The bears are trying to push Bitcoin (BTC) below $19,000 to further strengthen their advantage in the cryptocurrency markets. As we reported on Kriptokoin.com, Famous economist Alex Krueger pointed out that the volume of Bitcoin reached an all-time high in June. If Bitcoin follows the historical pattern of the 2018 bear market, Krueger expects its bottom to occur in July. Could Bitcoin make a higher bottom and set the crypto markets on a recovery path? We present the charts and analysis of the top 4 altcoin projects showing the possibility of a relief rally in the short term…

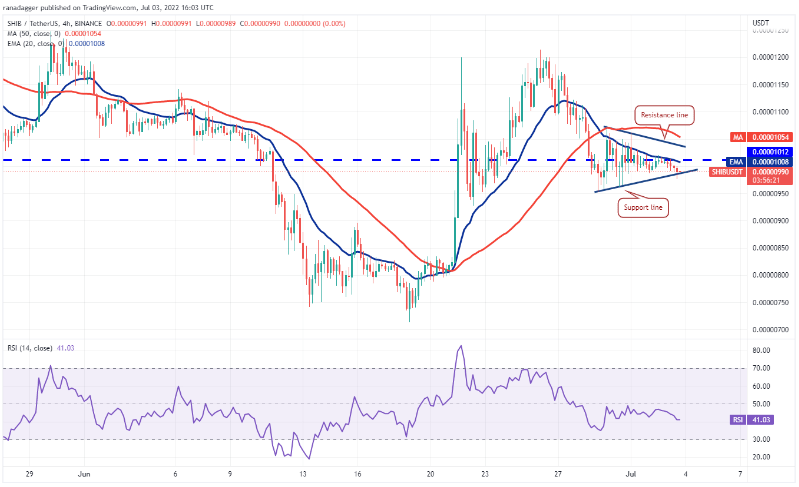

The first altcoin on the list: Shiba Inu (SHIB)

Shiba Inu (SHIB) is trading in a tight range near the moving averages as the bulls attempt to form a higher low near $0.000009. If the price rises above the 50-day SMA ($0.00010), the SHIB/USDT pair could gain momentum and rally to $0.000012 and then $0.000014. A break and close above this level could signal a potential change in trend. Contrary to this assumption, if the price dips below $0.0000009, it could trap bulls who may have bought the break above the 50-day SMA. This could clear the way for a possible $0.000007 retest. A break below this critical support could indicate a resumption of the downtrend.

The 4-hour chart shows the formation of a symmetrical triangle pattern. The pair is stuck between the 20-EMA and the support line of the triangle. If the bears sink and sustain the price below the support line, the pair could drop to $0.000009. A break below this support may indicate that the bears are back in the driver’s seat. Conversely, if the bulls push the price above the 20-EMA, the pair could rally to the resistance line of the triangle. If this level is surpassed, the pair could rally to $0.000011 and then decline to $0.000012.

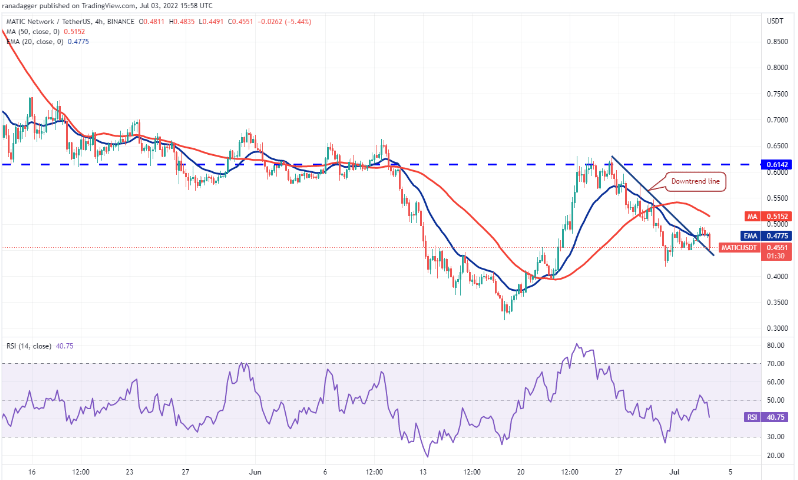

Polygon (MATIC)

Polygon (MATIC) fell from the strong overhead resistance of $0.61 on June 26 and the bears dragged the price below the 20-day EMA ($0.50) on June 28. Since then, the MATIC/USDT pair has been trading near the 20-day EMA. This indicates that the bulls are trying to push the price above the level. If they are successful, the pair may try to clear the $0.61 hurdle again. The RSI has made a positive divergence indicating that the bears may lose control. A break above $0.61 could clear the way for a possible rally to $0.75. Contrary to this assumption, if the price drops from the current level and dips below $0.41, it suggests that the recent recovery could be a bear market rally. Sellers will then attempt to push the price back to the critical support at $0.31.

Buyers pushed the price above the downtrend line and the 20-EMA but failed to surpass the $0.50 psychological level. This pulled the sell off and the bears pushed the price down to $0.45. If this support is broken, a retest of $0.41 is likely. On the contrary, if the price bounces back from the current level, it indicates that the bulls are buying on the dips. The bulls will then make another attempt to clear the overhead resistance at $0.50. If they are successful, the pair could rally to $0.55 and then to $0.61.

Cosmos (ATOM)

After a long downtrend, Cosmos (ATOM) is trying to make a bottom. Buyers pushed the price above the 20-day EMA ($7.84) on July 1, but the 50-day SMA ($8.81) is likely to act as a strong hurdle. The flat 20-day EMA and the RSI near the midpoint suggest that selling pressure may drop. If the buyers price rises above the 50-day SMA, the bullish momentum could increase and the ATOM/USDT pair could rise to $10.84 and then $12.50. A break and close above this level could indicate a potential trend reversal. This rise could be invalidated in the short term if the price breaks from the current level and slides below $6.89. If this happens, the pair could retest the critical support at $5.55.

The 4-hour chart shows that the bulls are attempting to turn the 50-SMA to support. If the price rises from the current level and rises above $8.38, the bulls may challenge the immediate resistance at $8.75. A break above this level could signal a resumption of the upward move. The pair could rally to $9 later. Conversely, if the price declines and breaks below the moving averages, it indicates that the bears are continuing to sell higher. The pair could slide to $7.18 and then $6.89 later.

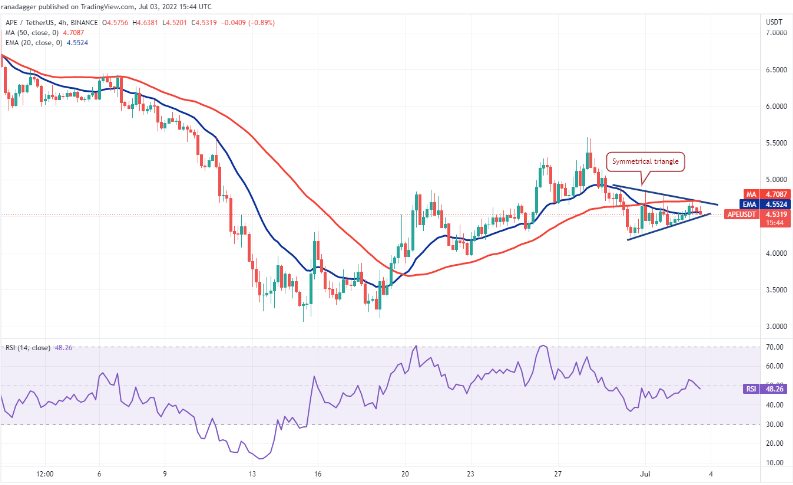

Last altcoin on the list: Apecoin (APE)

Apecoin (APE) bears pushed the price below the 20-day EMA on June 29, but a positive sign is that the bulls are not giving up much ground. This shows that the buyers are not abandoning their positions as they expect a higher move. The flattening 20-day EMA and the RSI just below the midpoint suggest that selling pressure may decline. Buyers can turn the advantage in their favor if the price moves above the 20-day EMA. The APE/USDT pair could then rise to the 50-day SMA ($5.72), where the bears are expected to form a strong defense. Contrary to this assumption, if the price breaks from the current level and falls below $4.21, the next stop could be $3.85.

The 4-hour chart shows the formation of a symmetrical triangle showing indecision between buyers and sellers. Both moving averages are flat and the RSI is near the midpoint, indicating an equilibrium state. If the price drops below the triangle, it means the bears are claiming their upper hand. The pair could later decline to the $3.78 pattern target. Alternatively, if the price rises from the current level and breaks above the triangle, it could give the bulls an advantage. The altcoin could then rally to $5.38 and later to $5.57.