Gold gave back most of its recent gains in the first week of December. It achieved its first monthly close above $2,000 last Friday. After hitting an all-time high of $2,150, the yellow metal showed a continuous downward trend in the following days. The shiny metal started the new week with a decline and fell below $ 2,000.

In the gold survey, analysts expect a decline, individuals expect an increase

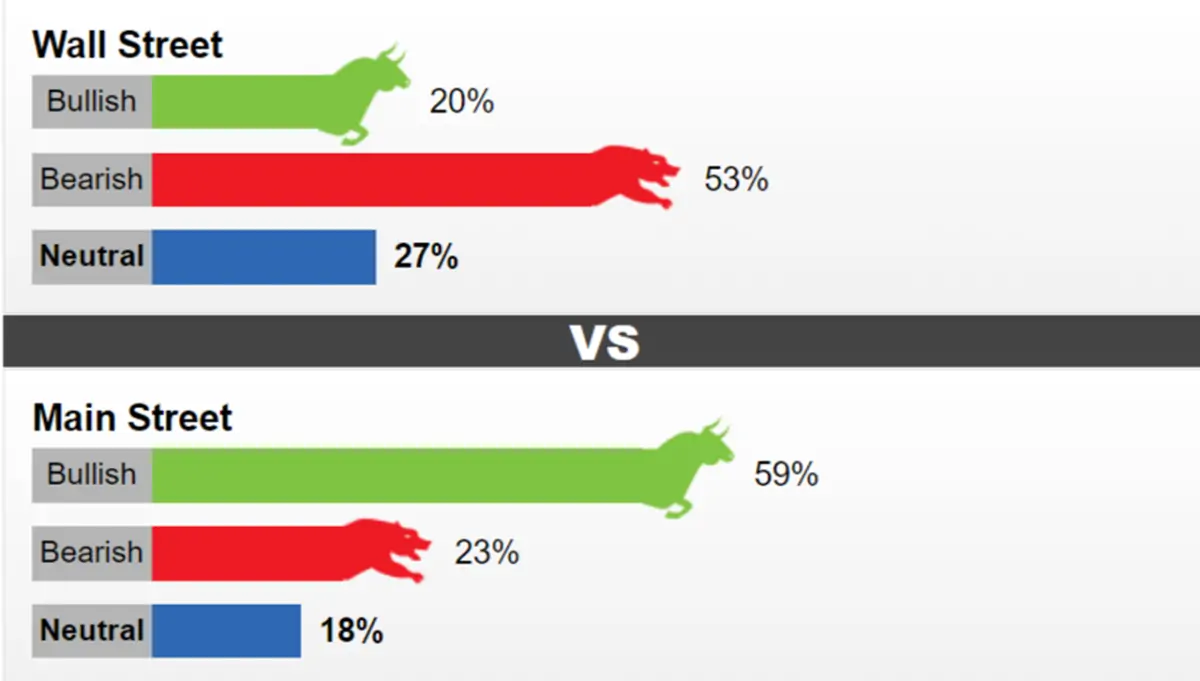

cryptokoin.com As you follow from , gold slid down after reaching its peak. The latest Kitco Weekly Gold Survey shows that most retail investors expect a price increase next week. However, the overwhelming majority of market analysts are bearish or neutral on the yellow metal’s near-term prospects. 15 Wall Street analysts voted in this week’s Gold Survey. Of these, only three experts (20%) expect gold prices to rise this week. Eight analysts (53%) predict a decline in prices. The remaining four experts, representing the remaining 27%, remained neutral on gold.

Meanwhile, participants cast 729 votes in Kitco’s online gold polls. Despite this week’s decline, market participants maintain their bullish outlook for this week. 428 retail investors (59%) expect gold to rise next week. Meanwhile, 167 (23%) expect a decline. The remaining 134 respondents (18%) remained neutral on the near-term prospects of the precious metal. The latest survey shows that retail investors expect gold prices to trade around $2,056 this week.

Mark Leibovit: It is better to be cautious

Mark Leibovit, publisher of VR Metals/Resource Letter, went from bullish to neutral on gold for next week. Leibovit comments:

With the US Dollar on the rise and following last week’s bullish breakout, I think we need to be cautious here. That’s why I’m voting neutral for now.

Colin Cieszynski: The correction will probably continue

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, is bearish on gold prices for the coming week. Cieszynski explains the reason for this as follows:

Market reaction to Friday’s nonfarm payrolls and wage inflation data pushed treasury yields and the USD higher, while gold retreated slightly. I think the Fed will be less dovish than the street hopes. This could continue the correction in gold that started after the overnight rise that started this trading week.

James Stanley: Gold will continue to rise because…

James Stanley, senior market strategist at Forex.com, thinks gold prices will rise this week. According to Stanley, gold has tended to set up bear traps this year. So, the reversal seen at the beginning of the week may be creating something similar. The analyst shares the following assessment:

If spot gold’s weekly bar closes below $2,000, it will look like an aggressive reversal candle. However, I’m not sure the risk environment currently supports such a thesis. Also, there are two big factors this week with the CPI and the FOMC. That’s why topics can change quickly. What we have seen so far is that even after the big reversal move to open the week, the bulls have emerged with support at or around the $2k level.

Adrian Day: There is a decrease for now but…

Adrian Day, President of Adrian Day Asset Management, changed his stance on the precious metal from neutral to negative. While the long-term fundamental outlook is very positive, gold is vulnerable to bad news after such a strong rally, according to Day. The analyst says we got that bad news with the official US jobs report coming in stronger than expected. Therefore, this destroys the optimism of other recent reports. It also reduces expectations for a rate cut in the near future. Accordingly, Day predicts “further decline” for the yellow metal. For this reason, the analyst makes the following statement:

Gold could easily fall below $2,000 to around $1,975. But the underlying assumption is that the Fed and other central banks will stop tightening in the face of worsening economies and unmanageable debt burdens as inflation remains stubborn. This scenario is very bullish for gold.

Daniel Pavilonis expects a range-dependent horizontal trend for gold

Daniel Pavilonis, Senior Commodity Broker at RJO Futures, says the pause in the rise in gold prices last week coincided with the pause in the decline in yields. According to the analyst, the gold market is questioning whether this thing will have the momentum to go higher. Additionally, Pavilonis believes the catalyst for the rise to all-time highs is geopolitics. In this context, the analyst makes the following comment:

My prediction for this week will be a horizontal course depending on the range. $2,000 seems like a magnet. We fall under it, we get back up there again. We thought we were going to get above it, then we went back down to $2,000. I think that’s the goal, that’s where the gold market is comfortable right now.

Adam Button: Basic picture intact for shiny metal

Adam Button, head of currency strategy at Forexlive.com, predicts gold will rise further this week. According to the analyst, weak hands have been shaken out of gold, but the basic picture remains intact.

Marc Chandler: Gold price will drop further!

Bannockburn Global Forex General Manager Marc Chandler predicts that gold will fall further this week. According to the analyst, last Monday’s major key reversal sets the technical tone. In this regard, the analyst draws attention to the following levels:

Breaking $2,006 could bring $1,985. Moreover, the five G10 central banks will meet next week and most will likely oppose aggressive rate cuts and early timing that the market has discounted.

Darin Newsom: Short-term trend is downward

Barchart.com Senior Market Analyst Darin Newsom also joins the bears in the near term. According to Newsom, February gold completed a key downward turn on its daily chart on Monday, December 4. Plus, he did it in a big way. The analyst says gold remains in a short-term downtrend. Newsom is marking last Tuesday’s low of $2,027.60. Starting from this point, it points to the following levels:

A break below this level could trigger selling to test the next downside target at $1,997.40. This is the 50% retracement level of the previous uptrend from $1,842.50 (October 6 low) to $2,152.30 (December 4 high).

Frank McGhee also bets on the decline for gold

Frank McGhee, chief precious metals dealer at Alliance Financial, also expects gold prices to fall next week. According to the analyst, the precious metal is “still reacting to the High Volume, Exhaustion Highs at $2,150.”

Jim Wyckoff expects December trade

Kitco Senior Analyst Jim Wyckoff expects gold prices to trade in a range this week. “The bears gained some technical momentum late this week,” Wyckoff said. That’s why I expect a horizontal and wavy trend,” he says.