The gold price continues its downward trend as the dollar remains resilient and steady employment growth in the US. The yellow metal is under pressure as the Fed plans to keep interest rates higher for an extended period of time.

Gold price remains under pressure

Gold bears are struggling for market acceptance ahead of top US data. Despite this, the gold price continues to decline for the fourth consecutive day. In doing so, the yellow metal reflects the cautious optimism of traders. However, doubts about China’s ability to defend the economic recovery are joining the rise in US Treasury yields. This supports the US Dollar’s recovery amid a sluggish session.

Friday’s upbeat US Nonfarm Payrolls (NFP), as global rating agency Moody’s optimistically revised its US growth forecasts and hawkish comments from Federal Reserve Bank of Cleveland President Loretta J. Mester, kept the US Dollar stronger and pushed the gold price downwards. It should be noted that it creates pressure.

Rising dollar prevents gold’s rise

Alternatively, positive news from China’s largest real estate player, Country Garden, and Beijing’s efforts to defend the economic recovery with a host of qualitative and quantitative measures should have encouraged gold sellers. However, the gold price could not achieve this against the recently rising dollar.

Moving on, markets’ reaction to the recent shift in sentiment and the July US Factory Orders release today, as well as concerns about the Fed, will also be important to watch for clear trends.

Key levels to watch for the gold price

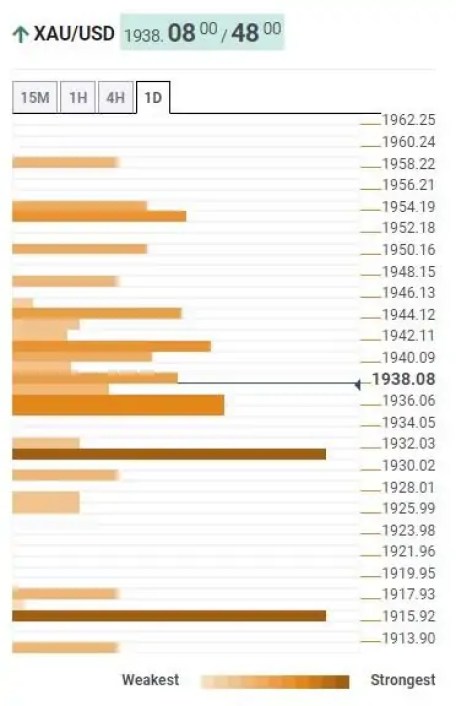

Market analyst Anil Panchal detects critical levels for gold via Technical Confluences Detector. According to the indicator, gold price is fluctuating solidly beyond the $1,930-$32 support confluence formed by the Pivot Point one-day S2, the 50-day SMA, and the four-hourly (4H) 200-SMA. However, the convergence of Pivot Point one-day S1, one-month Fibonacci 61.8% and Bollinger’s lower band in 4H are limiting the immediate downside of gold price around $1,935.

If the gold price continues its downtrend past $1,930, the 200-day SMA, Bollinger’s middle band, and one-month Fibonacci 38.2%, near $1,915 as of press time, will act as gold buyers’ last defense. Alternatively, a close of the Fibonacci 38.2% one-day and Bollinger’s middle band at $1,945 in the 4-hours will enable the gold price to recover immediately. Following this, the Pivot Point one-day R3, 100-day SMA and Fibonacci 161.8% will be a tough nut to crack for gold buyers around $1,955. If the gold price rises above $1,955, buyers will target an area around $1,985, which consists of multiple hurdles marked in May and July.

Technical Confluences Detector

Technical Confluences DetectorDevelopments affecting the course of gold

- Investors remain bullish more broadly, hoping the Fed is done raising interest rates. However, the gold price is correcting between $1,939 and $1,945.

- According to the CME FedWatch Tool, there is a 60% chance that interest rates will remain steady at 5.25%-5.50% by the end of the year.

- Meanwhile, the precious metal remains flat due to holiday-weakened trade. Because US markets were closed on Monday for Labor Day.

- On Friday, the unemployment rate in the US rose sharply to 3.8%. Additionally, wage growth slowed in August, raising hopes for a Fed soft landing.

- The US Dollar Index (DXY) reached a three-month high above 104.50. The USD found support from still-strong labor market data in August.

- The Fed’s hawkish stance has relaxed significantly. Despite this, fears of recession in the US economy have diminished. Therefore, the US Dollar remains resilient. This puts pressure on the gold price.

- Goldman Sachs analysts see the probability of the US economy falling into recession as 15%. The reason for these predictions is that inflation has fallen and employment growth has remained solid. Previously, recession expectations in the US economy were at 20%.

- This week, the focus will be on the ISM Services PMI data for August, which will be announced on Wednesday. Expectations are that PMI will be generally stable at 52.6.

- Investors expect the Fed to keep interest rates steady in September. But the US central bank is likely to keep the door open for further policy tightening. Investors are uncertain about whether the Fed will discuss interest rate cuts.