Gold faced hard selling in the week with the pressure of rising US interest rates and stronger dollar. Spot gold prices slid 1.2% daily to $1,860 at the time of writing, while US gold futures were down 1.29% to $1,858 at the time of writing.

ANZ: Market struggles with headwinds

China’s Covid-19 outbreaks darkened the risk sentiment outlook earlier in the week. Reuters reported that Shanghai is tightening its already tight Covid-19 quarantine by the end of this month in a new move to eliminate infections outside of the quarantined areas of China’s largest city.

Traders are waiting for more data from the Middle Kingdom, where most states are under some kind of restrictions and Shanghai is under a full month’s quarantine, with further slowdown in export growth and weakness in imports. ANZ analysts assess

China’s top leaders have warned against questioning Xi Jinping’s zero-covid strategy as pressure mounts to loosen virus restrictions. This comes as the US Federal Reserve tightens monetary policy, as the market struggles with headwinds such as a stronger USD and bond sales. The same issues also affected gold prices, which recorded a third-week decline.

Still a distinct possibility with further supply constraints across the base metal complex, recent sales seem overblown, according to analysts. Analysts expect Chinese demand to pick up sharply once restrictions ease, with stimulus measures likely to boost economic activity.

Key events and data to follow this week

Meanwhile, next week will focus on US inflation data and Fed speakers, alongside today’s China trade data. TD Securities analysts argue that core prices have regained momentum after recording 0.3% in March, remaining strong in April and regaining momentum to 0.5% m/m.

TD Securities analysts say used car prices are likely to have fallen less sharply than in the last report. Analysts are also looking for renewed strength in housing inflation. TD Securities’ monthly forecasts confirm that for aggregate/core prices 8.1%/6.1% year-on-year, March is likely the peak of the cycle. As we have reported as

Kriptokoin.com , a number of Fed officials will make statements in the week following the May meeting. The words of New York Fed’s John Williams and President Christopher Waller will be important, and some light will come after Fed Chairman Jerome Powell’s press conference last week that didn’t give much clarity on what the Fed would do after the neutral-to-neutral front-loaded rate hikes. expected to hold.

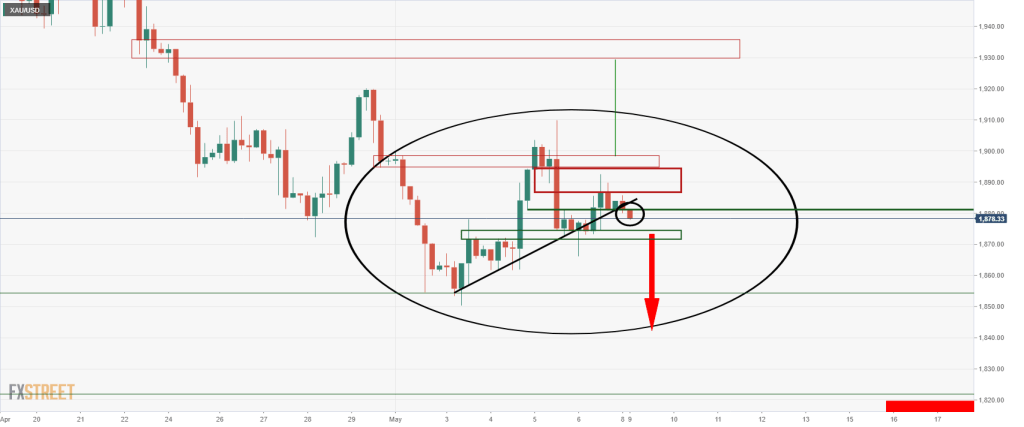

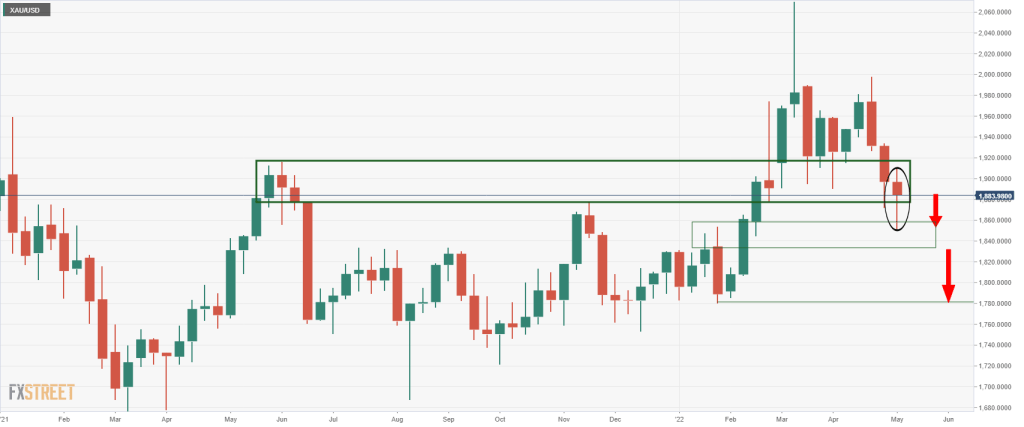

Gold prices technical analysis: Bears focus on bottoms

Market analyst Ross J Burland states that gold prices are under pressure and bears are resuming action, focusing on last week’s lows.

Gold prices chart of the week

Gold prices chart of the week A bearish close on the weekly chart and the wick are expected to follow a lower move in the coming days to test last week’s low and potentially forward. In today’s trade, the analyst states that the bears challenged the bulls at the first layer of the 4-hour support.