Gold has continued its unbroken string of losses since the Federal Reserve left interest rates unchanged. After this, it hit the lowest level in the last 7 months with the US employment report. However, it later posted its first positive close in two weeks on Friday.

Bulls and bears head to head in gold survey

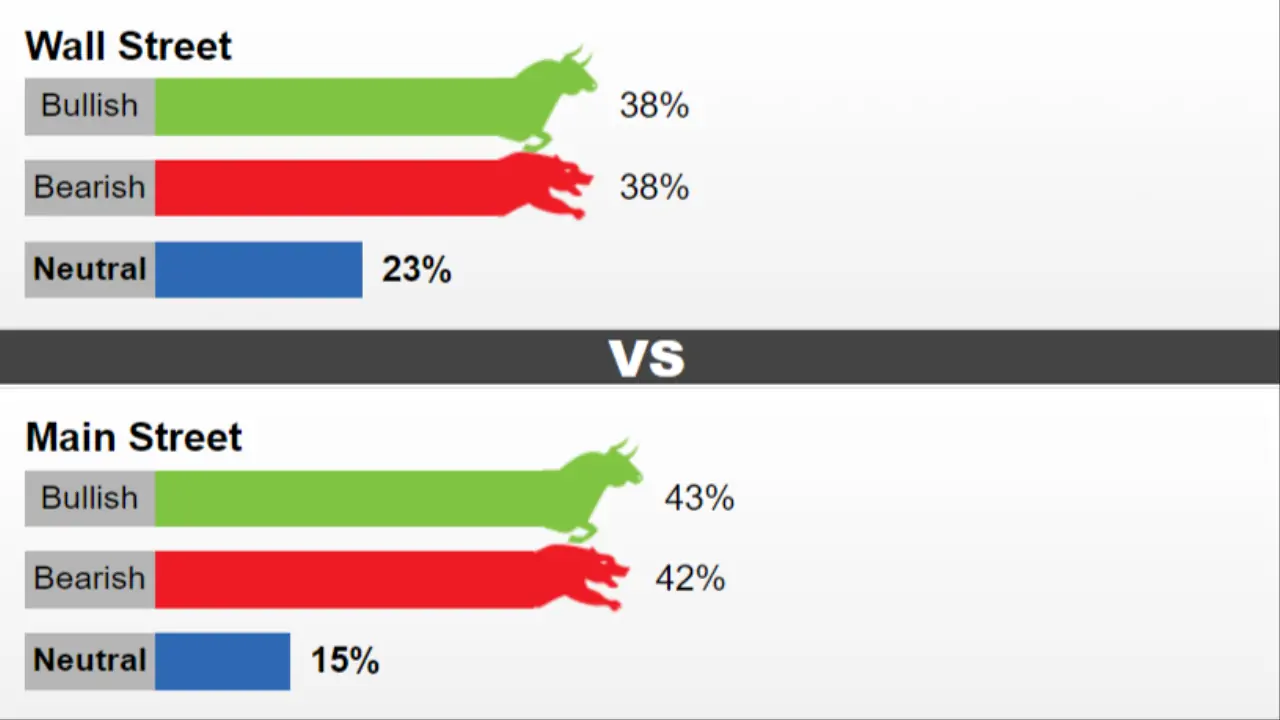

The latest Kitco Weekly Gold Survey shows that both market analysts and retail investors are evenly split on the precious metal’s prospects. 13 Wall Street analysts voted in the poll this week. Five experts (38%) expect gold prices to rise next week. The same number of experts predict that prices will fall. Three analysts (23%) prefer to remain neutral on gold next week.

Meanwhile, participants cast 528 votes in online surveys. Of these, 227 (43%) predict that gold will rise next week. Another 222 (42%) expect gold to decline. 79 participants (15%) prefer to remain neutral regarding the near-term prospects of the precious metal. The latest survey shows that retail investors expect the gold price to trade around $1,842 next week. This figure is $30 below last week’s forecast. It also represents an $11 gain from the current spot price.

Darin Newsom: Gold is in position for a bull comeback, but…

Barchart.com Senior Market Analyst Darin Newsom thinks gold prices will rise next week. In this context, Newsom makes the following statement:

Ounce gold appears to be in position to complete a bullish reversal on its daily chart on Friday. This could be a significant reversal if it breaks above Thursday’s high of $1,843.50. Key turns tend to be a more reliable formation. If so, it would indicate that the short-term trend has turned upward despite the strength of the US dollar… However, the long-term downtrend continues.

Michael Moor: The yellow metal is at a significant depletion level!

Michael Moor, creator of Moor Analytics, says he is bearish on gold. However, he states that the precious metal is at a significant depletion level. He also notes that it may be time to get back into the market. In this regard, Moor makes the following comment:

All technical data indicates that everything is pointing lower. However, these exhaustion levels are where traders should test the market. If these levels hold, we could see the beginning of a new long-term bull structure.

James Stanley: This situation seems a bit of a trap right now!

James Stanley, senior market strategist at Forex.com, believes the gold price will remain in its recent range next week. According to Stanley, it’s possible it could check the lows early in the week. The analyst states that gold is declining aggressively. Stanley explains his views on this issue as follows:

Spot gold showed an RSI value below 20 on the daily chart this week. This is a rare occurrence, it has only happened three other times in the last 20 years. The bar for the sell-off to continue is incredibly high considering how quickly it priced out and the March lows were just below the price. This situation seems like a bit of a trap right now.

Stanley doesn’t think a pullback in the gold price will necessarily bring a bottom. But he says it’s possible for this to happen. Along those lines, “I would think of this more as an oversold bounce that sets the stage for sellers to emerge at low-high resistance, especially if we continue to see yields rise.” says.

Daniel Pavilonis: Gold will probably rise next week!

Daniel Pavilonis, Senior Commodity Broker at RJO Futures, believes there is a good chance gold will bottom. Pavilonis makes the following recommendations for positions:

If I were someone looking for a long position, I would probably start buying gold here. If I were short, it’s the end of the week, so I’d want to unwind everything. Because the market made a nice downward move. But from where we are right now, there’s a possibility that rates will have that explosive peak, and I think Monday will really be the deciding factor. CPI data will likely show that inflation is weakening. This will be good for gold. I predict gold will rise next week.

Marc Chandler isn’t convinced the gold price is on the rise

Bannockburn Global Forex Managing Director Marc Chandler says he needs to see sustained strength in the yellow metal to be convinced it’s bullish. cryptokoin.com As you follow from , gold has been at the level of 1813-15 dollars in recent days. However, strong US employment growth has pushed the US dollar and interest rates higher. According to Chandler, the next important support area is near $1,800 and then $1,787.

Chandler notes that the main driver for gold remains the US dollar and interest rates, not central bank purchases. In this context, the analyst notes that it currently needs to rise above $1,833-35 to stabilize the tone.

Colin Cieszynski: A bounce is possible in case of oversold!

Colin Cieszynski, chief market strategist at SIA Wealth Management, is bullish on gold next week. The analyst says the gold price is technically oversold. The shiny metal seems to be stabilizing near $1,820. Cieszynski states that the downward momentum of gold is decreasing. He expects gold to bounce some, at least in the short term of a few days. Cieszynski is also looking forward to the CPI report coming next week. The analyst interprets the impact of the data on gold as follows:

Crude oil will likely have a big impact on the headline figure. But if the core figure continues to fall, that would be encouraging and could help gold. Today, we had every excuse in the world for another big move, and we really didn’t. This suggests that maybe things are starting to get priced out now. It might take a pretty significant surprise in consumer prices to change that.

Adrian Day: Markets are misreading, gold will continue to fall

Adrian Day, President of Adrian Day Asset Management, predicts that gold prices will continue to fall next week. He also warns that markets are likely misinterpreting employment data. He explains his views on this subject as follows:

Near-term risk remains to the downside. While tightening conditions pose a hurdle for gold, technically breaking the 50, 100 and 200-day moving averages, gold could fall to the next major support in the mid-1,750s. Investors continue to misread strong employment data as a sign of a possible ‘no landing’ scenario. This would be negative for shiny metal. But unemployment is always strongest just before a recession.

Jim Wyckoff: Still downside risks

Mark Leibovit, publisher of VR Metals/Resource Letter, sees the gold price emerging from recent lows with some upward momentum. So, a bounce is in store.

Kitco Senior Analyst Jim Wyckoff still sees downside risks for the precious metal. Wyckoff said, “Steady-low because technical data is bearish. Price downtrend is the friend of the bears.” says.

To be informed about the latest developments, follow us twitter ‘ in, Facebook in and Instagram Follow on and Telegram And YouTube Join our channel!