According to market analyst Ross J Burland, the gold price is under pressure again. Also, much more negativity is possible. The analyst says everything will depend on whether the US dollar can continue its northern flight trajectory. We have prepared Ross J Burland’s market commentary and technical analysis for our readers.

Gold’s path depends on the direction of the US dollar and its yields

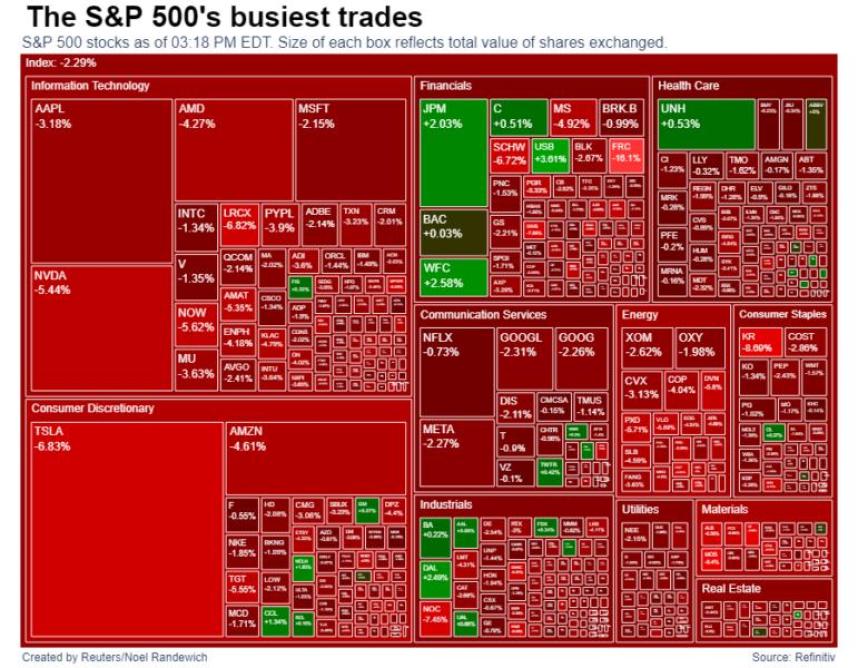

cryptocoin.com As you follow, the week ending October 14 was eventful. So much blood has been spilled in the markets that it seems like Halloween has come early. Wall Street closed a volatile week sharply lower as investors worried that the Federal Reserve’s rate path would plunge the U.S. economy and with it the world into a slump.

Blood on Wall Street

Blood on Wall StreetThe moves came as a strange result reversal after the previous day’s CPI data. This ignited an initial hedging response that turned a penny and led to a drop and a rally in the US dollar and yields. Friday, however, reversed the moves. It returned more appropriately to the narrative of hot inflation and subsequent negative effects on the U.S. and broader global economies. He acknowledged the possibility of market interest rates staying higher for longer. That’s why both dollar and US Treasury yields rose on Friday.

When you add the geopolitical risks and all the global dollar-denominated debt to the mix, the US dollar milkshake theory, a term coined by Brent Johnson to denote the dollar swirling, makes sense. Gold’s trajectory this week will largely depend on risk sentiment and the direction of the US dollar and its yields.

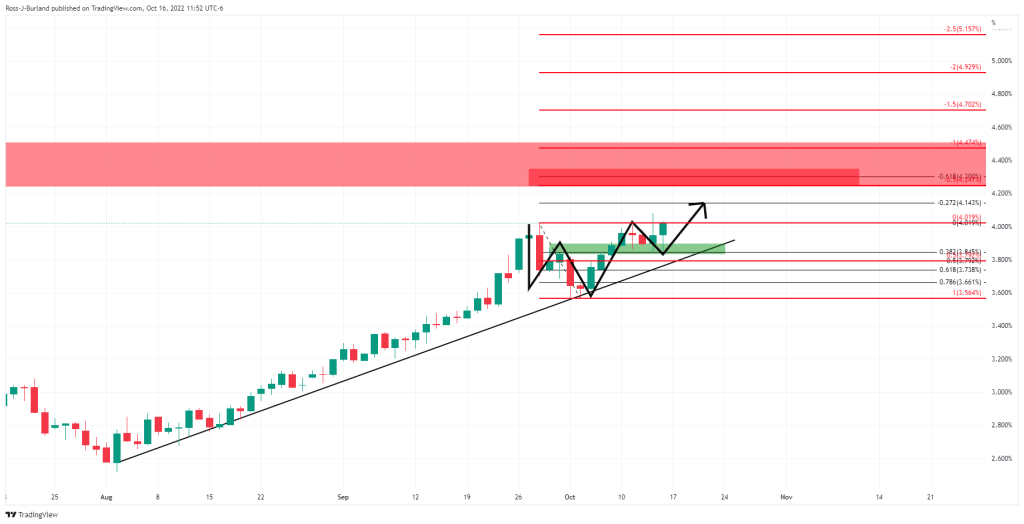

US 10-year returns

They say bond markets don’t lie. The 10-year return may have only just begun after last week’s 4% test. The W-form is bullish. However, the yield still has some way to go, according to the Fibonacci measurement of the 28 Seo-4 Oct retracement range. The -272% Fibo, a popular metric used for targets, is at 4.143% and the -0.61.8% Fibo is at 4.30%. Which brings us to 2007/08 Financial Crisis levels.

US dollars generally follow the same flight path as returns. If the bulls enter the April/May 2002 regions, it is possible that this will weigh on the yellow metal for the foreseeable future.

Louis Federal Reserve Chairman James Bullard said it was “too early” to discuss the end of the QT. He also noted that rapid rate hikes contributed to the strength of the dollar. He stated that this will only ease once the Fed reaches the point of stopping interest rate hikes. He stated that the Committee exerted a significant downward pressure on inflation. Therefore, he said, there is no need for interest rates to continue to rise.

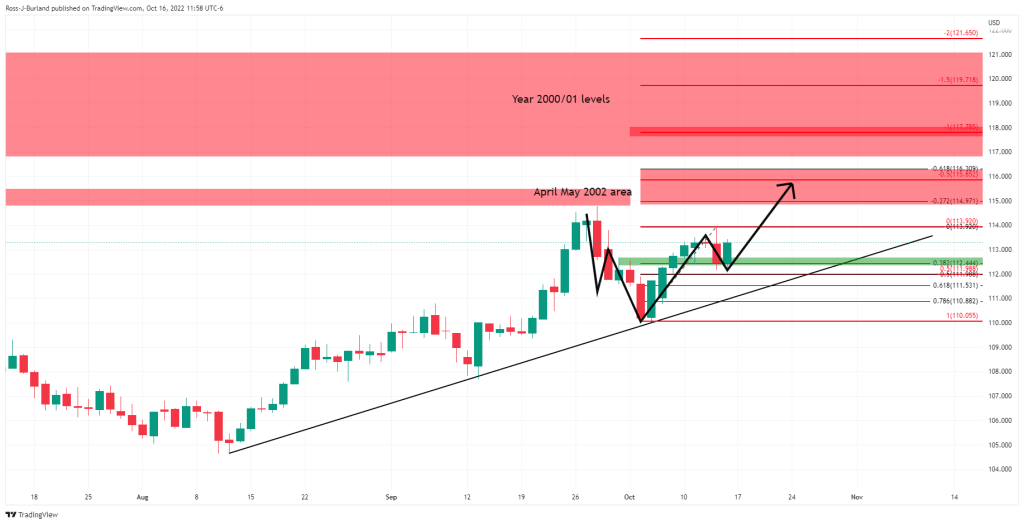

Gold price technical analysis

As shown, the price has bounced back below the critical $1,670 structure on the weekly chart. Also, it remains on the leading edge of bearish dynamic resistance. While below them, the outlook remains technically bearish. A break of the September low of $1,615 risks a 100% restrained move of the latest bullish correction to the neckline of the M-formation. That puts it on the radar at $1,500 and below $1,450 for a test into the 2020 demand area.

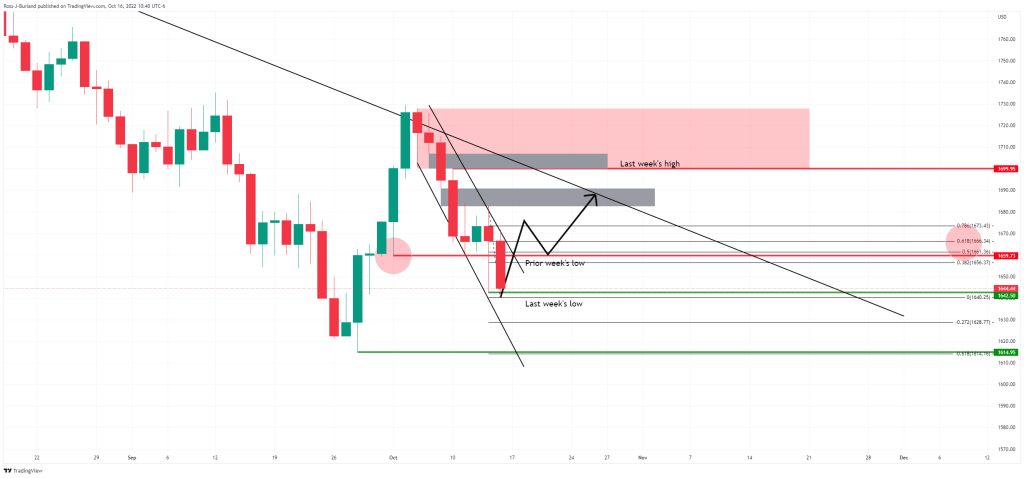

gold weekly chart

gold weekly chartPrice is positioned on the front of the trendline resistance. However, it is possible to easily break out of the micro-channel for last week’s highs and the rest of $1,700.

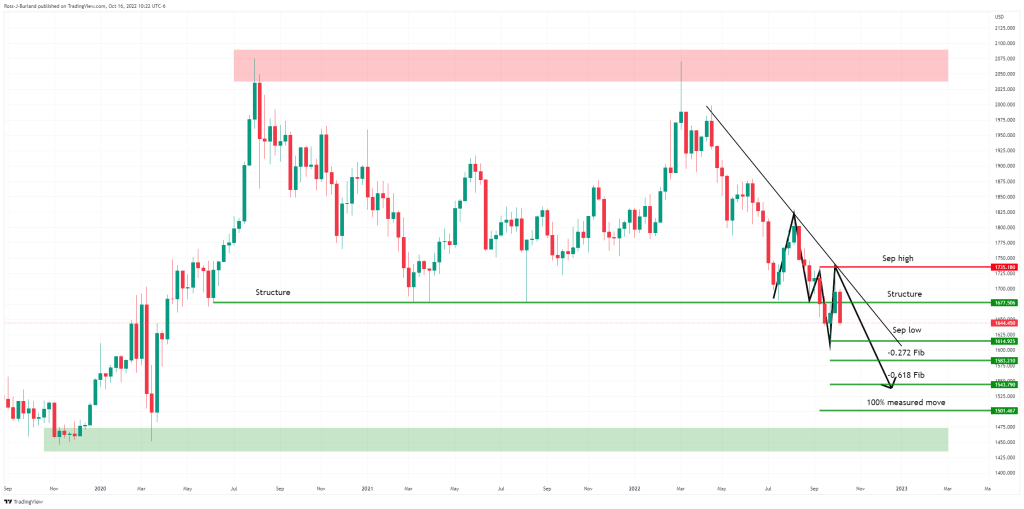

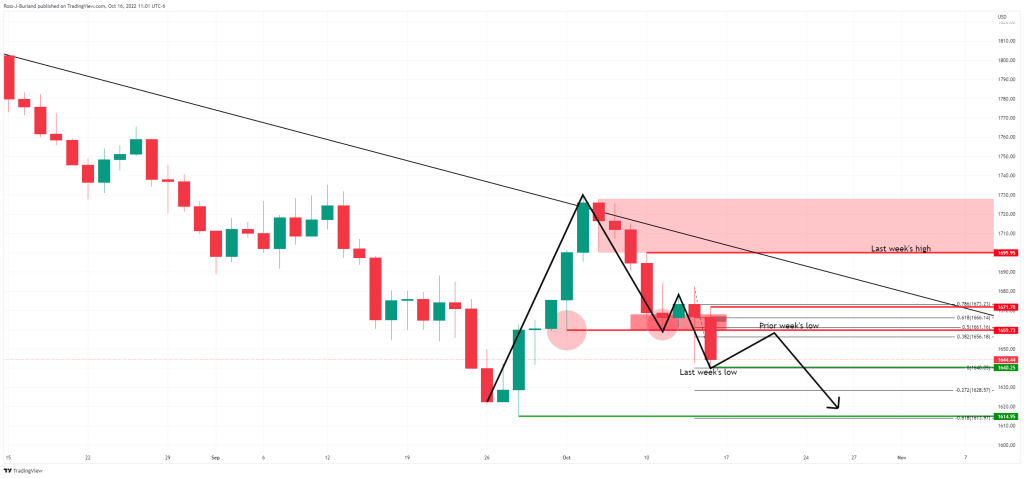

gold daily chart

gold daily chartWhen we zoom in, a break from the previous week’s low will be significant in this respect. Thus, we will likely witness price imbalances. We will also see it reveal gray areas on the way to trendline resistance above and last week’s highs.

However, if the bears commit at the micro trendline resistance where the neckline of the M-formation meets the previous week’s lows and a 38.2% Fibonacci retracement, then that’s where the price will start heading south again.

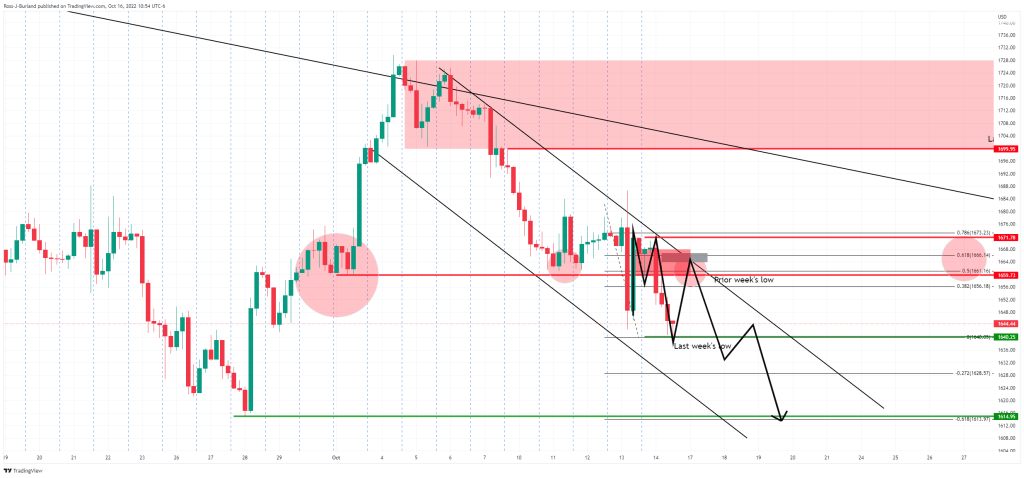

On the 4 hour time frame, we have the same scenario as the M-formation. However, watch out for the $1,670 gold price imbalance (grey area).

Gold 4-hour chart

Gold 4-hour chart