Gold prices fell on Monday as central banks pointed to further rate hikes to curb persistently high inflation, curbing the metal’s appeal. Analysts interpret the market and evaluate the technical outlook of gold.

“Hard data may be more decisive for gold prices”

Spot gold fell 0.1% to $1,853.92 after hitting its highest level since February 15 in the early hours of the session. U.S. gold futures rose 0.3% to $1,859.60. Investors are waiting for Federal Reserve Chairman Jerome Powell’s statement to Congress on Tuesday and Wednesday and the February payroll report on Friday for monetary policy tips. IG market analyst Yeap Jun Rong comments:

More sustainable moves for gold prices could be driven by tangible data. A one-off against strong January labor data, a weaker-than-expected US non-farm payroll data could provide this.

Analyst predicts this trading range for gold

San Francisco Fed President Mary Daly said on Saturday that interest rates should rise higher and stay there longer if data on inflation and the labor market continue to come in warmer than expected. Richmond Fed President Thomas Barkin said on Friday that he could see US interest rates in the 5.5%-5.75% range.

Data on Friday showed the US services sector grew steadily in February as new orders and employment hit a one-year high. Meanwhile, European Central Bank (ECB) President Christine Lagarde stated that core inflation in the euro area will remain high in the near term, so a 50 basis point rate hike by the end of this month is increasingly certain. In a monthly note, metals analyst Edward Meir at Marex shares these predictions:

We anticipate a trading range of $1,775-1,900 as we expect the March Federal Open Market Committee meeting to be more hawkish than investors had hoped.

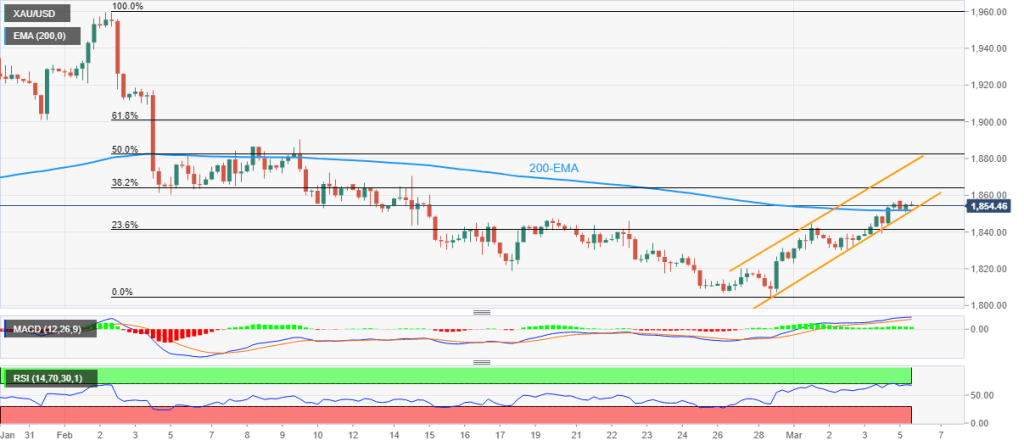

Technical analysis: Gold prices tease bears

Market analyst Anil Panchal analyzes the technical outlook for gold as follows. Gold prices are mostly hovering around $1,855 as traders prepare for key data/events in Europe early Monday. Adding filters to the yellow metal’s movements could be due to the inactivity of the US dollar despite mixed headlines from China and the decline in Treasury yields.

While the overbought RSI (14) is pushing Gold buyers around $1,855, the convergence of the 200-bar Exponential Moving Average (EMA) and the lower line of a one-week bullish channel are pushing the bears around $1,850. It’s worth noting that gold’s weakness above $1,850 could quickly drag the price towards mid-February $1,818 before highlighting the previous monthly trough surrounding $1,805 and the $1,800 threshold for golden bears.

Meanwhile, recovery moves could target the top of the aforementioned channel near $1,878 before targeting the February 9 high of $1,890. With gold buyers holding the reins above $1,890, there is a 61.8% Fibonacci retracement of the metal’s marked weakness in February and a psychological magnet near the January 31 low of $1,900. Overall, the gold price is making fun of the bears in the middle of a quiet day at the beginning of a crucial week.

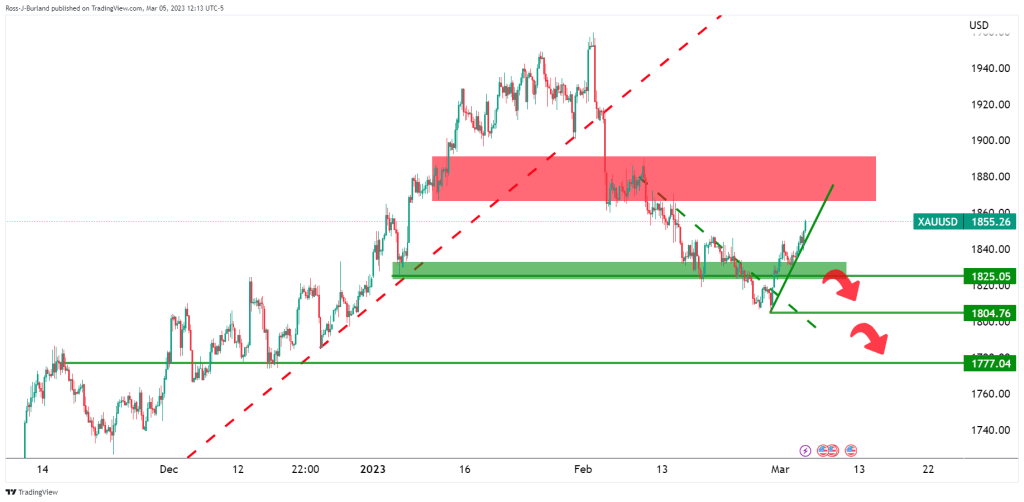

Gold technical analysis: Gold in dynamic support

cryptocoin.com As you can follow, gold prices declined slightly at the beginning of the week as the markets held their breath before Fed Chairman Jerome Powell’s update on the US interest rate outlook. U.S. labor market data will also be critical towards the end of the week. Technical analyst Ross J Burland illustrates the technical outlook for gold as follows. The 4-hour chart shows that gold price is holding dynamic support.

Below that, the key support structure of $1,825 is what the bears will aim for, while a break there will likely see a triggered flurry of orders followed by a rapid bearish move.

“Next target for gold prices appears to be $1,890”

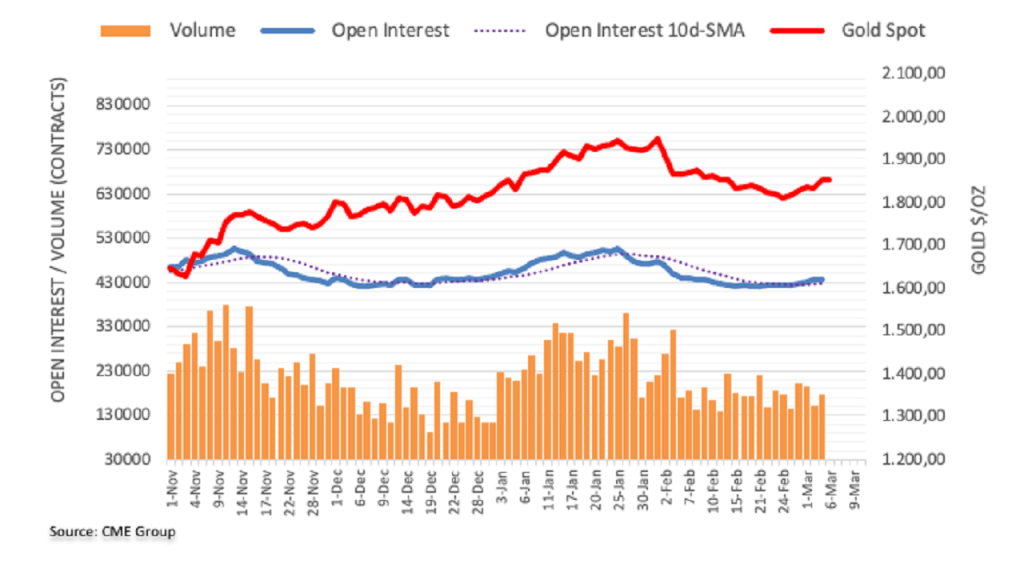

Open interest in gold futures markets rose by around 2.3k contracts this time for the fourth consecutive session on Friday, according to preliminary data from CME Group. Volume followed suit, rising by around 24.4k contracts after two consecutive days of pullbacks.

Market analyst Pablo Piovano states that Friday’s strong increase in gold prices was driven by rising open interest and volume. According to the analyst, this left the door open for the continuation of the monthly recovery in the very near term. However, he notes that the next upside target is $1,890 (February 9), the weekly high.