Market analyst Anil Panchal says the price of gold lacks any upside momentum, even though it bounced from a two-week low ahead of key US jobs data. Gold, while taking cues from stagnant markets, is also failing to capitalize on softer US Treasury rates and a pullback in the US dollar amid mixed concerns.

Gold investors’ eyes will grace the data calendar US ADP and NFP

Gold traders to break the current stalemate, along with monthly data from the US ADP Employment Change, May They are eagerly awaiting the data of the Non-Farm Payrolls (NFP) to be released on Thursday and Friday, respectively. The data is gaining traction amid the Fed’s latest hawkish comments and the upbeat US statistics that have recently renewed the central bank’s calls for aggressive rate hikes. According to the analyst, if the announced figures match the optimistic forecasts, the expected recovery of the US Treasury yields and the US dollar may put pressure on precious metal prices.

The Fed’s Beige Book on Thursday, as well as St. Global markets continue to be dangerous after the comments of new growth fears by James Bullard, Chairman of the Federal Reserve Bank of St. Louis. The Fed’s Beige book has raised concerns about economic growth in the US, as the majority of regions show mild or modest growth, while many are aware of continued price increases.

“Stronger US data impacts yellow metal”

Additionally, three out of 12 regions voiced their concerns about the US recession. As we have mentioned in the news of Cryptokoin.com , St. Louis Federal Reserve Bank President James Bullard also expressed his concerns about the recession in the USA, while repeating that a 50 basis point increase per meeting is a “good plan” for now. However, “There does not appear to be a recession in data or actions from business executives,” Thomas Barkin, Chairman of the Federal Reserve Bank of Richmond, said in a statement. The analyst comments:

Stronger US data raises doubts about recession fears. However, the same increases the likelihood of the Fed’s aggressive stance on rate hikes and affects market sentiment as well as gold prices.

US ISM Manufacturing PMI for April rose to 56.1, compared to previous expectations of 54.5 and 55.4. Also, US JOLT Job Openings fell below the previous data of 11.8 but matched market forecasts of 11.4. The analyst states that recession fears and optimistic US data join the hawkish Fedspeak to support stronger Treasury rates, which plays a crucial role in challenging the gold price. However, the benchmark 10-year US Treasuries fell 1.4 basis points (bps) to 2.91%, dissatisfying stock buyers amid recession woes.

“Geopolitical fears are also putting pressure on gold prices”

China-related headlines pointing to a new trade war as the dragon nation is one of the world’s largest gold consumers putting pressure on precious metal prices. The analyst reminds that Beijing’s economic difficulties also raise questions about global growth, as it is the world’s second largest economy.

Reuters news suggesting that the United States is ready to impose a ban on Xinjiang goods is also breaking the mood in major markets. Also, comments by China’s Ambassador to Australia, Xiao Qian, point out that Beijing has not relieved Australian companies from the ban, despite the change in government.

Additionally, the analyst notes that geopolitical fears surrounding Russia are putting pressure on market sentiment and bullion prices as the hawkish Fed attracts safe-haven flows towards the US dollar. Recently, Moscow’s tough struggle in the Donbas has spread pessimism.

Gold price technical view

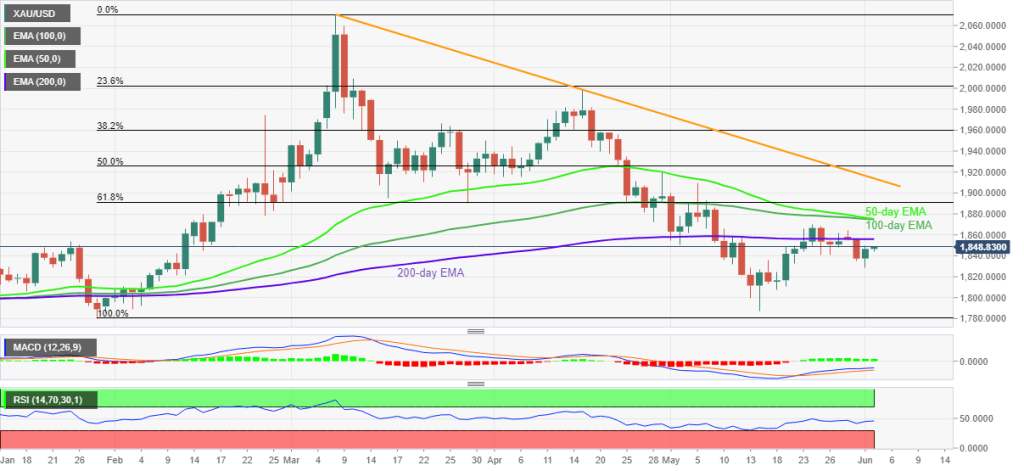

Market analyst Anil Panchal as gold price, tighter RSI and bullish MACD signals support the previous day’s recovery He notes that it is attempting to poke again the 200-day EMA surrounding $1,856. Anil Panchal points out the following technical levels:

However, any rise above $1,856 will require confirmation as the 100-day EMA and the 50-day EMA of $1,876 converge. If the buyers manage to break the $1,876 barrier, it will be important to watch a downward sloping resistance line around $1,915 from March. Alternatively, multi-support around $1,810 and the $1,800 threshold will challenge the golden bears.