Traders await US economic data for further guidance on the Federal Reserve’s monetary policy stance. Therefore, gold prices remained in a narrow range on Wednesday. Analysts interpret the market and share their forecasts.

This will likely be positive for gold prices.

cryptocoin.com As you follow, the market is waiting for the US quarterly GDP data, which will be released on Thursday, and the core PCE price index, which will be released on Friday, ahead of the Fed’s policy meeting on May 2-3. CMC Markets chief market analyst Michael Hewson says all eyes will be on the Fed’s stance. In this context, the analyst makes the following statement:

Further weakness in yields is likely to be positive for gold as long as $1,960 holds down. But much depends on whether the Fed signals a pause when making its decision next week.

This uncertainty is exactly what gold will be sensitive to!

Investors mostly expect the US central bank to raise rates by 25 basis points. Meanwhile, US consumer confidence slid to a nine-month low in April. “Recession fears already seem to provide a base for gold prices,” says Matt Simpson, senior market analyst at City Index.

Investors are also considering US Treasury Secretary Janet Yellen’s warning that Congress’ failure to raise the government’s debt ceiling will trigger an “economic catastrophe” that will raise interest rates for years. Everett Millman, chief market analyst at Gainesville Coins, comments on the latest developments as follows:

The Fed will try to keep interest rates higher to suppress inflation. But that probably means there may be a constraint on the rapid growth of the economy. Whatever decision they have to make, it will likely result in some kind of stress. Also, this uncertainty is exactly what gold will be sensitive to.

This situation, will be a new macro driver for gold prices

Joy Yang, global head of index product management at MarketVector Indexes, said in an interview that the threat of inflation may have subsided, but investors continue to face a host of other risks as the global economy has not yet felt the full effects of the Federal Reserve’s aggressive monetary policies. Based on this, Yang makes the following assessment:

We are now beginning to see the potential vulnerability that comes with the end of years of access to easy money. The shift from expansion to aggressive tightening comes with tighter credit issues. This will be a new macro driver for gold prices. Investors are beginning to realize that if the Fed continues to raise rates, there may be a wider economic contagion. So there is still a lot of safe-haven support for gold.

These will create a strong environment for gold prices

Yang’s bullish view of gold coincides with a new wave of fear in the banking industry. In addition, Yang notes that it will take time to solve all the problems in the global banking system. Yang points out that there was a months-long delay between the collapses of Bear Sterns and Lehman Brothers in the Great Financial Crisis of 2008.

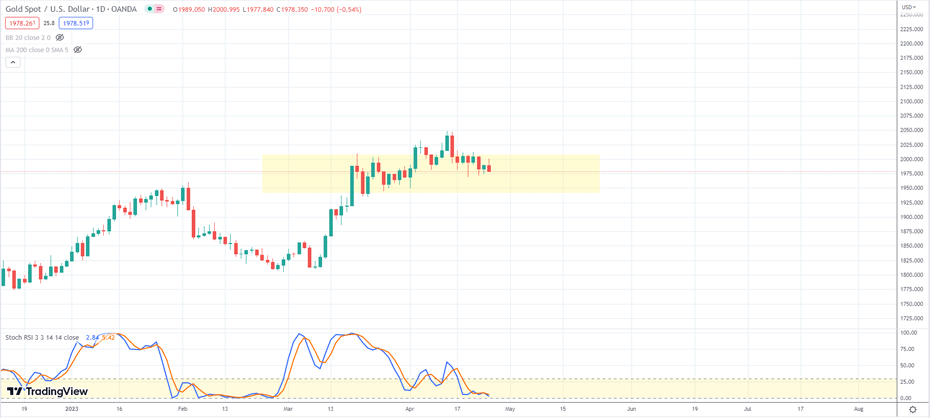

Gold prices are trying to hold around $2,000. However, Yang says investors should pay attention to the wider environment. Yang points out that even though gold has failed to reach an all-time high, the market is seeing support on the upside. Since October lows, gold has rallyed at $1,600, then $1,730, again forming solid support near $1,800. The most recent support level that analysts watched is around $1,950. Finally, Yang underlines the following:

The drivers of this gold rally are central bank demand, geopolitical uncertainty, inflation fears and slowing growth. These have not disappeared. The bottom of the gold is definitely sliding upwards. Because there are more factors supporting the price… The inflation monster will not disappear easily. In addition, we risk experiencing both economic crisis and inflation. This will create a strong environment for gold.

Even if the Fed keeps interest rates steady, it’s enough to support gold!

The gold market is likely to continue to consolidate around $2,000 as the Fed prepares to raise interest rates one last time, according to Tim Hayes, chief global investment strategist at Ned Davis Research. It is then possible to hold the line until inflation is brought under control. But even this new way of holding doesn’t diminish gold’s potential. Hayes says the trend underneath is clearly higher. In addition, Hayes states that nine of the 16 indicators he monitors in the Gold Watch report are bullish.

Tim Hayes explains that the gold market has benefited from solid tailwinds. He cites the high course of commodity prices, bond yields and the continuing strain on the US dollar as the reason for this. It is likely that the market’s expectation of a rate cut this year is early. However, Hayes says that even if the Fed keeps interest rates steady, it will be enough to support gold. Because he states that other winds direct the precious metal.

Hayes states that in addition to real and nominal returns, gold investors should also pay attention to the dollar. In addition, Hayes says that the narrowing divergence in global monetary policy will continue to hurt the US dollar and support gold prices.

Gold prices on solid ‘golden cross’

Looking at the technical outlook for gold, Hayes says the uptrend was confirmed in January when the 50-day moving average crossed above the 200-day moving average, forming a “golden cross” pattern. Around the same time, the US dollar’s 50-day moving average dropped below 200-days. This created a “death cross”. Hayes uses the following statements in his statement:

We are not close to testing gold’s 50-day moving average. But it needs to start reversing to signal the end of the uptrend. I think we are mostly stalling and consolidating at these record levels. Perhaps the market is shedding some of the optimism and the trend continues. Gold is on a solid ‘golden cross’.

Golden opportunity to buy the drop?

Technical analyst Jonathan Da Silva comments on the technical outlook for gold. Gold holds the $1,965 level, while the bottom of the yellow box corresponds to a breach of $1,950. Violation of a psychological level usually occurs before the onset of the next leg.

In this case, it is possible for the symptoms of the bottom to appear quickly. Less than four trading days later, gold is oversold on the daily timeframe. Also, the bull trend is not broken yet. The question a fortune teller will ask is whether to exceed 1950 dollars. Still, as of now, such an event presents the buying opportunity that the pushed-on bulls have been waiting for.