Gold price hovered near its lowest levels since late January on Wednesday, amid a rebounding dollar and pressure from the US Federal Reserve chief’s aggressive inflation stance.

Ilya Spivak: Overall direction for gold price drops to $1,750

DailyFX currency strategist Ilya Spivak says gold has been consolidating since the end of last week, but overall direction is around $1,750. He says he fell. The strategist continues with the following statements:

The question is, when will we find a new momentum to get us there?

“Gold is very focused on interest rates and the outlook of monetary policy”

Kriptokoin.com As you mentioned, Fed Chairman Jerome Powell promised on Tuesday that the US central bank will raise interest rates as necessary to stem the rise in inflation, which he says threatens the economy’s foundation. The dollar rallied after three sessions of decline, reducing gold’s appeal for investors holding other currencies. Ilya Spivak has the following to say about the current state of gold:

Gold has focused a lot on interest rates and the outlook for monetary policy, especially in the US. The dollar also failed to rally.

SPDR Gold Trust’s holdings decline

Benchmark US 10-year Treasury yields eased to zero yield after a sharp increase in the previous session stimulated demand for gold and limited losses. The Fed raised the benchmark policy rate by 0.75% this year and is on track to raise it again, with half-point increases at its next two meetings in June and July.

Reflecting on investor sentiment, SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, said its holdings fell 0.4% to 1,049.21 tons on Tuesday, from 1,053.28 tons on Monday. This marks the ninth consecutive daily decline.

Ian Ball: It’s hard to tell if gold is undervalued

Abitibi Royalties’ Ian Ball, the latest correction in the cryptocurrency market

When you look at Bitcoin and other cryptocurrencies, they were seen as an alternative to the US dollar. However, I don’t think they perform very well when there are 20%, 30% and 40% fluctuations in some of these cryptocurrencies. I don’t think they perform the function for which they were designed.

Explaining his views on the gold price, Ian Ball says that the gold around $1,800 is at the ‘basic support level’ and makes the following statement:

Gold is not below its value. it is very difficult to say. When you see the US dollar fall, you can see gold rally.

TDS thinks any relief in gold will be temporary

yellow metal moves above $1,830 level, according to TD Securities economists can experience relief. Economists assess:

A convincing break north of the $1,830 daily level could whip momentum funds that have recently started selling the yellow metal. However, we think any easing will be temporary as the downward momentum strengthens and broad macro liquidations weigh on the gold.

Pablo Piovano: Gold price appears capped by the 200-day SMA

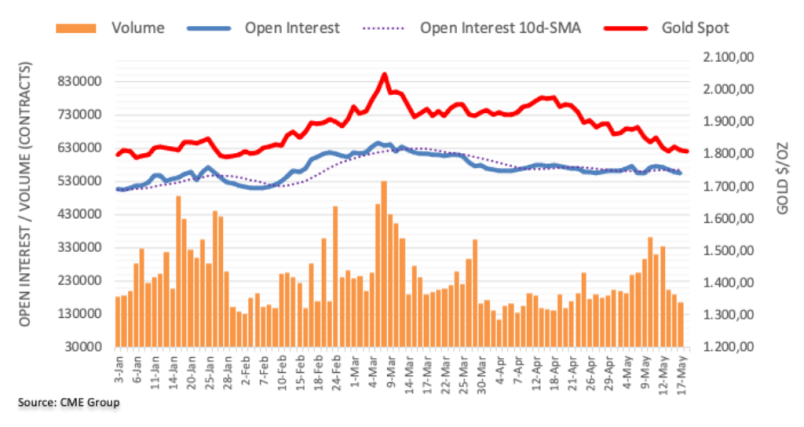

gold futures markets open interest for the fourth consecutive session on Tuesday, according to preliminary figures from CME Group this time it narrowed to about 1.4 thousand contracts. Along the same lines, volume fell by around 22.7k contracts in the third consecutive session.

Market analyst Pablo Piovano states that yellow metal prices briefly tested the 200-day SMA at $1,830 on Tuesday, but then pulled back and closed the session with modest losses. This move was behind dwindling open interest and volume, suggesting that further declines below are no longer likely.