Gold bulls are waiting for the recent rally peaks ahead of the Fed to break, according to market analyst Ross J Burland. Golden bears benefit from DXY techniques and continued support. Ross J Burland is trying to determine the direction for the gold price from the charts of the week.

“Gold price maintains long-term bearish trend”

With the intervention of central banking, the dollar index (DXY) fell below 112. Thus, DXY lost about 1% altitude per week. Therefore, the gold price closed the week in a turbulent way. Gold price gained 1.8% on a rally from $1,617.28 to $1,657.95. Markets are entering a period of blackout before the November Federal Reserve rate decision. In this environment, technically, the rally is leaving the outlook complex for next week.

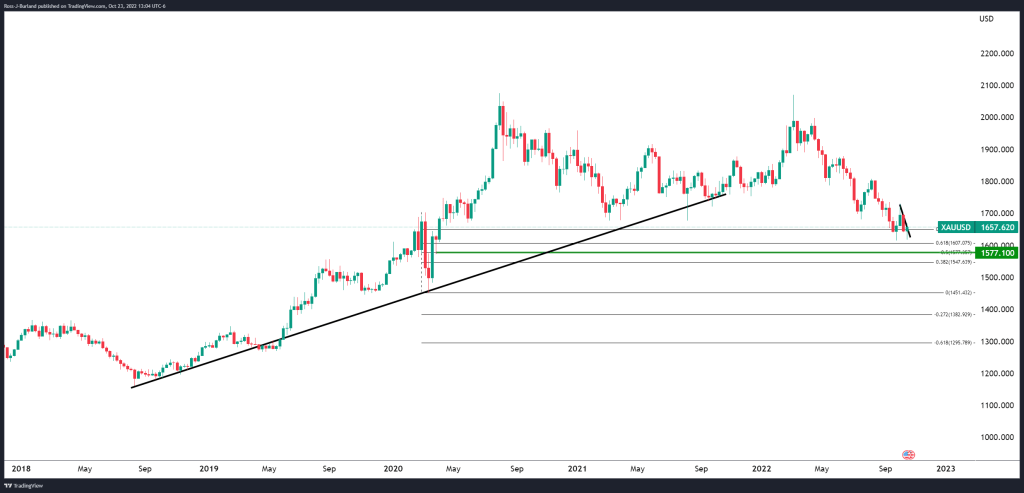

Gold price weekly and daily charts

Gold price weekly and daily chartsFor the gold price, the long-term outlook remains bearish. However, it has started to break through the daily trendline resistance.

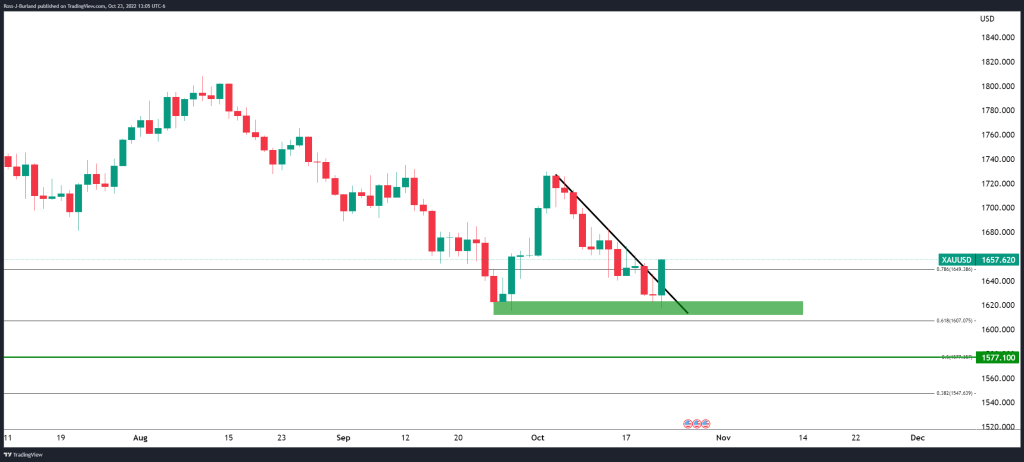

Gold weekly and daily charts

Gold weekly and daily chartsThis will leave the emphasis on the upside especially if the bulls are able to break past this 4-hour resistance area.

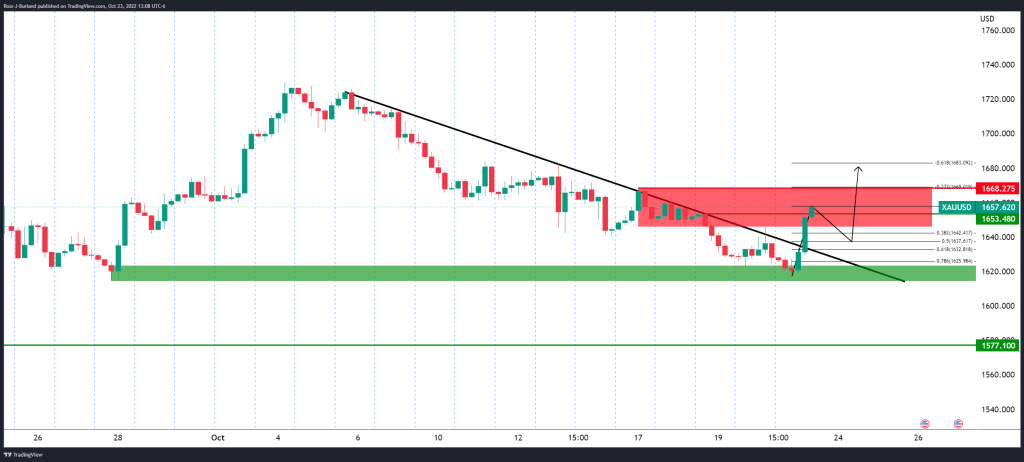

Gold weekly and daily charts

Gold weekly and daily chartsThe US dollar is currently testing a key micro trend line on the daily chart. If the bulls commit, an uptrend beyond the recent highs of around 114.80 is possible on the cards. It is also possible that this will cause gold to break above the border with a break of $1,625.

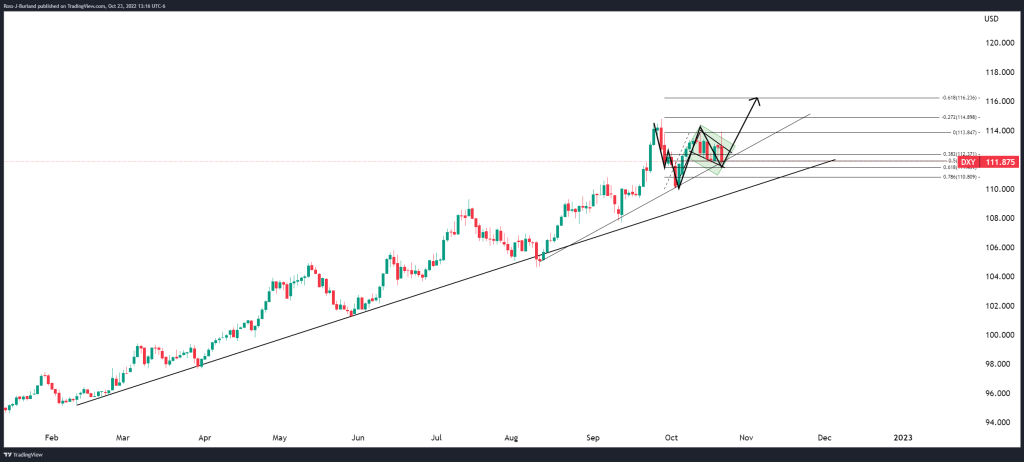

DXY daily chart

DXY daily chart“The column preventing the lower treatment of precious metals may collapse”

Gold price fell on Monday as the dollar strengthened. Investors are looking for clues as to whether the US Federal Reserve will pause monetary tightening. cryptocoin.com As you follow, markets expect the Federal Reserve to increase the federal funds rate by 75 basis points in November. This rate hike will be the fourth straight rate hike of this magnitude. However, the December rate hike is likely to be smaller. So this puts pressure on the dollar.

However, as TD Securities analysts point out, rising global macro headwinds in emerging market economies are eroding consumers’ purchasing power. Given this situation, the pent-up demand from his individual group is likely to decrease. Analysts are predicting that this will also likely collapse an important support column preventing precious metals from trading lower. In this context, analysts underline the following points:

As a result, interest rates entered the restrictive zone. This is why precious metals generally tend to underperform in the later stages of their walking cycle.