Gold found some support on the last trading day of the last week of May, which could be a key for those shorting and seeking a deeper correction to the previous daily bullish impulse. Here’s what can be seen this week according to analyst Ross J. Burland…

Will bears dominate again below? As we reported on

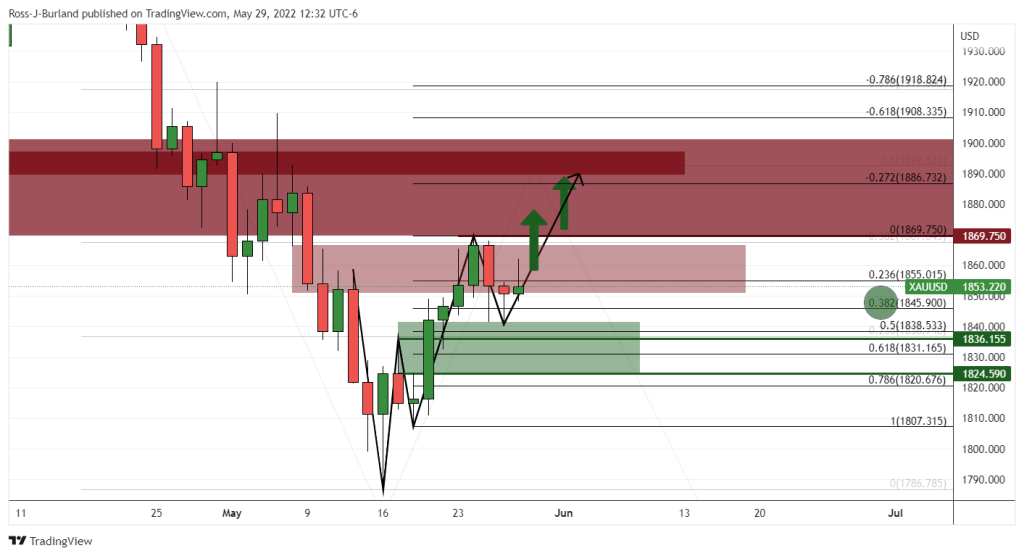

Kriptokoin.com , according to last week’s analysis, gold bulls were tasked to challenge critical resistance, price moved towards resistance but in line with daily W-formation. covered by the next supply. The multiple timeframe analysis below shows the current market structure and concludes that the bulls should hold the 1,850 level or the risk-hungry bears should take over again.

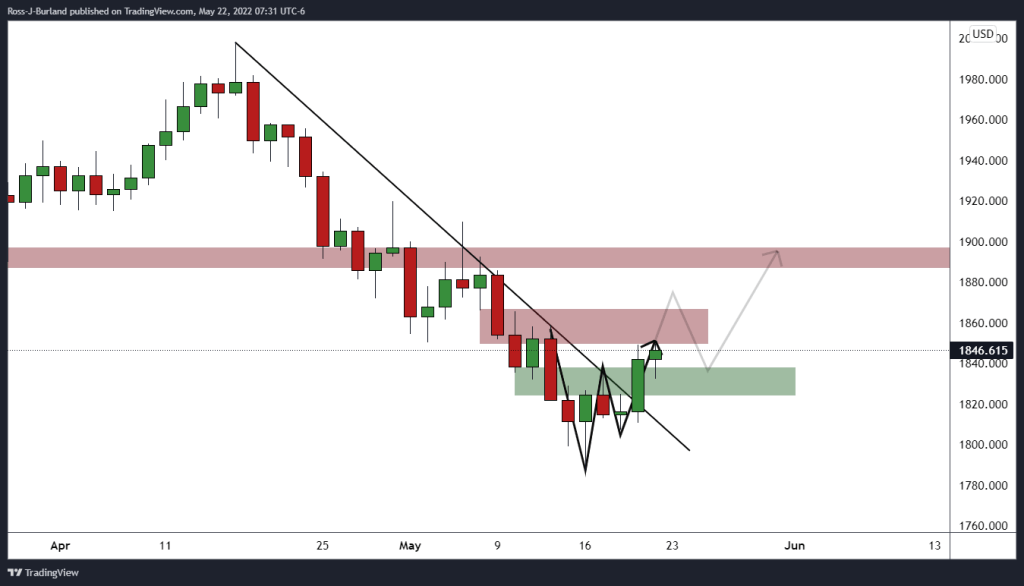

In the pre-opening analysis last week, it was stated that “expectations of a deeper correction in the weekly bearish trend to reduce the price imbalance on the four-hour chart to $1,858. After that, the 38.2 percent Fibo of the weekly impulse is located at 1.867.” The bulls reached 38.2% with some change and took a high of $1,869.75.

Analyst: Gold could approach $1,900

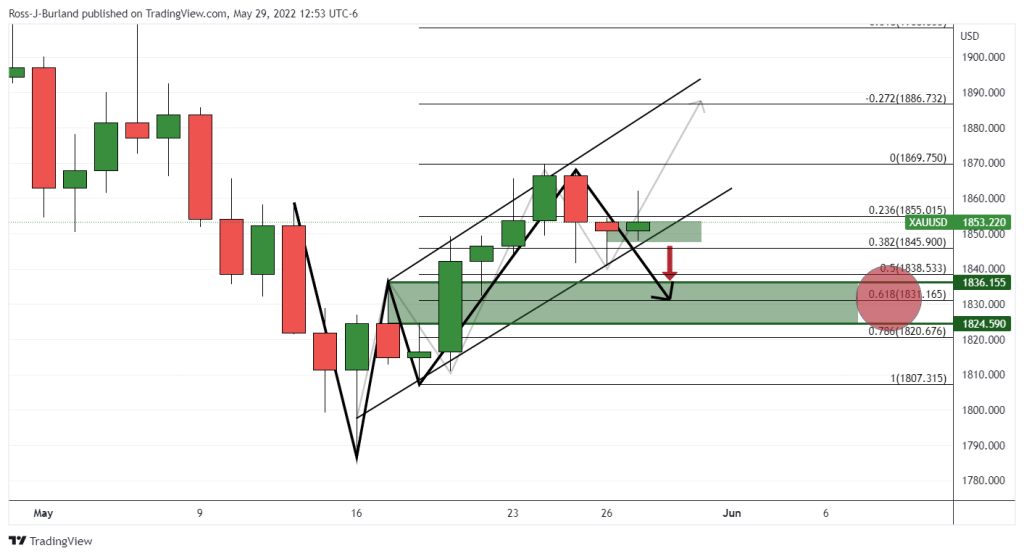

Although the 38.2 percent Fibo level is likely to be far enough for the bulls to make it The 50% average retracement target near $1,893 still holds. Last week’s bullish candle indicates that the bears are moving to maintain higher levels, but given that the bulls are generally in control, there are still expectations for a move higher before a breakout of the weekly low of $1,786.79.

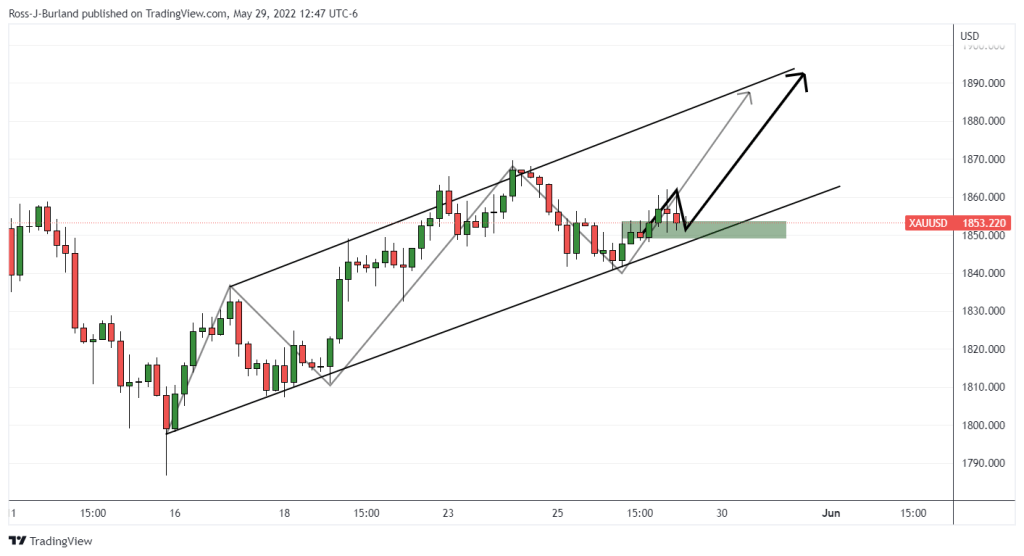

The price entered resistance and moved down and strengthened towards the neckline with a 38.2 percent correction, leaving any possibility of further bullishness on the cards in the coming days. “Here, on the four-hour chart, there is a bullish structure around the psychological $1,850 level where the bulls might be open,” Burland said. If the bulls commit, the weekly target of 50 percent will be observed,” he says. Looking at the hourly chart

, the price seems to have tested the $1,850 level, but should the bulls fail to break the short-term resistance, the bears may consolidate the price for another test at $1,850. dollars can be encouraged.