Gold is accumulating above $1,700. Eyes on a major bullish correction. On the other hand, those who anticipate bearish anticipate that the rally will eventually face a bid wall. So, what levels can be seen during the week? Analyst Ross J. Burland says XAU/USD bulls are trying to “catch the falling blade”. It also points to certain levels. Here are the details…

TD Securities drew attention to the positions of gold traders

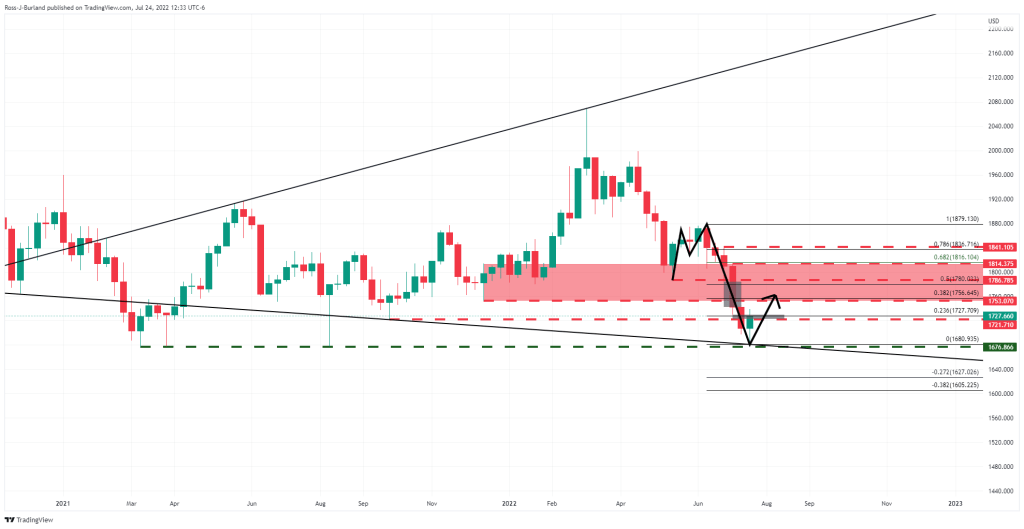

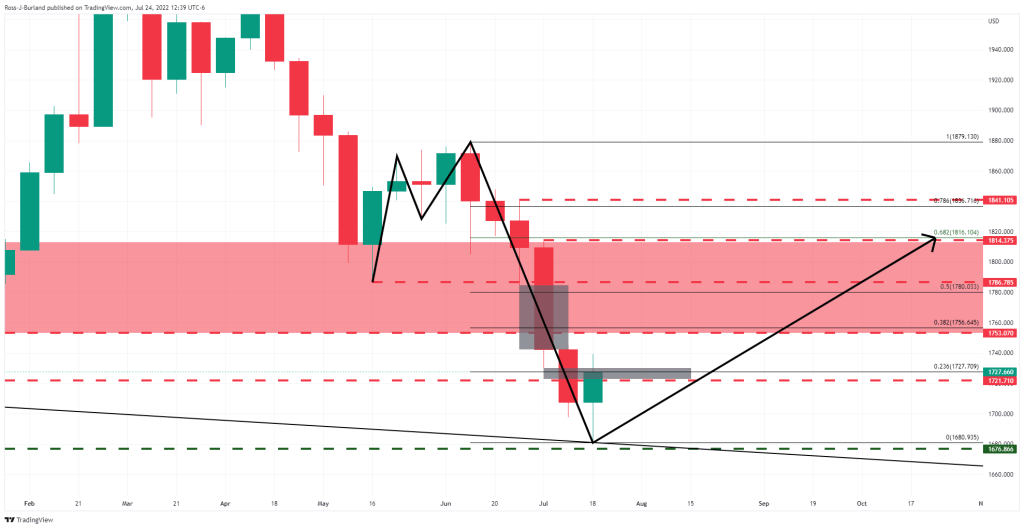

According to previous analysis, the gold price may be on the verge of a significant correction. According to the analyst, the Fed meeting will be decisive. Currently, the gold price has eased a significant price imbalance on the weekly chart ahead of this week’s Federal Open Market Committee meeting. Burland says he looks at the market from a fundamental perspective. He argues that a correction may make sense, as the conflict between slowing growth and rate hikes will add volatility to gold prices. Recession fears caused a turnaround in rates markets, which began pricing high rates for a 100 basis point gain.

This allowed the gold price to correct higher for a weekly upside close on Friday. If the Fed’s rate decision this week is in line with the recent flattening in US yield curves, gold price is expected to keep its corrective trajectory away from the decline. On the other hand, analysts at TD Securities are looking at traders’ positions. The giant position held by the average trader still appears to be almost twice its typical size, according to the company. They suggest that as prices fall, there will be a significant amount of boredom in the gold markets. It uses the following expressions:

We have yet to see a capitulation below, suggesting that the last rally will eventually face a bid wall.

Loss of yield on US 10-year bonds

Meanwhile, technical factors may emerge. First of all, the decline in bond yields can be taken into account. The 10-year yield is trading around 2,734 percent, the lowest since May 27. It can be expected to support gold prices, but it is stated that the expanding formation providing more room to the downside is challenging.

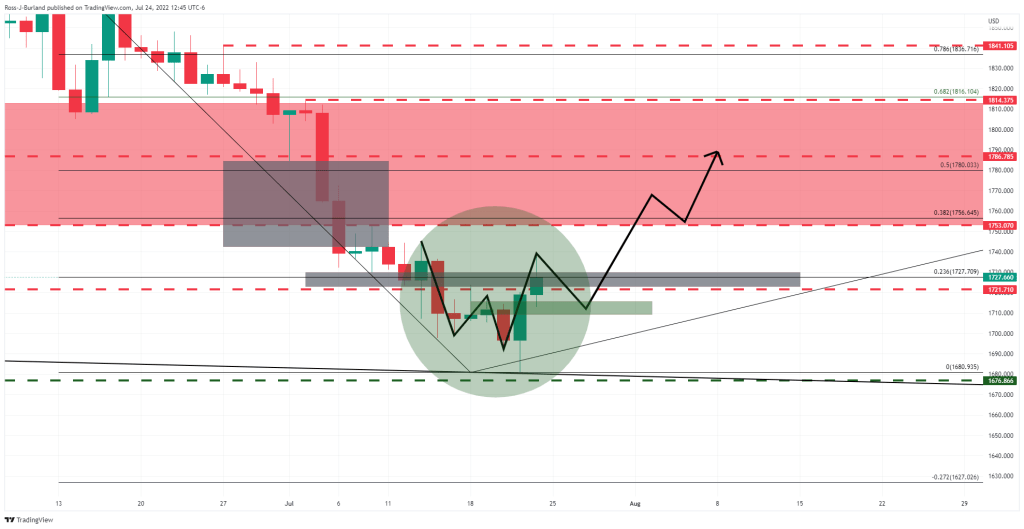

cryptocoin.com As we have also reported, the M-form is a powerful feature on gold charts. If the next major area of price volatility is mitigated, the cards have an average return of 50 percent, according to the analyst. Meanwhile, the W formation on the daily chart is pointing towards $1,700 before a full rise in the coming days. According to the analyst, this indicates a possible drop above gold, which is expected to revisit the neckline of the formation.