The famous economist Peter Schiff, who predicted the 2008 stock market crash, made an alarming Bitcoin prediction of $ 3,800. While other experts expect more reasonable prices, ‘decline’ is common opinion.

Peter Schiff predicted that Bitcoin price will soon drop below $3,800

cryptocoin.com As a result, we mentioned that Peter Schiff expected a decrease in the BTC price to $ 10,000 last year. The senior analyst shared that he expects a sharper drop in Bitcoin price in a comment he made on Twitter yesterday. Earlier today, he predicted in a tweet that Bitcoin would drop below $4,000.

Lol pic.twitter.com/FhehOj7DMW

— frog4233.eth (@frog4233) March 12, 2023

The extremely downward statements made by Schiff are not shocking at all. He has been predicting that Bitcoin will collapse for years and has been criticizing cryptocurrencies. Still, different crypto analysts also agree that we will see a correction in BTC in the short term.

Technical analysis shows weak market conditions pointing to $18,000

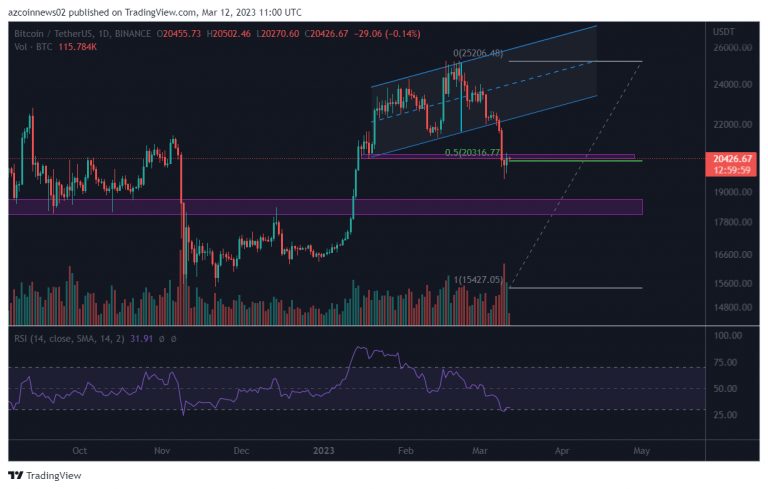

After a strong increase since the beginning of the year, Bitcoin is trading in an ascending parallel channel. This is usually a bearish pattern that in most cases leads to a collapse. BTC fell below the formation on March 8 and then caused a sharp decline. The move caused the price to decline below the $20.4k level formed by a sideways support area and the 0.5 Fib retracement support level.

Later, the bulls managed to print a 2-day bullish candle, which reduced the selling. However, Bitcoin needs to quickly regain $20,400 to avoid further declines, otherwise the selling pressure will strengthen and cause the price to drop to the next level of support to $18.3k.

According to David, an analyst at Azcoinnews, the most likely scenario shows that Bitcoin will continue to decline in the coming days. The key support level to watch is $18.3k. But historical data suggests that BTC may surprise players with a harder-than-expected drop.

Bitcoin dropped 50% 3 years ago today, can history repeat itself?

Exactly three years ago, on March 12, 2020, the world was experiencing a state of uncertainty and panic due to the rapidly spreading COVID-19 pandemic. During this period, the Bitcoin price dropped 50% in just one day.

The drop in Bitcoin price caused a widespread wave of liquidations on popular exchange BitMEX. Within minutes, $750 million worth of BTC was liquidated. This has caused many investors to panic and question the stability of Bitcoin as an investment.

Current data provided by CryptoQuant shows that Bitcoin’s current market cap to realized value (MVRV) ratio is similar to that in the 2018-2020 price cycle. During this period, after testing the first level of the MVRV rate, the BTC price entered a bull run and market profitability. Therefore, if the bitcoin price successfully tests the first level of the MVRV rate and rises above the EMA 100D of this metric, it may indicate that Bitcoin is back in the game.

The crash on March 12, 2020 is a reminder that Bitcoin is not immune to market volatility and external events. However, it also shows Bitcoin’s resilience and ability to recover from significant price drops. As with any investment, there are risks, but there is significant profit potential for those with a long-term investment strategy and those who can weather short-term price fluctuations.