Technical analyst Ross J Burland says gold’s hourly trendline support is broken below the double top on the chart. Also, according to the analyst, the structure in the 50s for gold maintains the selling for the opening sessions. That’s why the analyst says the golden bears are about to take action to kill. We have prepared Ross J Burland’s gold price technical analysis for our readers.

“These are likely to be hefty for the gold price in the coming days”

cryptocoin.com As you follow, gold jumped from the lows of the last 2 years. However, it remains under pressure. Gold bulls have moved to the previous support structure near $1,660 mid-month. Thus, gold closed flat on Friday after its sharp correction to end the week. However, as the new quarter begins, radicals will weigh heavily on speculation about the next phase of the war. This and the Fed’s walking cycle could weigh on the gold price in the days ahead. Analysts at TD Securities comment:

Given the rise in the stubbornness of inflation this cycle, it’s possible that a restrictive regime will outlast historical precedents. Therefore, the Fed is likely to keep rates high for a while. This suggests a prolonged period of significant weakness in precious metals, even as recession risks rise.

“The golden bears are about to take action to kill them”

Meanwhile, when it comes to techniques, if the bears persist on this point, the downside argument will definitely kick in again, as the analysis below shows.

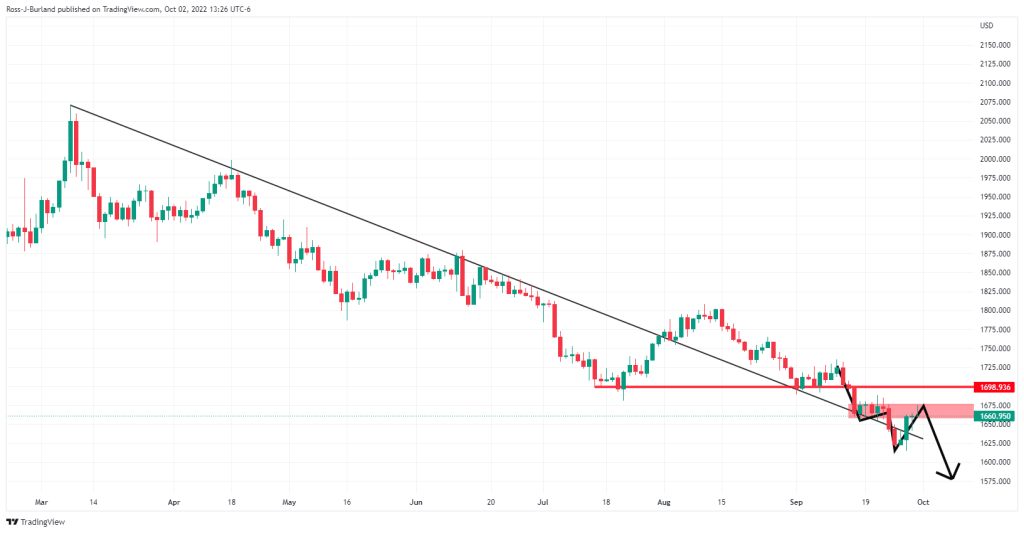

Gold price daily chart

Gold price daily chartFrom an everyday perspective, we have the aforementioned resistance in the game. We expect a legacy critical support structure to play an important role in the coming sessions. If this holds, the hopes of the bulls feeling the heat of the failed exit will almost be thrown into the new month.

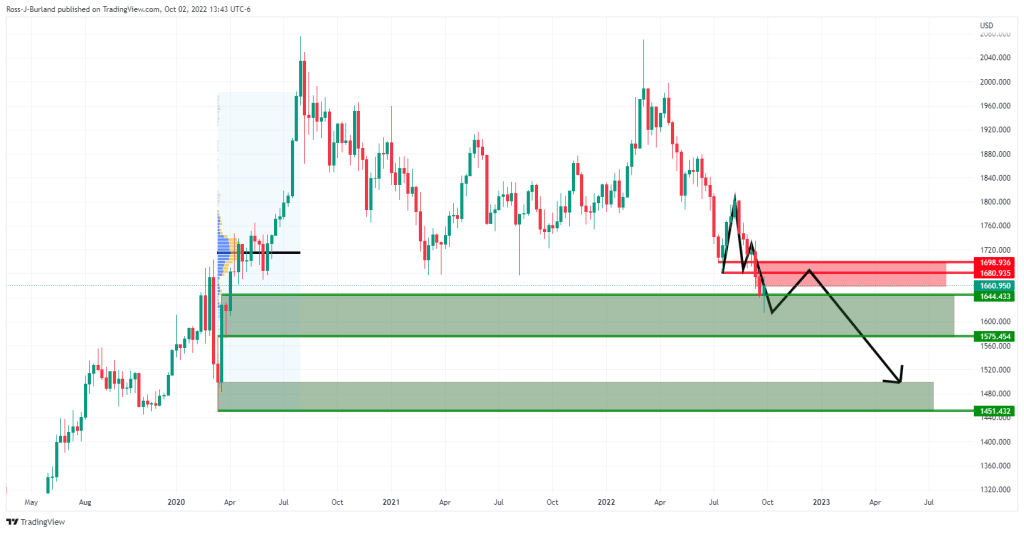

There is a risk of a significant downside continuation below $1,680 according to the weekly chart below:

Gold price weekly chart

Gold price weekly chartThe price was rejected at a key support level near $1,645 after a sharp recovery from the recent $1,615 high. Looking at the volume profile of the March-August 2020 range, the probability of a bull scenario is minimal as the price melts into a liquidity gap.

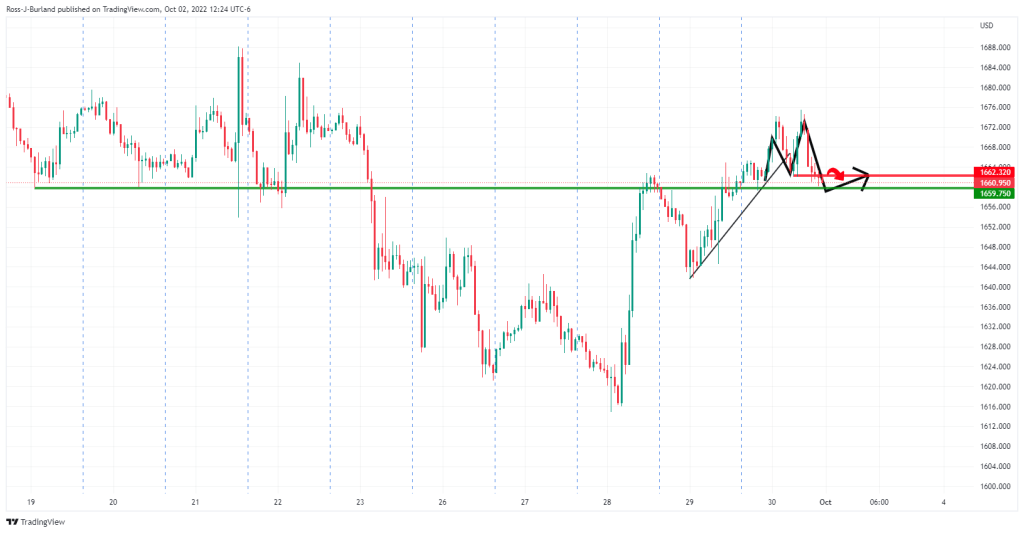

Gold price 1-hour chart

Gold price 1-hour chartMeanwhile, from a more near-term perspective, we have the possibility of a near bearish trend. Trendline support is broken after a top formation. Also, the second attempt at hourly highs failed. This left a double peak on the chart. Meanwhile, the structure in the 50s maintains the selling for the opening sessions. Retesting the neckline of the M-formation will inform us about this.