Gold is displaying a stable auction profile above $1,770 as investors await the US CPI, according to market analyst Sagar Dua. Market analyst Ross J Burland notes that gold has been under pressure at the end of last week, potentially limiting its bullish trend. We have compiled analysts’ technical assessments and forecasts for our readers.

“Strong US NFP will support Fed’s aggressive rate hikes”

The US dollar index (DXY) is following a fluctuating course after encountering roadblocks around 106.80. Therefore, the gold price stays in a narrow range of $1,771.60-$1,776.30. The precious metal made a bearish move after record US Non-Farm Payrolls (NFP) data. Now it is trading in the consolidation zone.

cryptocoin.com As you follow, the US economy added 528,000 jobs to the US labor market. This is significantly above expectations of 250,000 and the previous 372k. According to market analyst Sagar Dua, gold will support the Fed’s unwavering interest rate hike. The growth rate in the US economy is solid as a rock. Surprisingly high US NFP will push Fed policymakers to act hawkish as US companies’ hiring process stalls.

The eyes of the gold markets will be on the US CPI

Meanwhile, DXY delivered all of its intraday gains. It fell below the opening price. Now investors are waiting for the US Consumer Price Index (CPI) to be released. The annual inflation figure is likely to remain low at 8.7% compared to the previous 9.1%. According to the analyst, the continued negative course of oil prices in July may be the critical factor for a reasonable decline in CPI.

“Gold sees establishment above $1,770”

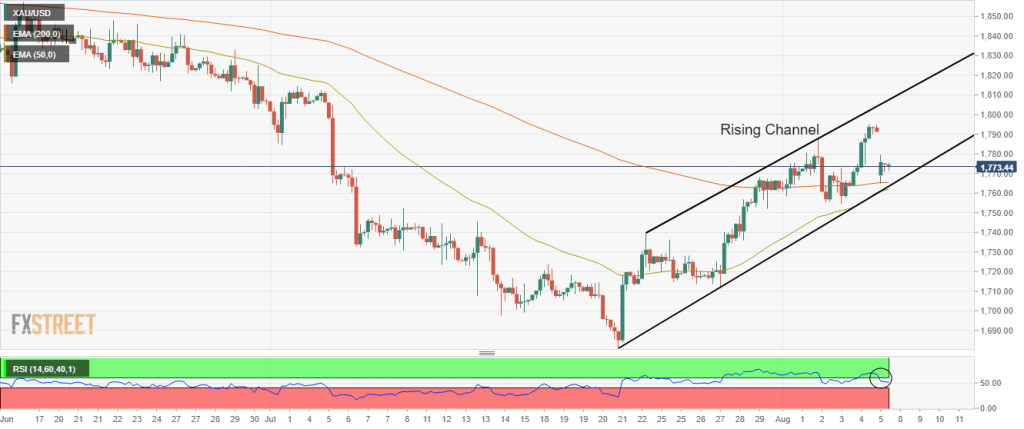

Analyst Sagar Dua depicts the technical outlook for gold as follows. On a four-hour scale, gold price is dipping towards the bottom of the ascending channel at $1,681.87 as of July 21. The top is drawn at the July 22 high of $1,739.37.

The precious metal defended the 200-period Exponential Moving Average (EMA) at $1,765.80. Also, the shiny metal is holding above the 50-EMA at $1,760.00. This shows the power of gold. Meanwhile, the Relative Strength Index (RSI) (14) slipped into the 40.00-60.00 range. This shows that the gold bulls have not been holding the bullish momentum for a while.

Gold technical analysis: Bulls afloat against strong winds

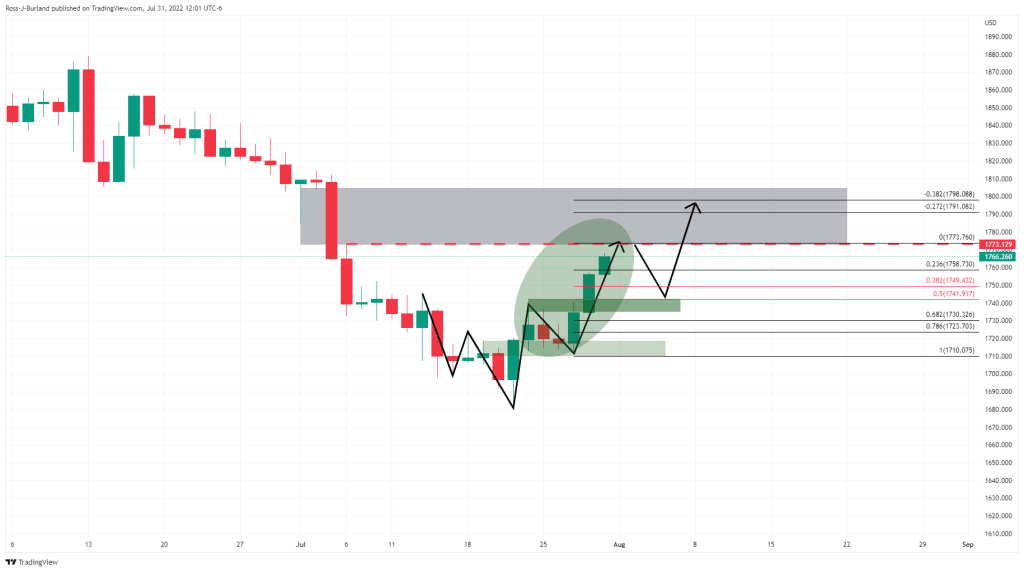

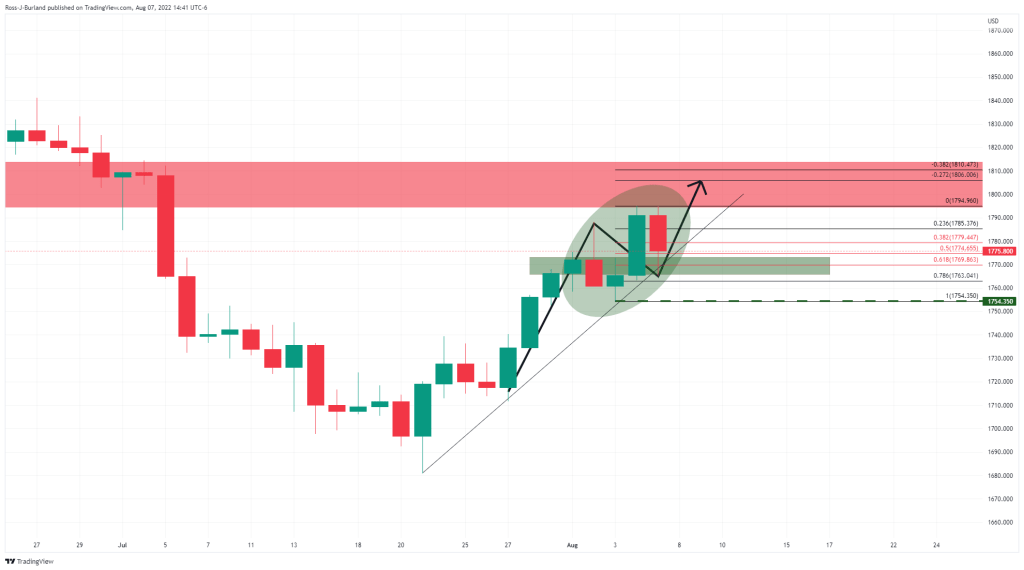

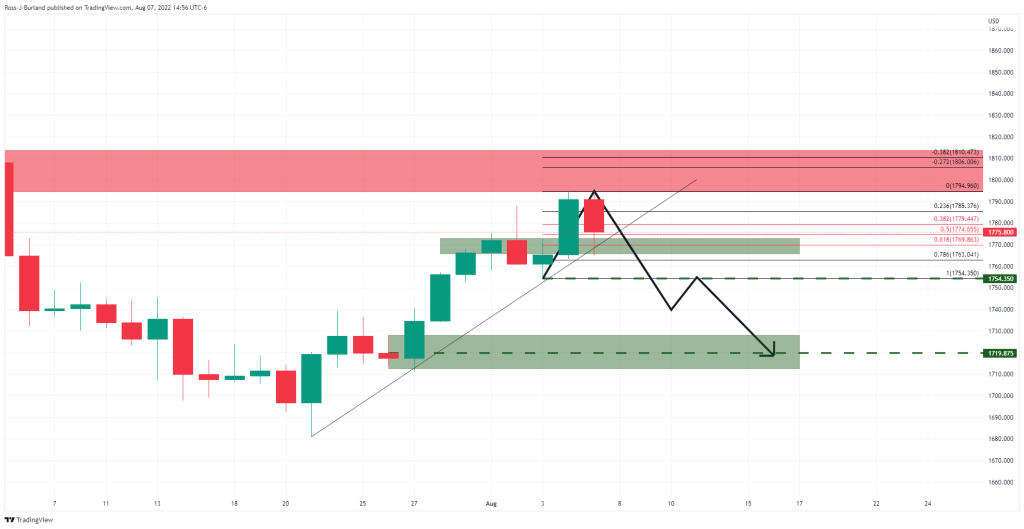

Market analyst Ross J Burland draws attention to the following levels in the technical analysis of gold. According to last week’s pre-opening gold analysis, gold bulls are moving in the critical recovery zone. Gold came roughly $5.00 close to its $1,800 target, just shy of 61.8%.

At the opening last week, we noted that taking profits is a possible scenario. We noted that this would also result in a pullback in price before the next potential spike to reduce the price imbalance between $1,772 and $1,804. $1,754 stands as a key structure in the market for the week ahead. This is what we have.

As long as the bulls commit at this point, the price will respect the trendline support of the previous bullish impulse and the key Fibonaccis cluster. However, a break of $1,754 risks a significant downside move with the eye of $1,720.

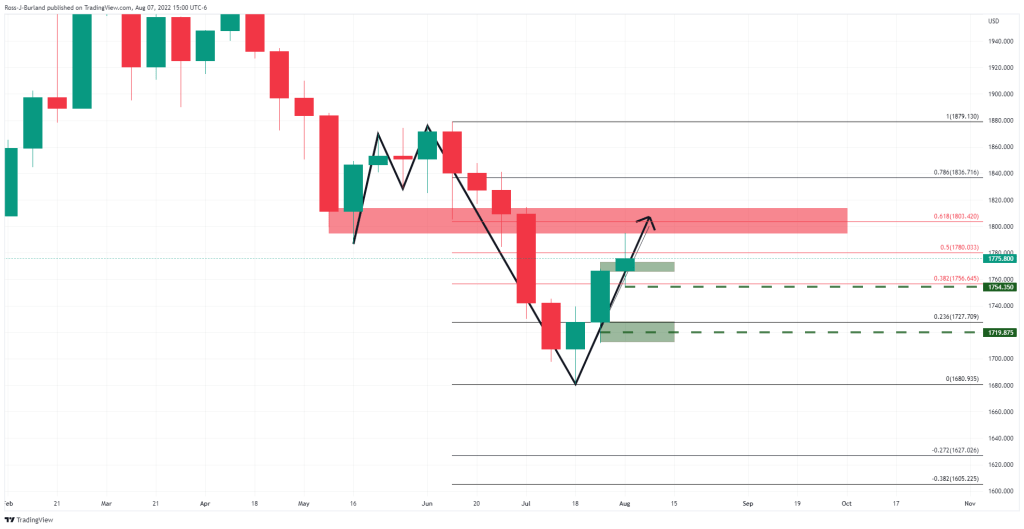

Meanwhile, on the weekly chart, it aligns with the 61.8% Fibonacci M-form as follows:

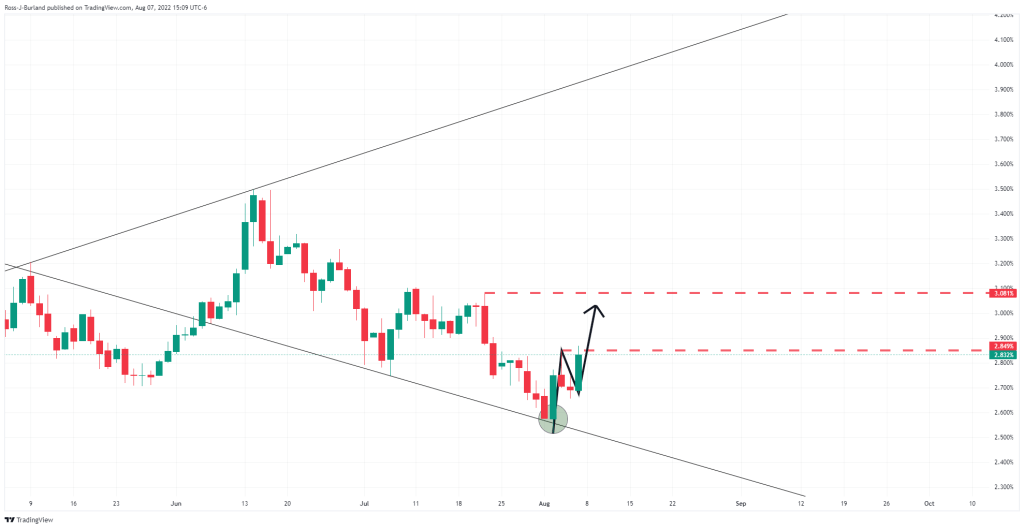

The M-form is a reversal pattern that pulls the price to the neckline resistance. Last week’s candle has a bearish stance. However, the bulls are still in the game for the next week as the daily chart shows. However, the fundamentals are opposed. This will be linked to the rally in the US 10-year Treasury yields, driven by the support of the following technical analysis and broadening pattern: