Gold is at an important crossroads in the bullish pattern that has taken shape over the past few weeks. A resistance breakout this week will be critical or the bears will come under control. So, what levels are next? What price levels will investors face on a weekly basis? Here is analyst Ross J. Burland’s weekly analysis…

Which level needs to be broken for a rise in gold price?

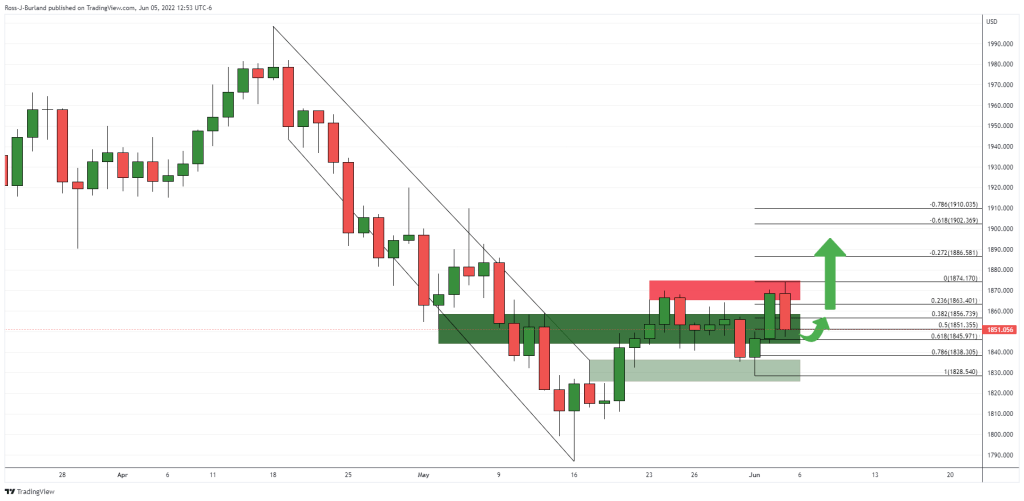

In last week’s pre-open analysis, gold bulls drew attention to a critical one-day resistance break; It was noted that there are expectations of a bull trend after the breakout from the downside channel. However, the resistance shown in the chart below needs to be broken.

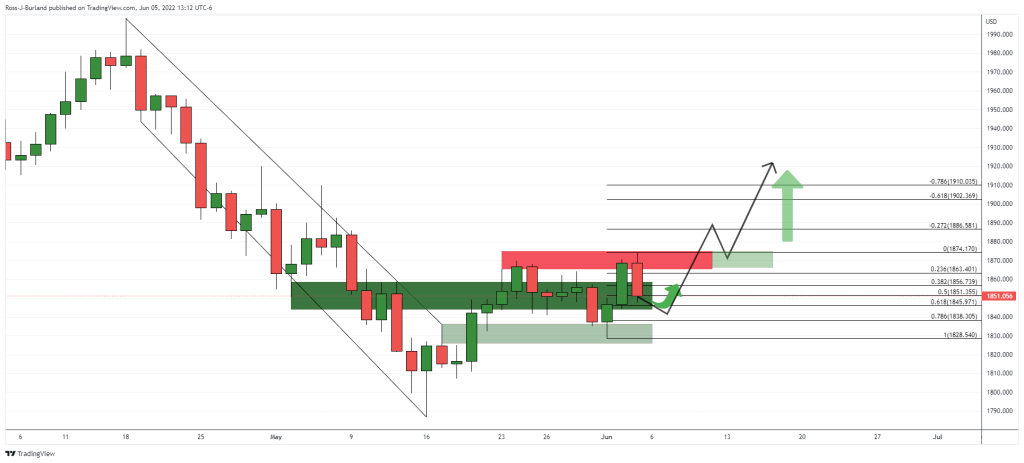

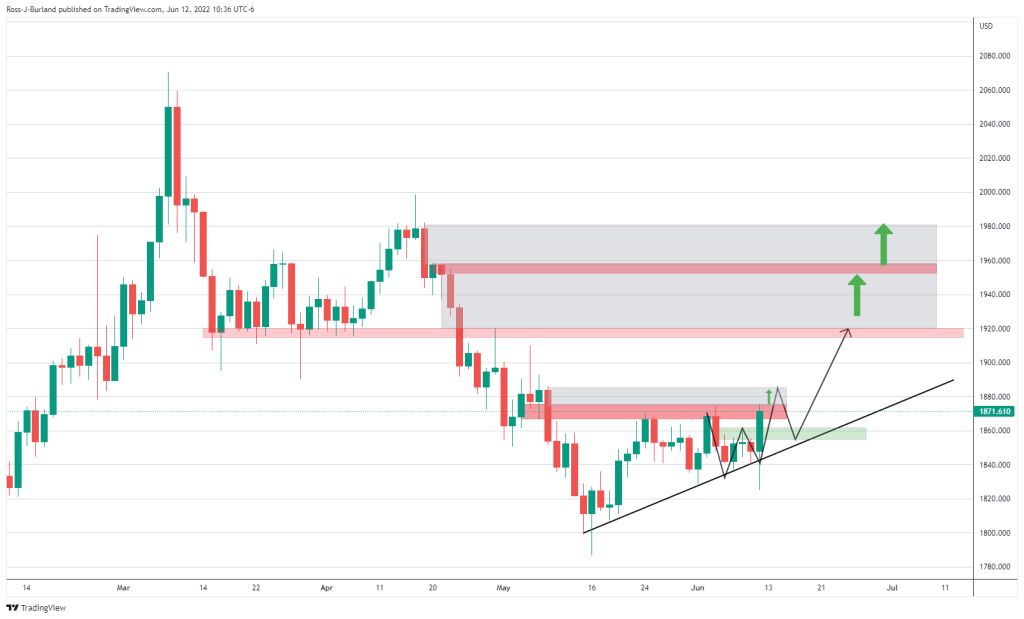

Last week, price laid the groundwork for a W-shaped breakout, according to the analyst. This is a reversal pattern in which price is expected to revisit the neckline support as shown in the projected price trajectory in the chart above. If the neckline holds again, as with the last two adjacent formations, the bulls will be on the run for an exit in the coming days. On the upside, a break of $1,920 could be significant as it leaves the price imbalance vulnerable to $1,957 before $1,982. On the other hand, if the bears commit to $1,885 or below, the downside risk could be the May 16 low of $1,786.

TD Securities analysts also quoted their comments

TD Securities analysts when it comes to positioning, gold market clarity is expected to add additional long positions and modest He stated that it remained quite sticky with the closing of short positions. TD Securities analysts used the following statements:

In fact, with the Fed’s next moves well indoctrinated, the group of discretionary traders more prominent since the pandemic period, unknown post-September Fed moves amid growing recession concerns unwilling to be shaken by it. “While this dynamic shows that gold prices are holding steady against a strong dollar and rising rates, we think the yellow metal will eventually succumb to the Fed’s fight against inflation.

What is the latest situation in the market? As

Kriptokoin.com also reported, gold prices hit a one-month high on Monday. It gained momentum from the sharp rise in the previous session amid concerns that an aggressive US Federal Reserve approach to tackling inflation could potentially deal a blow to the US economy. Spot gold rallied above $1,870. Gold is seen as a safe haven in times of economic crisis. At the beginning of the session, it saw its highest level since May 9 at $ 1,877.05 an ounce.

However, benchmark US 10-year Treasury yields also rose to their highest level since May 9, limiting demand for zero-yield gold. The dollar, which also limited the gains of the dollar-priced gold, climbed to the highest level in nearly four weeks. Gold prices were volatile on Friday as focus shifted to economic risks after rising US inflation data supported bets on aggressive rate hikes.