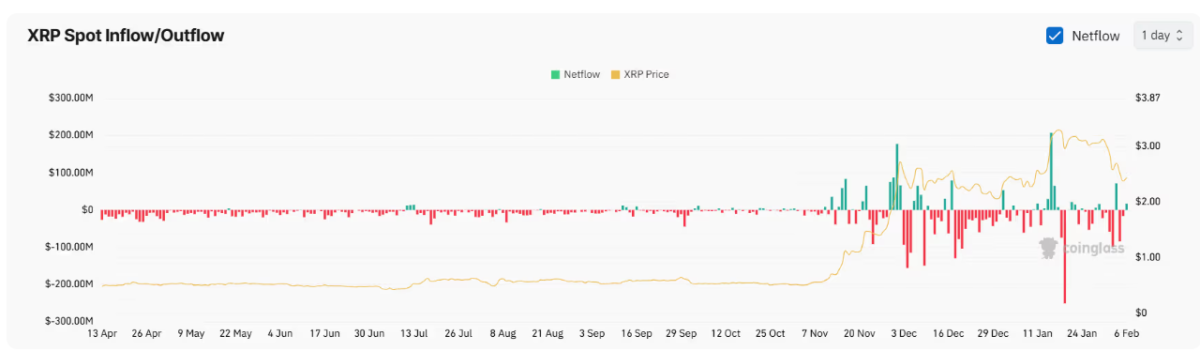

Net entrances to the Spot XRP exchanges passed to the positive area on Thursday after days of exit. This development caused investors to enter the focus of investors after the record -breaking month on the XRP’s decentralized stock market (Dex). In addition, a few negative data are on the agenda of analysts. Here is the existing XRP estimation

XRP loading on the stock market

According to Coings data, more than $ 15 million entry to the central stock market for XRP on Thursday. Most of these entrances were made to Bybit and Kraken exchanges. In Spot markets, entry into stock markets may weaken the likelihood of XRP’s rise, since investors may intend to sell tokens in the open market.

On the other hand, the 8 -hour funding rates in the XRP -term transactions market were as of 0.0065%as of Thursday. This shows that investors who open Short positions for XRP have gained weight in the market to gain from price decreases. In addition, it is noteworthy that XRP’s funding rates are more negative than BTC and ETH. Negative funding rates indicate that Short position holders are willing to maintain their decline positions by making a small payment to those who open long positions.

XRP scared the estimation

According to Coindesk Analyst Shauria Malwa, the short -term appearance of XRP continues to remain weak. The 10 -day mobile average (EMA) is $ 2.84 and 21 -day EMA is $ 2.88. The processing of XRP below these levels indicates a short -term decline tendency. However, long -term moving averages draw a more positive picture. The 100 -day simple moving average (SMA) is just above the $ 2 level, while the 200 -day SMA is at $ 1.30. These indicators show that the XRP has a long -term rise potential.

As of the moment, the XRP’s closest resistance levels are $ 2.49 and $ 2.60. If these levels are exceeded, the price is expected to move to the level of $ 3. For the first time in January 2018, the XRP managed to exceed $ 3. The XRP’s 14 -day relative power index (RSI) is 36. RSI is used as a indicator that measures the size of price changes. Traditionally, RSI values over 70 are considered excessive intake and levels below 30 are considered as excessive sale zones. The current RSI value of XRP is located in the neutral region.

As a result, it can be promising for investors that the XRP enters a positive period in terms of entry into the spot stock markets and its long -term moving averages. However, in the short term, price movements continue to decline and critical resistance levels need to be exceeded.