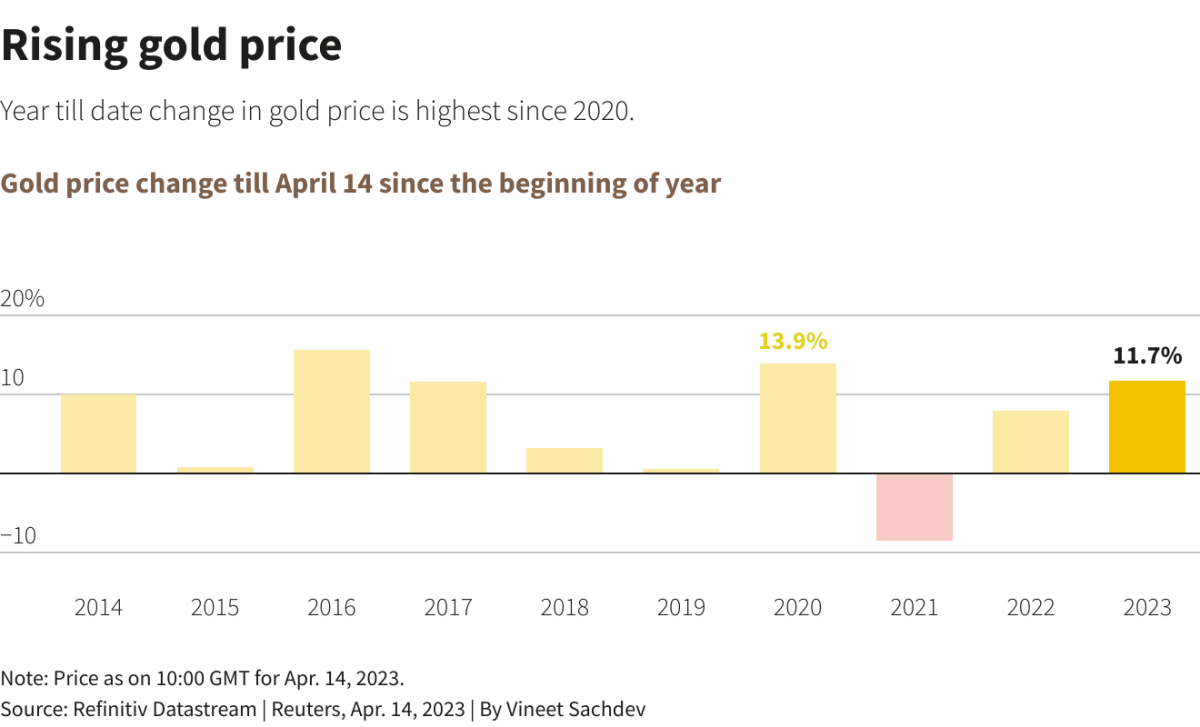

In a three-day rally, gold prices hit a 13-month high above $2,050. However, that profit-taking turned into a major pullback as economic data bolstered expectations that the Federal Reserve is on track to raise interest rates another 25 basis points next month.

This situation will continue to be supportive for gold prices.

Grant’s Interest Rate Observer analyst James Robertson said in an interview that the Federal Reserve’s potential to end its most aggressive tightening cycle has created too much volatility in financial markets and gold remains an attractive hedge against monetary policy turmoil. Based on this, Robertson makes the following assessment:

The banking crisis, which emerged last month with the bankruptcy of Silicon Valley Bank and Signature Bank and the collapse of Credit Suisse, one of the largest banks in Europe, showed that the pressure on the global economy began to increase and “rivets began to burst”. The monetary disorganization we’re seeing is far from over, and right now we’re just waiting to see how it spreads. This will continue to support gold prices.

Gold prices could go higher

Robertson’s bullish outlook for gold comes as the precious metal found support at just over $2,000 on Friday after falling from a 13-month high on Thursday. Robertson says gold could rise even higher as Western retail investors are just starting to enter the gold market. The speculative positioning in gold remains below the August 2022 highs, even though the bullish momentum has increased in recent weeks.

According to monthly data from the World Gold Council, in March the gold market saw net monthly inflows of global gold-backed exchange-traded products for the first time, and ten months of consecutive outflows ended. While Robertson is optimistic that gold prices will continue to rise through 2023, he notes that one area in the gold industry where he sees real value is stocks. He adds that gold mining stocks have significantly underperformed the precious metal, but have traditionally outperformed in the bull market due to the leverage effect of this sector.

The challenge for gold is that inflation is a sufficient threat.

It’s been another eventful week for the gold market, but despite strong bullish optimism, the precious metal isn’t ready to hit an all-time high…or below $2,000. At one point on Friday, gold prices dropped more than 2% during the session, giving back all of their weekly gains. While the price action is rather bleak, there is still reason to remain optimistic; Despite solid selling pressure, gold entered the weekend holding support above $2,000.

Recent economic data also indicate that investors are taking a more nuanced position below. Everyone paid attention to the inflation figures this week, and as consumer prices continue to fall, there are still some worrying trends in the economy. The challenge for gold is that inflation is still a sufficient threat for the Federal Reserve to raise interest rates again in May. Liberum analyst Tom Price said in an interview:

Why did multiple bullish demand factors for gold only support the price? Because these are still offset by the Fed’s inflation-targeted rate hikes.

Yellow metal halo in a solid uptrend

The positive news for gold is that the Federal Reserve may have to end the current tightening cycle after May. Despite stubborn inflation, markets still think the US central bank will cut interest rates in the second half of the year.

Despite the ongoing threat of inflation, markets still think the Fed will cut interest rates in the second half of the year; These expectations form a solid foundation in the gold market. Currency analysts say a peak in interest rates next month will keep the US dollar in its current downtrend and create more tailwinds for the precious metal. Despite Friday’s correction, analysts note that gold is still in a solid uptrend above $1,960 and $1,950.

Gold prices It will stabilize somewhere around $2,000

cryptocoin.com As you watch on , gold prices pulled back sharply on Friday after the dollar bounced and a Fed official pointed to the need for another rate hike, after climbing to a more than a year high in the last session. Meanwhile, the CME FedWatch tool shows traders are now pricing in the 80.2% probability of a 25bps increase in May, up from 70% at the start of the week. Daniel Pavilonis, senior market strategist at RJO Futures, comments:

The metals market is likely to weaken as we enter a “blackout period” ahead of the Fed’s decision, which is expected to rise by 25 basis points in May. Prices will stabilize somewhere around $2,000.

“ I expect gold to expand its gains to $2,100.”

However, analysts say bullion’s outlook remains positive after the stellar rise in the past few sessions as recession concerns that could cause the Fed to eventually end its rate hike cycle. Phillip Streible, chief market strategist at Blue Line Futures in Chicago, expects prices to still hit record highs and extend gains to $2,100. On the physical gold front, the rise in prices has made physical gold purchases unattractive in major Asian hubs this week.

There are signs that gold is overbought

Andrew Schrage, CEO of Money Crashers, says Friday’s price action “signifies that gold is overbought in the near term.” In this context, Schrage makes the following statement:

For gold to break any record, we probably need confirmation that the Fed has finished raising interest rates. Markets are approaching this idea, but there is still significant uncertainty.

GoldSeek.com chief executive Peter Spina said gold is the result of central bank gold purchases, continued weakness in the United States, “failure to remove inflation as economies enter recession, historic geopolitical shifts that threaten to displace the U.S. dollar as a global reserve currency, and higher interest rates.” takes advantage of many unknown risks”. In his latest comments, Spina draws attention to the following:

At the moment, it is very difficult to say that gold is ready to rise to new heights in the coming days. It will take several weeks for gold to consolidate below record levels, and bullion will then rise again. The market is overbought in the short term.

Bullish targets for gold prices

Still, Peter Spina says the stagflationary scenario seems to be kicking in, as expectations for rate hikes are over, inflation hasn’t fallen to the 2% target, and the economy seems to be entering a contraction phase. According to the analyst, this is the most positive of bullish scenarios for gold. That is, a situation where real interest rates are negative and very few sectors are growing.

Spina set an initial upside target of $2,300 to $2,500 as gold hits record highs. In line with this, the analyst says there is potential to rise up to $2,7000 as “Western buyers join many parts of the world that buy gold.”

Gold prices continue to rise, albeit slightly shaken by disappointing US retail sales figures fueling recession fears, especially as the market expects the Fed to cut rates by summer, according to Lukman Otunuga, head of market analysis at FXTM.