Leading altcoin Ethereum (ETH) is approaching its next bull cycle, according to Macro Guru Raoul Pal. However, Citron Research says that the bearish trend continues in Ethereum.

“Leading altcoin approaches its next bull cycle”

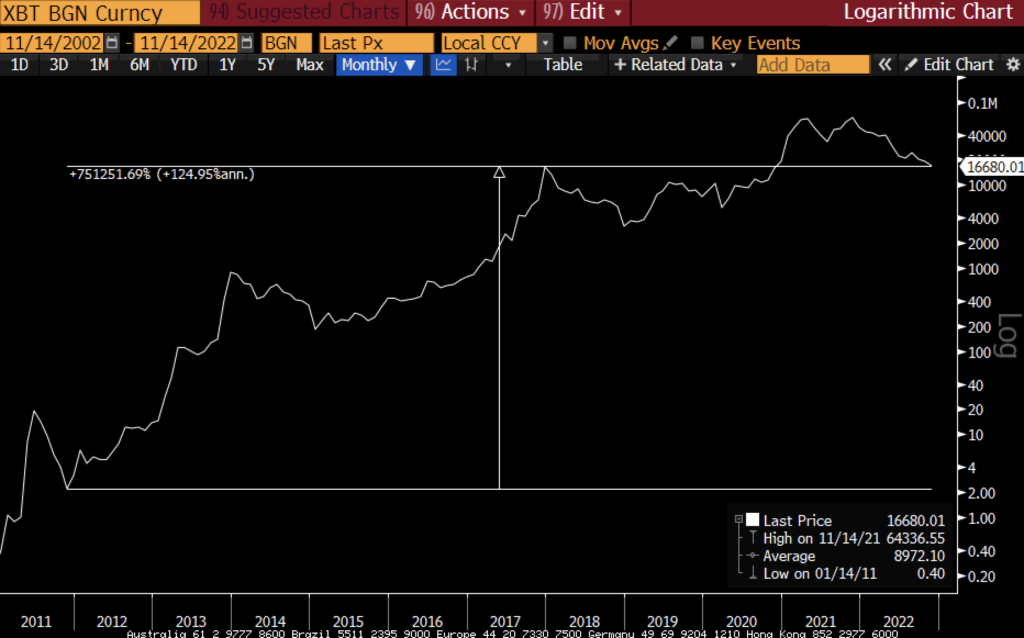

Former Goldman Sachs executive Raoul Pal says bottoming is likely for Ethereum (ETH). He also notes that a crypto bull run is now just around the corner. The macro guru says that after the collapse of crypto exchange FTX, those who were skeptical of the industry forgot about Bitcoin’s (BTC) historical performance and network growth. He notes that there are dark times like this that typically precede large price increases. In this context, Pal makes the following statement:

But this is tiring. Fraud! Ponzi bullshit. It hides the fact that the network growth in BTC is 125% per year. Moreover, this is an astonishing growth. This leads to huge price increases as liquidity returns and the network continues to grow.

Source: Raoul Pal / Twitter

Source: Raoul Pal / TwitterPal says there is a strong correlation between the M2 money supply and risk assets like crypto. According to the expert, an expansion in the global money supply and a liquidity wave will emerge once again. In this context, Pal notes:

Liquidity will return soon. We do not need a super liquidity cycle like 2020. It will only provide a positive cycle for crypto to perform as the network continues to grow.

“ETH probably bottomed out in June”

With his eyes fixed on Ethereum, Pal predicts that the bottom is mostly like in June. He also says that ETH is accelerating to surpass Bitcoin once again in another bull cycle. He expresses his views on this matter as follows:

In the last cycle, the network effects grew faster. Also, their returns were even greater than BTC. This is why ETH has become dominant. The increase has roughly doubled. Here we are again. It’s near the bottom of the loop. ETH probably bottomed out in June. As everyone has lost their minds, the bottoms of despair are spreading everywhere. Just like they did at the bottom of every previous cycle. But the network continues to grow over time.

Citron Research remains bearish on Ethereum

Citron Research shared that the bearish trend continues in the leading altcoin Ethereum. He believes the $130 billion token is as “common sense flaw” as the failed FTX exchange. Citron talks about the ongoing cryptocurrency crisis. He says he re-lit his flame to shorten it accordingly. In fact, he notes, there are many stocks that have risen under the “Someone else did the homework” misconception. Also, Citron doesn’t seem to have much sympathy for the victims of the FTX debacle. He makes the following statement about it:

As for victims or account holders, you wanted decentralization, you got decentralized. What did you think about sending your money to the Bahamas?

cryptocoin.com As you follow, Andrew Left, the founder of Citron Research, known as one of the most famous shorts in the world, describes cryptocurrencies as ‘totally fraudulent’. In 2017 Left targeted the Grayscale Bitcoin Trust with a ‘ridiculous’ assessment. However, Citron Research has warmed to Bitcoin, arguing that it can act as an excellent inflation hedge.