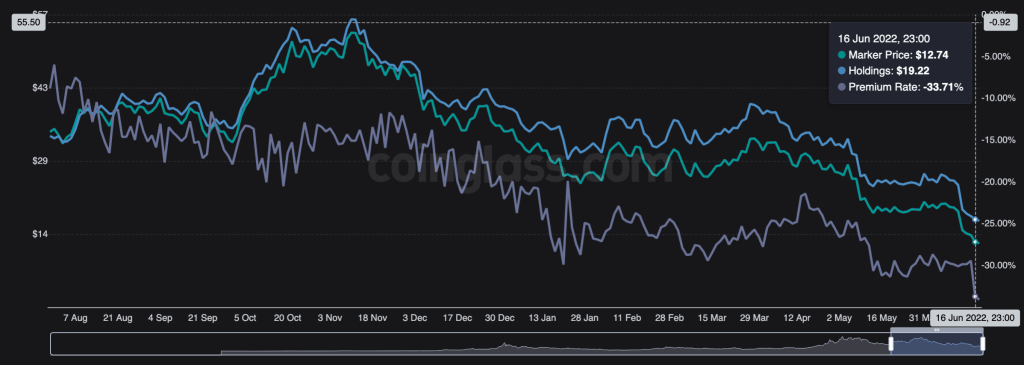

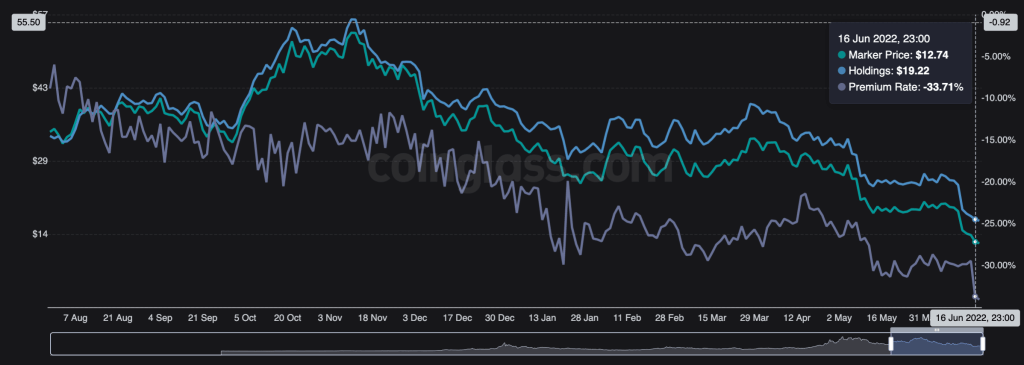

The price of Bitcoin on GBTC, Grayscale’s BTC trust fund, has dropped to $12,000 per BTC. That is well below the average worldwide market price of $18,500. Low cost now expands to 34 percent amid a market crash; faith seems to translate into a freely traded ETF. Here are the details…

Bitcoin price dropped by almost $7,000 on Grayscale

Grayscale is a digital asset management company. It is especially focused on institutional investors with its crypto-based funds. However, these funds do not directly invest in BTC. For this reason, sometimes there may be a difference between the price of BTC in the spot markets and the price in Grayscale. This difference occurred last day. As it is known, Bitcoin also fell below its previous high of $ 20,000. In fact, it changes hands for around $18,500 at the time of writing.

The price in GBTC, on the other hand, dropped to $12,000. In other words, there was a difference of about 6,500-7,000 dollars. Meanwhile, Grayscale continues to file with the SEC for a Bitcoin ETF. We will also talk about developments in this regard.

SEC and Grayscale topic: Here are the latest developments

As we reported on cryptokoin.com , US Securities and Exchange Commission (SEC) official Hester Peirce, known for her positive approach to the crypto space, on Tuesday presented an argument for the approval of Grayscale’s Bitcoin spot ETF utility. Peirce used the following statements:

It’s time to categorically refuse to identify exchange-traded cryptocurrency products.

“The entire Grayscale workforce is looking into this,” Grayscale Chief Executive Officer Craig Salm said, referring to Hester’s speech. Who may not know what it’s like between the SEC and Grayscale. Therefore, we can briefly summarize.

Grayscale’s Bitcoin ETF filings

Grayscale applied to convert the Grayscale Bitcoin Trust into a spot ETF in October 2021. The SEC has since delayed a decision. But it currently plans to make a decision by July 6. In a presentation to the SEC at a recent meeting, Grayscale said that converting the marquee product into an ETF would “protect investors and the public interest, give investors the freedom to invest in Bitcoin while allowing them to better monitor the net asset value of the product.”

Additionally, he said Grayscale, an ETF vehicle rather than the current trust structure, will “allow better NAV (net asset value) tracking, reduce rebates and premiums, and unlock approximately $8 billion for investors.” Grayscale Bitcoin Trust, which currently has approximately $20 billion in assets under management, is known to trade by net asset value with wide premiums/discounts and is currently selling NAV at a discount of 27 percent.

Giving hope to Bitcoin ETF fans, the SEC approved a futures-based fund from Teucrium in April. What sets this approval apart from other futures-based ETFs is that its application is covered by the “Act 33” and the “Act 34” (Securities Acts of 1933 and 1934). Previous Bitcoin (BTC) ETF approvals were covered by the “Act 40” (the Investment Company Act of 1940).