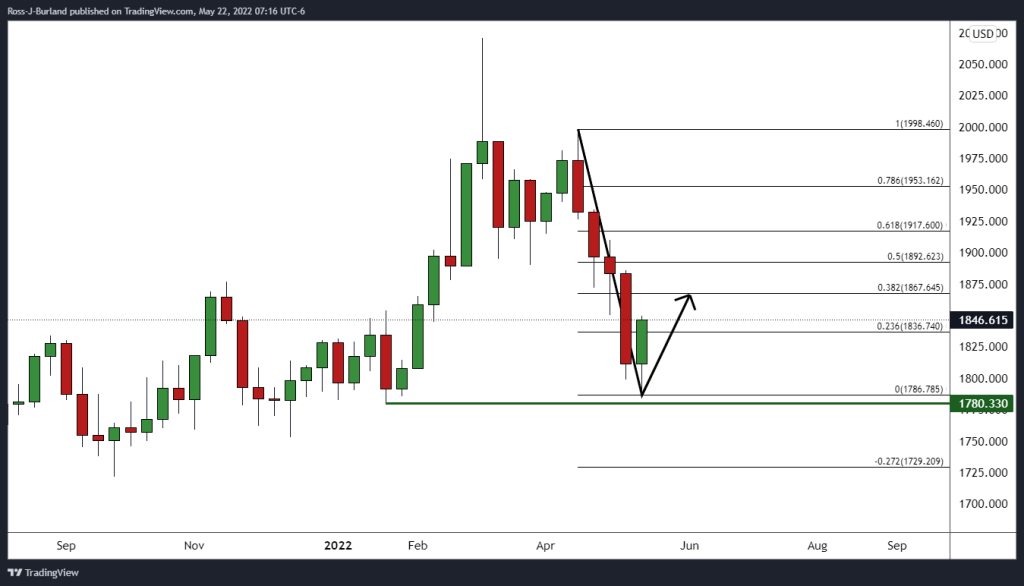

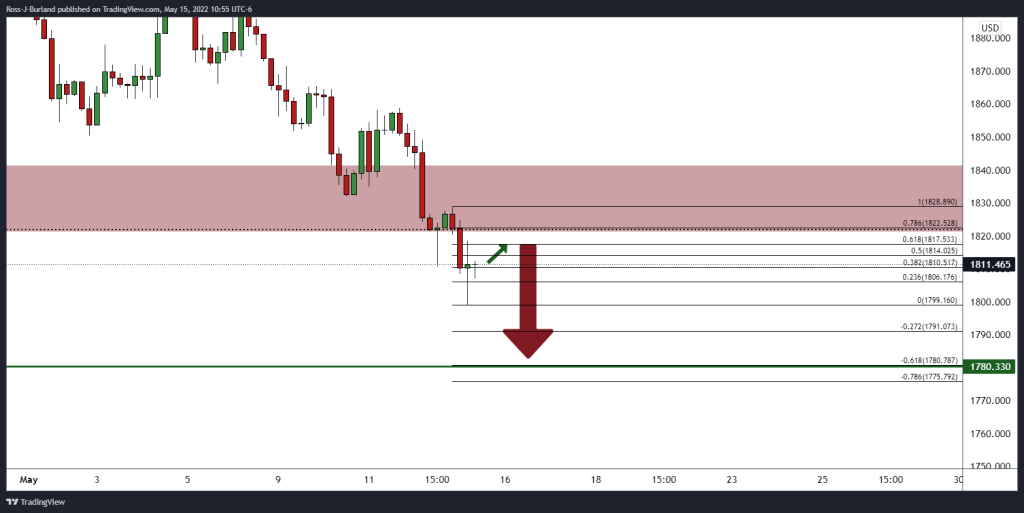

Gold prices on Monday, as we reported on Cryptokoin.com The day hit the highest level in more than a week in international markets as rising US Treasury yields continued to support gold, which was priced in a softening dollar, even as gains were capped. According to the previous week’s analysis, the price moved with a 61.8% Fibonacci retracement on the 4-hour timeframe, but the weekly target of $1,780 remains elusive as the bulls moved in at $1,786.78 last week. As shown below, the price was expected to correct 61.8 percent and then move down towards its weekly target of $1,780. The result was as follows:

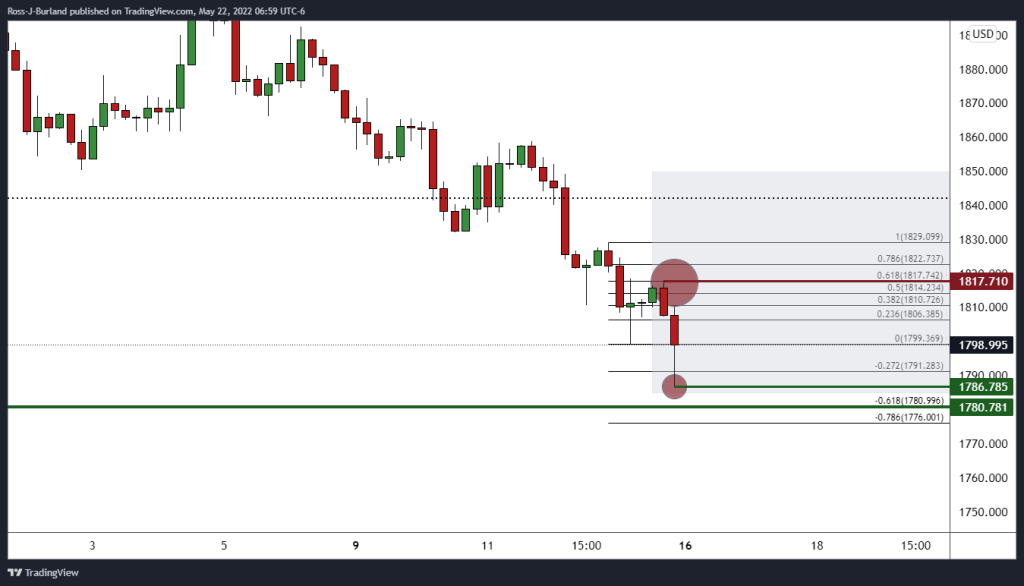

The price met 61.8% with an excellent touch before dropping towards the target. However, the bulls have moved above the level. The price has since rallied to test the levels around $1,850:

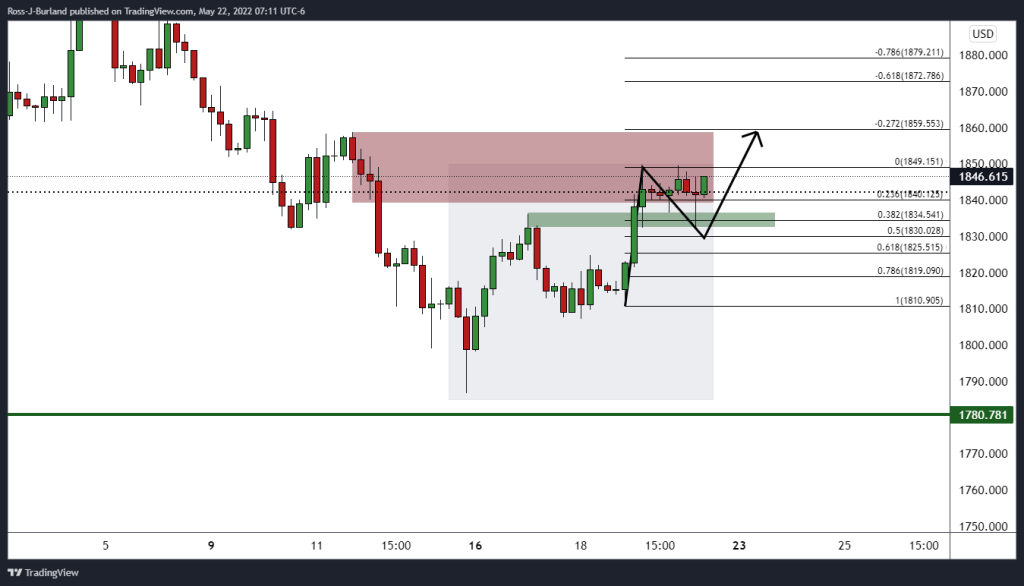

bullish prospect for gold prices

Price met resistance but percent The 38.2 rate test attracted the bulls. There are prospects for a deeper correction of the weekly bearish trend to drop the price imbalance on the four-hour chart to $1,858. After that, 38.2 percent Fibo of weekly levels is at 1.867:

A higher probability of move in 50 percent average reversal if bulls stick to purpose will be. Meanwhile, the analyst thinks the daily chart is challenging. Finally, according to the analyst, “the price has formed a W formation. This is a reversal pattern and the price is expected to readjust the neckline when the time comes. However, a resistance near $1,860 will need to be broken to open the way to the 50 percent average reversal target on the weekly chart for the coming days.”