Eurostat, the European Statistical Office, published the most critical data for the regional economy as of 12:00. According to Eurostat data, annual inflation met expectations, while growth data followed a more positive course.

Monthly Turkish Consumer Price Index CPI in the Euro zone turned negative after a long period of time. Consumer prices in Europe fell by 0.1% against the market’s expectation of 0.3%. Consumer prices had risen by 0.3% in the previous month.

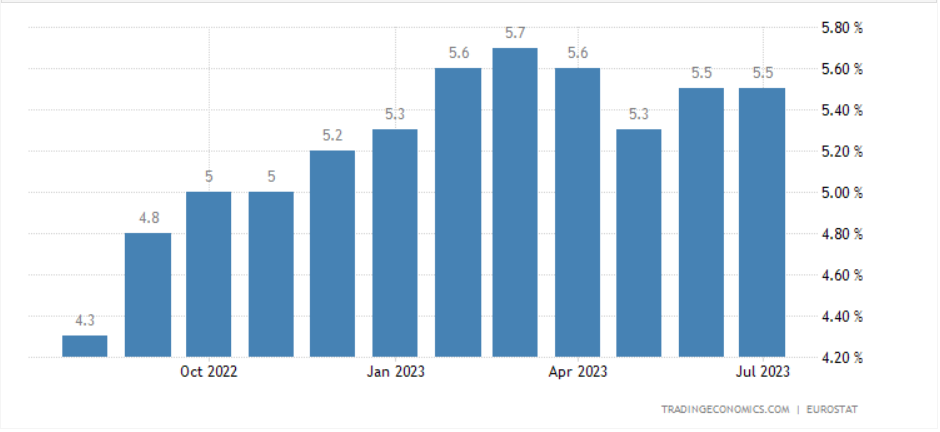

Annual inflation in Europe was announced in line with the 5.3% projections. The metric, which was recorded as 5.5% in the previous period, reveals that the rate of price increase continues to slow down on an annual basis.

Although these data cause investors to expect that interest rates will decrease in the coming period, another inflation metric that the European Central Bank (ECB) carefully monitors does not leave much room for interest rate cuts.

Core Inflation Detail!

According to Eurostat data, although the headline CPI, which is based on the majority of citizens, showed a limited decline, core inflation confused them. Ignoring temporary price increases, the core CPI did not move down at the end of the month.

Eurozone Core Inflation Chart

Eurozone Core Inflation ChartWhile the markets expected the monthly core inflation in Europe to be -0.5%, Eurostat announced this figure as -0.1%. Annual core inflation remained stable at 5.5% according to the latest data. Most surveys expected the annual core CPI measure to be 5.4%.

Moderate Growth Continues

Eurostat, the European Statistical Office, also announced the second quarter and annual GDP figures. The growth data, which exceeded the expectations, causes the possibility of recession in the economy to decrease. According to the data, the European economy grew by 0.3% in the second quarter of the year. Annual GDP, on the other hand, was announced as 0.6%, against the expectations of 0.5%.

The absence of the expected decline in the core metric gives the ECB more room for rate hikes, as GDP figures do not indicate a serious recession.