Artificial intelligence (AI) has been in vogue for the past few months as the rise of ChatGPT has sparked a resurgence of interest in potential applications of AI. It sparked a rally for AI-related cryptocurrency projects like SingularityNET (AGIX) and Fetch.ai (FET). According to Google data, AI searches took a leap, and JPMorgan shared data from a survey on artificial intelligence. Here are the details…

Google explained: AI token searches intensified

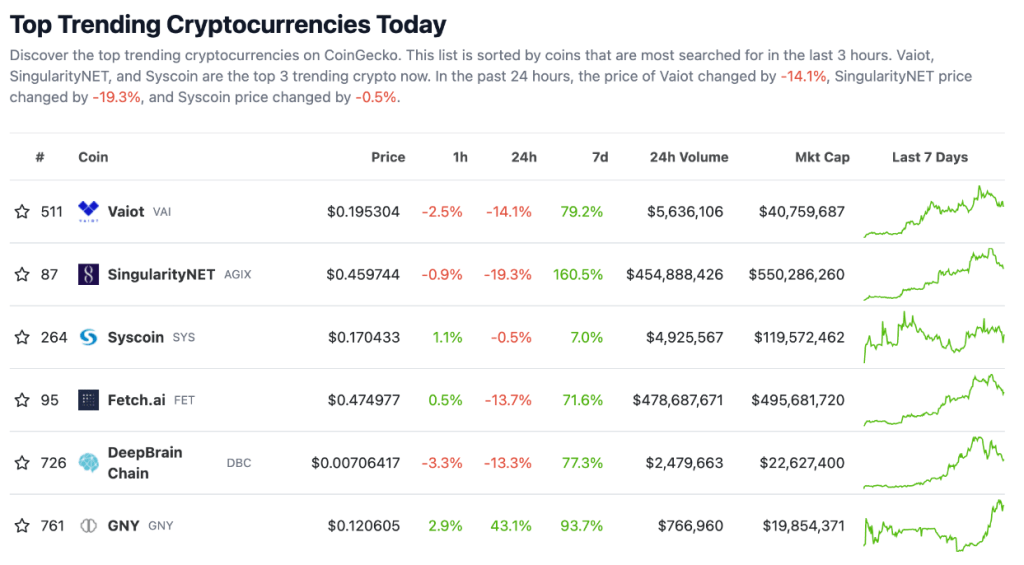

Five of the top six cryptocurrencies trending Wednesday on price data source CoinGecko had one thing in common: They all had to do with artificial intelligence, the latest trend in cryptocurrencies. Tokens like Vaiot’s VAI, SingularityNET’s AGIX, Fetch.ai’s FET, DeepBrain Chain’s DBC, and GNY have all gained at least 70 percent over the past week. cryptocoin.comAs we have also reported, AGIX, the leader of this list in the same period, made the biggest leap of over 160 percent.

AI tokens are gaining a lot of attention from the crypto space, and the growth in both price and search traffic is a sign that traders are looking to capitalize on AI-related advancements due to ChatGPT. Big tech companies are betting big on language models. Microsoft has reportedly invested $10 billion in OpenAI, the creator of the chatbot. This sparked an AI race among search engine companies rushing to overhaul their technology.

According to Google trends, more people than ever are looking for ways to invest in AI technologies. The search engine is also seeing a notable increase in “AI crypto” queries. Fashion is making a big mark on Wall Street: In a recent survey of institutional investors by Megabank JPMorgan, 53 percent of respondents said AI and machine learning will have the most impact on finance in the coming years.

JPMorgan survey respondents are hopeful about artificial intelligence

The topic of artificial intelligence was also covered in JPMorgan’s seventh eCommerce Regulatory report, an annual sentiment assessment across different asset classes that includes responses from 835 institutional traders in 60 global markets. More than half of the institutional traders surveyed said that artificial intelligence and machine learning will be the most influential technology to shape trading methods in the next three years. While blockchain stood out in previous surveys, in this survey AI; Four times more preferred than blockchain and distributed ledger technology. Since the beginning of 2023, FET has increased by 425 percent in this area. The Graph (GRT) and Ocean Protocol (OCEAN) also gained more than 200 percent.

53 percent of respondents predicted AI/machine learning technology to be the most influential in shaping the future of commerce, outpacing all other major technology categories included in the survey. API integration (14 percent) was second, followed by blockchain/distributed ledger technology (12 percent). Mobile commerce apps received 7 percent of the vote. By comparison, AI and Blockchain technology ranked second in the 2022 eCommerce Regulation results. While 25 percent of the participants estimated these to be emerging technologies, mobile commerce applications ranked first with 29 percent.

With many crypto projects now racing to integrate ChatGPT into their business models and platforms, crypto enthusiasts have discovered a variety of useful applications, including use in research, building trading bots or providing coding assistance to developers. An example of a ChatGPT-inspired development in the crypto space was the announcement on Wednesday that the TRON (TRX) ecosystem had set up a $100 million Artificial Intelligence Development Fund.