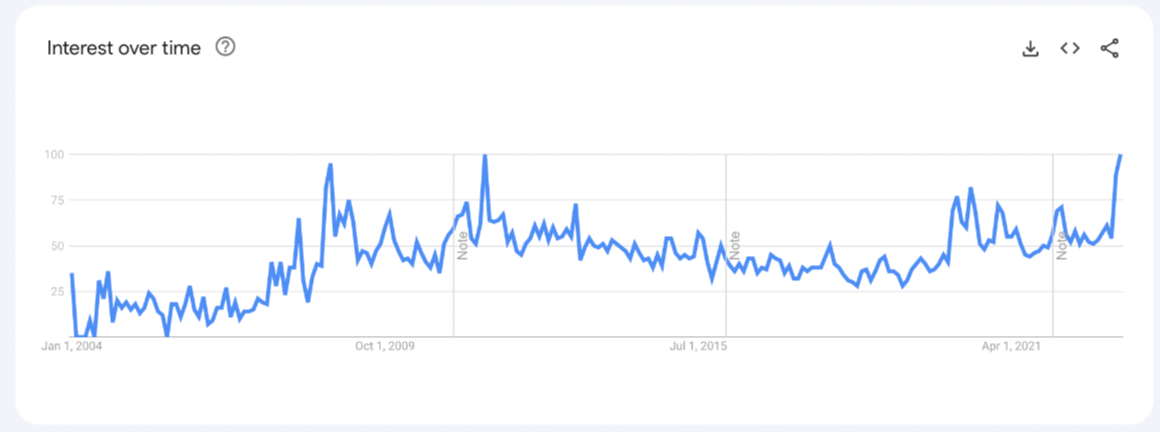

According to data from Google Trends dating back almost 20 years, searches for the question “how to buy gold” on Google soared to record levels in the US, with the price of gold hitting all-time highs in April.

Gold market is witnessing a big rally

The phrase reached record popularity this month. Even when gold broke new records in 2020, rising above $2,050, the search query wasn’t that high. Interest was last so widespread in the US in August 2011, when prices first exceeded $1,900. Gold peaked after that. However, it remained lower until the next rally in 2020 that took prices to new highs. Data from Google Trends dates back to 2004.

The gold market is witnessing a major rally that started with the banking crisis in March. Spot gold is up about 10% year-to-date and was last at $2,08.70. Since hitting a 13-month high two weeks ago, gold has been trading around $2,000 as investors sell the rallies and buy the lows.

Weakness in the US dollar supports gold

All eyes are on the Federal Reserve’s potential pause after its expected 25 basis point increase in May. Moreover, the weakness in the US dollar also plays a major role in the rise of gold, according to analysts. Lukman Otunuga, senior research analyst at FXTM, comments:

Repeated signs that price pressures are cooling and disappointing US economic data could add further fuel to expectations that the Fed will pause and ultimately cut rate hikes.

Investors will follow US GDP and PCE data

cryptocoin.com As you’ve followed on , investors this week are paying close attention to the US Q1 GDP data and the Fed’s preferred inflation measure, the core PCE price index. The announcements will be on Thursday and Friday, respectively. Lukman Otunuga shares the following comment:

US economic growth in the first quarter is expected to be moderate from 2.6% in the previous quarter. Also, persistent price pressures may be present in Friday’s core PCE report. Ultimately, if the data supports the expectations that the Fed will pause interest rate hikes after May, it is possible that this situation will push the dollar down.

Gold will rise even higher in the long run!

Meanwhile, gold is stuck in a narrow range for now. The uncertainty surrounding the direction of the Fed’s future monetary policy decision is effective in this. Based on this, Otunuga makes the following comment:

While markets now expect US interest rates to peak in the summer and cut rates by December, gold will rise even higher in the long run. Price action shows that a new catalyst is needed to trigger an uptrend or downtrend. A strong move above $2,000 could lead to a rise towards $2,025 and $2,048. If prices stay below $2,000, it is possible for gold to test $1,950 and $1,900.

Gold price parallels financial crisis

Many analysts expect new record prices when markets decide when the Fed will act this year. Mike McGlone, senior macro strategist at Bloomberg Intelligence, said:

We see that the gold price has potential parallels with the financial crisis. This will place the next key round number resistance towards $3,000. The metal started 2008 around $850 and peaked in 2011 at around $1,900.

Gold likely to make a move to $2,100

Bart Melek, head of global commodities strategy at TD Securities, says gold is likely to make a “sustainable” move to $2,100 this year, despite the risk of serious selling in the second quarter. The strategist explains these views as follows:

Risks are on the upside if monetary authorities are seen to dovetail before inflation approaches the target in a meaningful way. In fact, positioning suggests that the discretionary investor community could be a catalyst for prices to rise significantly above our year-end target as they have plenty of room to grow long exposure.

Factors supporting gold at high levels

These factors are: low nominal and real interest rates, US dollar concerns, strong physical buying, and continued interest from central banks. On top of that, Nicky Shiels, head of metals strategy at MKS PAMP, says there has been an unresolved debt ceiling debate, which will increase volatility and possibly upside pressure on gold. Shiels explains:

There has been unprecedented political turmoil in the last 2 years. Given this, some gold risk premium needs to be priced in for this low-probability, but high-impact, potential event. This probably explains why gold is holding more than $1,950 despite the Fed’s renewed hawkish tone… Gold bulls say that America can no longer meet its obligations to its citizens, America has a spending problem, and America’s tax revenues are only 5 percent of government spending. He did not forget the fact that he met the 4th.