US-based investment bank Goldman Sachs Group Inc. According to strategists, inflation in the US will not fall quickly.

Strategists led by Praveen Korapaty, the bank’s Chief Rate Strategist, noted that the assumption may be common among investors that a sharp slowdown in growth will ease price pressures and that energy prices may tend to fall more than implied in commodity futures.

However, strategists think they have limited scope to lower prices and say markets are ignoring the potential for “delayed inflation” in sectors such as healthcare.

“Although we expect further declines in inflation going forward, markets seem much more optimistic than we are about the rate of cooling,” the strategists said.

Peak In Inflation Remained Far Away

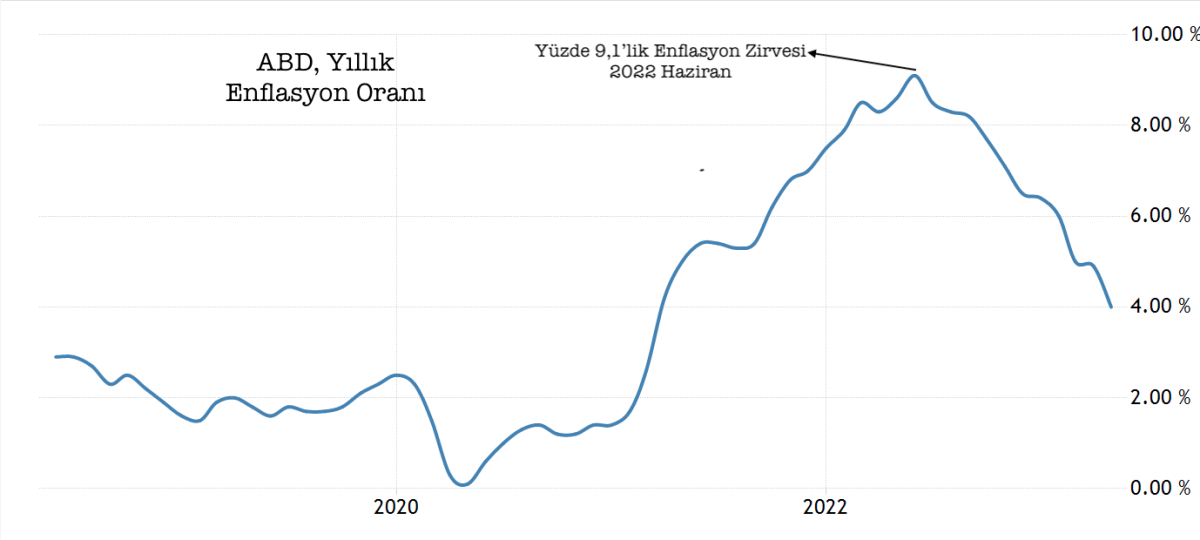

Faced with rapidly increasing prices in the global inflationary environment, the USA was faced with sharp increases in housing, food and energy prices. Inflation, which was around 2 percent on average in 2020, close to the Fed’s inflation target, rose to 9.1 percent during 2021 and 2022.

The US Federal Reserve (Fed), which entered the path of increasing interest rates with the rapid increase in inflation, increased the interest rate from 0.25 percent to 5.25 percent in the same period. The Fed, which raised the interest rates in 10 consecutive meetings, announced that it decided to keep the interest rates constant in the last meeting held in June, and did not raise the interest rate, which was 5.25 percent.