Artificial intelligence (AI) has been one of the most heavily talked about topics in the cryptocurrency space lately. This area has also witnessed the rise of many cryptocurrencies. In this article, we will share the latest analysis for three prominent altcoins (HBAR, GRT and FET) in the field of artificial intelligence. Here are the details…

Bulls continue to support GRT

The recent surge in AI-connected cryptocurrencies has proven that the combination of AI and crypto is reliable for traders. The success of ChatGPT demonstrated the power of AI technology. Among the most talked about AI tokens is The Graph (GRT), which is the largest cryptocurrency in the category by current market cap.

A look at the moving average metric for GRT suggests a clear uptrend in sentiment for the asset, according to analyst Anvesh Reddy. However, the AI token has made some adjustments following ChatGPT and Google’s record high around the Bard robot discussion. Therefore, more positive developments in AI adoption could potentially mean another rally for all AI tokens.

In the case of the GRT token, the moving average curves still point to upward movement, indicating more upward movement in the near future. Compared to its price at the beginning of January 2023, the GRT gained more than 300 percent. Currently, GRT is changing hands at $0.166, up 4.4 percent.

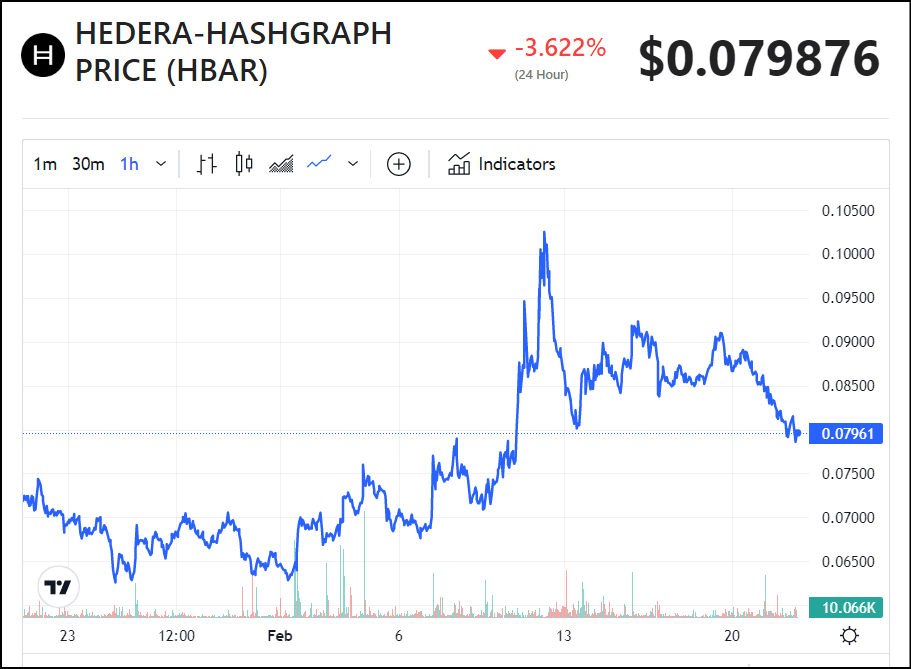

New AI product fuels excitement for HBAR

Hedera (HBAR) is one of the prominent projects in the field of artificial intelligence. The latest entry of Untink.ai, the new product in the ecosystem, allows the Hashgraph-powered layer-1 solution to make a mark in the artificial intelligence industry. cryptocoin.com As we reported, Hedera’s development arm, the HBAR Foundation, announced the launch of Untink.ai on Thursday. The new dApp is an e-commerce content creation platform that uses the Hedera Token Service (HTS) to run web3 transactions. It also uses the capabilities of artificial intelligence (AI) and “real-time personalization algorithms” to facilitate online advertising.

Hedera will be able to help companies reach the appropriate context, such as content or gaming websites, with the majority of their time thinking. For example, someone searching for a website for hiking destinations will come across an article offering advice on hiking equipment. The text will be embedded in suggested product sections (e.g. walking shoes), allowing users to click through and make a purchase immediately.

Using the Hedera Token Service (HTS), Unspethink can provide creators and publishers with tiered benefits through NFTs that work in a similar way to loyalty tokens. An NFT is awarded to its creator for actions such as generating new content, generating sales, driving traffic to a brand’s website, and similar events. This token; It can be used to claim incentives from various partners, including companies, agencies, and publishers. In addition, on February 7, giant Dell joined Hedera’s governing council. Recent developments have caused the HBAR token to experience a significant price increase to $1.

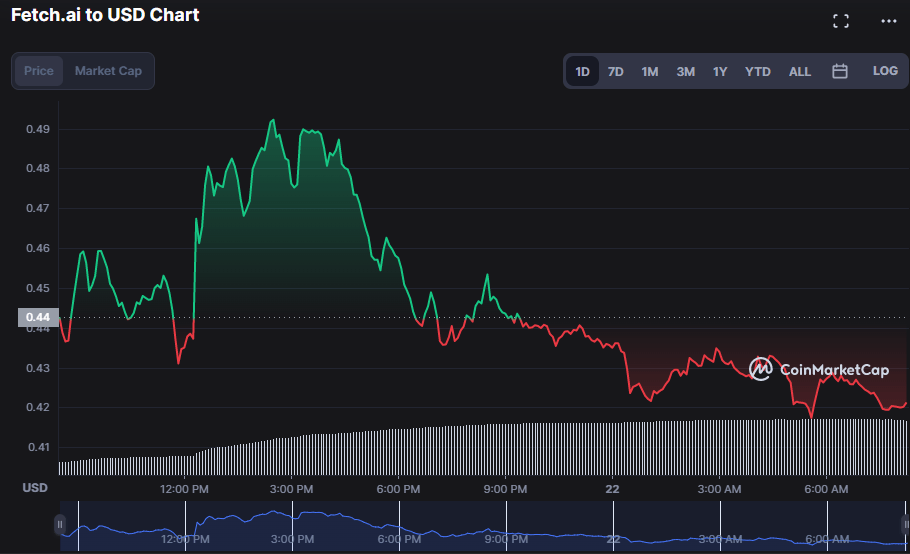

FET exhibits a “death cross”

While the bulls had the upper hand for most of the day, sellers emerged to reclaim control of the slumping Fetch.ai market after meeting resistance at $0.4979. The current dip in negative momentum manifested itself as the bulls pushed FET price to a new 7-days $0.4979. Due to the expected breakout of FET price, traders moved forward to expand their market positions, which led to an increase in trading activity.

According to analyst Kelvin Munene, this volatility implies that the market is ready for investment and that more profits are possible. Price action creates a big red candle and pushes towards the lower band, which indicates a downward trend, implying that FET price may continue to decline in the short term. This volatility can cause more significant fluctuations in price action. However, this move could be an opportunity for investors to profit from market uncertainty. If investors are willing to take more risk, the promise of higher returns creates the risk of investing in the FET market.

The Coppock curve, which has a value of 1.05164833 and moves down, shows that there is an expectation that the market will start to rise again in the long-term, despite the negative in the near-term. On the other hand, the 100-day MA is crossing above the 20-day MA, which shows a bearish 0.43657889 and 0.43483812 values on the 2-hour price chart, respectively. On the other hand, the MACD line breaks below the signal line and enters the negative area, indicating that the buying pressure is decreasing and selling is dominant. As a result, the analyst provides a bearish outlook for FET in the short term.