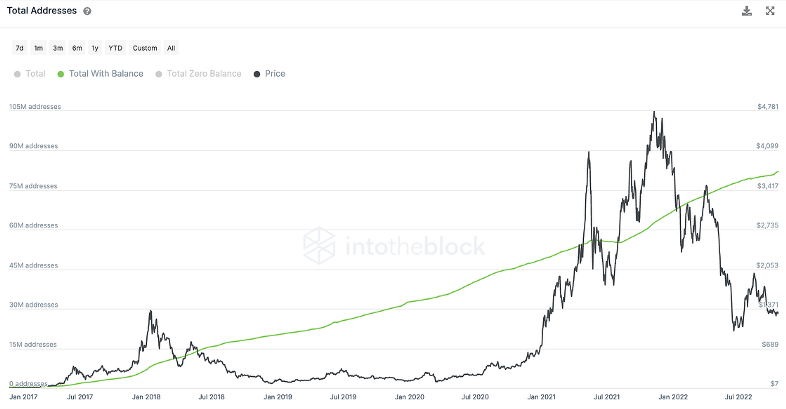

According to crypto analytics firm IntoTheBlock, institutional investors continue to pour money into the market’s 2 largest cryptocurrencies.

Institutional investors are accumulating these 2 cryptocurrencies

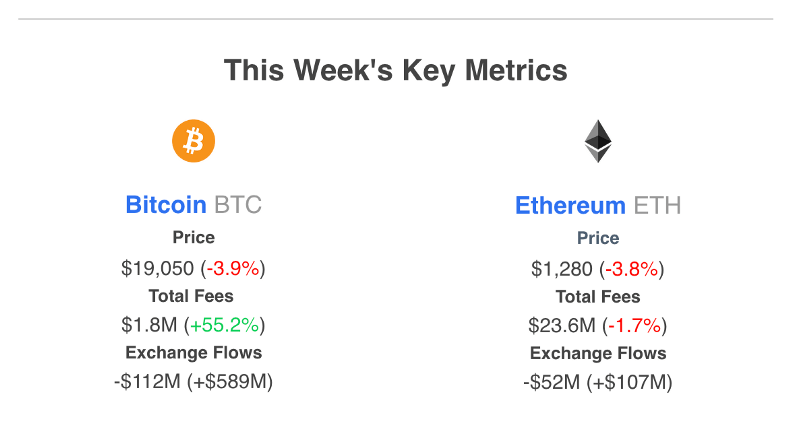

The company’s head of research, Lucas Outumuro, stated in a recent analysis that large amounts of Bitcoin and Ethereum are segregated on exchanges. However, this week is progressing at a slower rate compared to previous weeks. According to Outumuro, withdrawals from the exchange indicate that the investor is stockpiling cryptocurrency that is kept outside of centralized exchanges.

The report also shows that Bitcoin gas fees are up 55% this week from the yearly low recorded last week. Outumuro noted that Ethereum gas fees are still “pretty expensive for bear market norms.”

Bitcoin suffers from low volume

The data also shows that Bitcoin’s 30-day volatility has dropped to a two-year low. cryptocoin.com As you follow, Bitcoin is currently trading above $19,000. It has spent less than $20,000 overall since June. The largest cryptocurrency by market cap is stable at around 0.33% over the last 24 hours. Ethereum, on the other hand, is trading above $1,300 at similar rates. It has rebounded around 1.86% since last week.

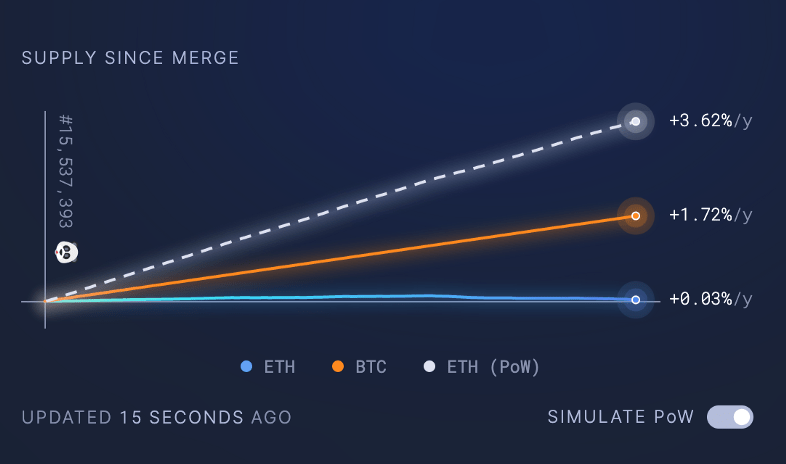

How close is Ethereum to becoming a store of value?

ETH’s low inflation has helped make it a more scarce asset, especially after the merge. In his analysis, Lucas Outumuro writes in this thread:

- The supply of ETH is now only increasing 0.03% per year, as most of the transaction fees were burned and issuances dropped by 90% after the merge.

- Also, fees not burned are used to reward stakers, providing a similar function to the GDP dividend, where shareholders yield from the economic activity supported by Ethereum.

- Finally, ETH is also indirectly accrued in value due to the maximum extractable value (MEV) where the (re)organization of transactions creates opportunities for profits and therefore more demand to verify them.