Today, the duration of Bitcoin (BTC) and Ethereum (ETH) options worth $ 3.12 billion are full. Crypto Rara investors are wondering how this big maturity ends will affect the market. While the BTC is still under $ 100,000, can the closure of these billion dollars of options move up?

Leading crypto currency is full of Bitcoin options: What are the critical levels?

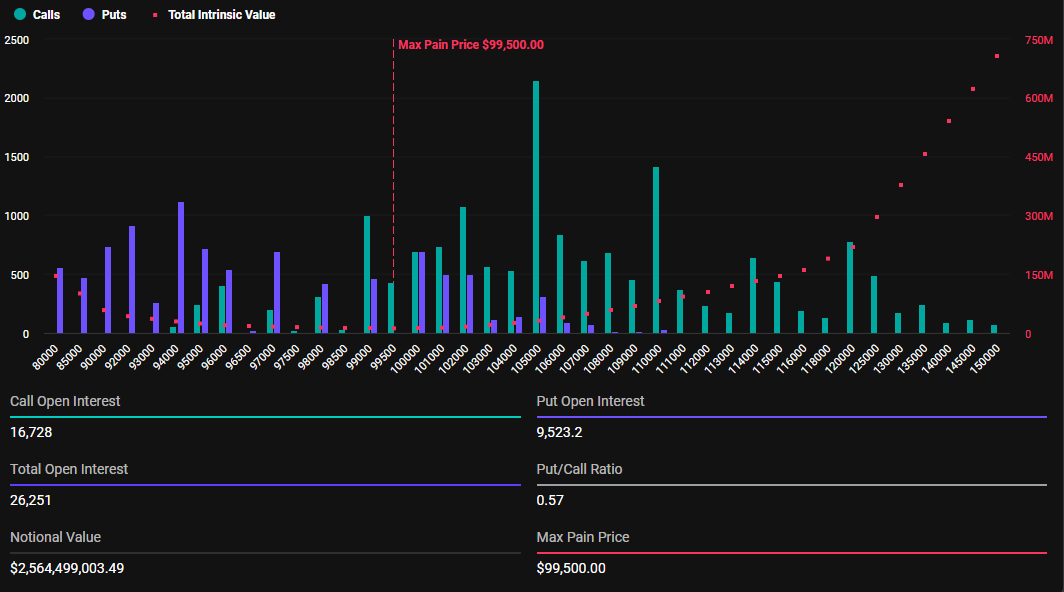

Today, the total value of BTC options that are matched today is 2.56 billion dollars. According to the data, the 26.251 Bitcoin option departs from the process. The Put-to-Call ratio of these options is 0.57. This shows that purchase options (CALL) sales options (PUT) are more dominant in the market.

The maximum damage point for Bitcoin (Max Pain) is $ 99,500. This is known as the price level that the most damage will occur. If BTC closes close to this level, many options investors may experience losses. This can increase short -term volatility in the market.

How will Ethereum options affect the market?

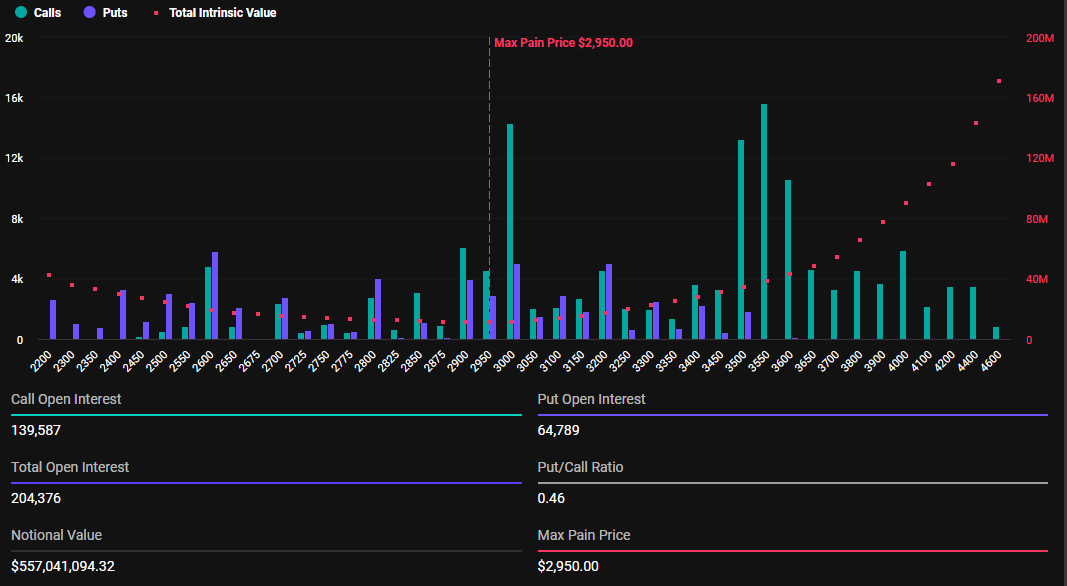

In addition to Bitcoin, the 204,376 Ethereum option today fills its time. The total value of these options is 557.04 million dollars. Put-to-Call ratio is 0.46, ie Ethereum, the purchase options are more dominant. ETH’s maximum pain point is $ 2,950.

Last week, a total of more than $ 10 billion BTC and ETH option expired. The decrease in the number of options this week shows that volatility may be lower than last week. However, the market may still react to this big closing.

Trump tariffs and macroeconomic effects continue!

According to market analysts, US President Donald Trump’s trade policies directly affect the crypto market. Last week, these policies caused the largest daily liquidation in history. Investors are still trying to intimidate the effects of a possible trade war.

On the other hand, unemployment and non -agricultural employment data to be announced in the US today may also affect markets. According to analyst Mark Cullen, the increase in unemployment rate can increase the interest in Bitcoin. However, strong economic data can make it difficult to see Bitcoin as a safe port by increasing interest in traditional markets.

Crypto market can be moved! What’s next step in Bitcoin and Ethereum?

With the expiry of the options, sudden price movements may occur in the short term in Bitcoin and Ethereum. If Bitcoin remains less than $ 100,000, more sales pressure may occur in the market. However, if a strong recovery is seen, these options closing can create new opportunities for investors.

Market observers should carefully monitor how Bitcoin and Ethereum will follow after these big options closing. In particular, the movements of whales and corporate investors can determine the short -term course of the market.