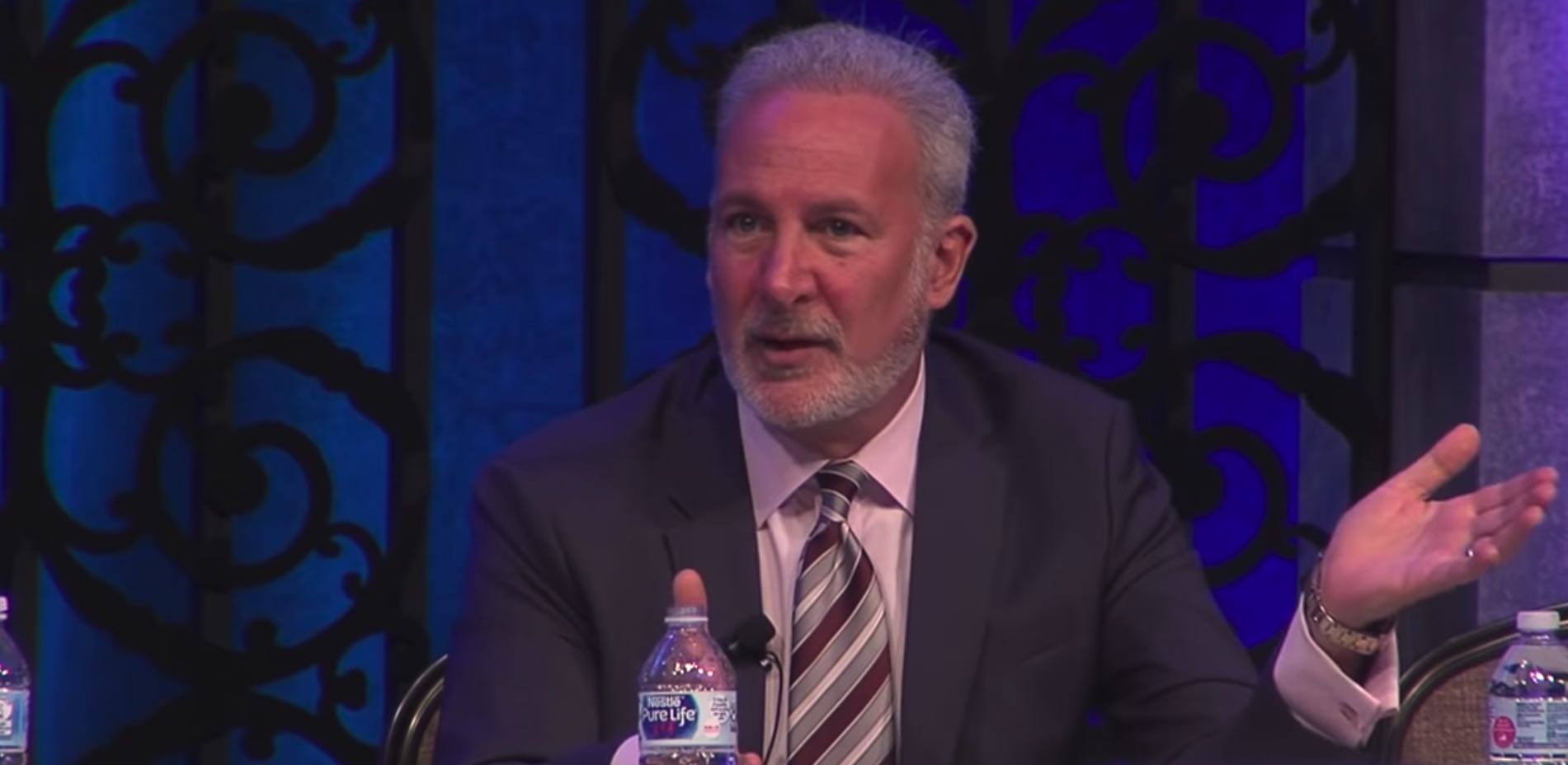

Peter Schiff, CEO of Euro Pacific Capital and head of SchiffGold mutual fund, shared an Ethereum chart and predicted that ETH will return to May 2021 lows. He pointed out that the chart shows a combination of two super bearish patterns that could push the altcoin price down significantly from its current level.

Peter Schiff expects $1,000 in ETH due to the super bear pattern

Peter Schiff compared the Ethereum chart to a previously published chart for Bitcoin and the leading cryptocurrency He said it was an “unfortunate combination” for his unit. Similarly, it points to something similar here. A double top formation appears in combination with a head and shoulders top appearing in the first. Thus, Schiff tweeted that the chart shows that Ethereum is likely to continue falling and could reach the “lower yellow line” which is the minimal bearish sign at $1,000. The last time Ethereum was traded at this price level was a year ago, in early May.

Support for #Ether at the upper yellow line has clearly been violated and the chart projects a minimum price decline to the lower yellow line. As with #Bitcoin this chart pattern combines an ominous double top with a head and shoulders top on the right side of the double top! pic.twitter.com/fDQaUDCWFz

— Peter Schiff (@PeterSchiff) May 27, 2022

Ethereum (ETH) at the time of writing, It is trading at $1,767.81, 86% below its peak of $4,891 on November 16.

Peter Schiff expects Bitcoin and altcoin market to crash

As quoted by Cryptokoin.com , Peter Schiff tweeted on May 16, He stated that he sees the “unlucky” combination of the aforementioned extreme bearish trend on the Bitcoin chart and that BTC has a “long road” ahead. He expected Bitcoin to drop to the $8,000 level. However, he later shared his surprise on Twitter that Bitcoin is “holding up so well.”

The leading altcoin took an ever bigger hit amid its recent capitulation

Peter Schiff, Ethereum ETH price continues its downward momentum after today’s latest drop. The cryptocurrency market is also in a frenzy right now, with $520 million liquidated yesterday. Worrying signs are the bearish trend developing on the RSI side. The index value here stands at a low of 29.4, which effectively puts Ethereum in the “oversold” category. Therefore, investors have to protect their portfolios more while going through difficult volatility periods.