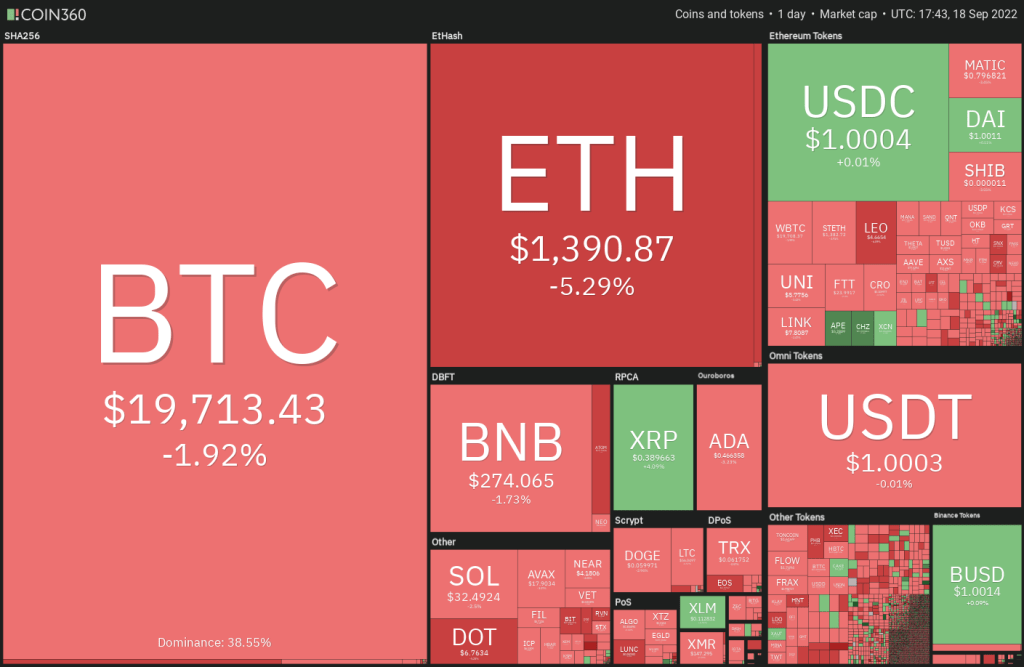

There’s the much-anticipated Fed meeting this Wednesday. The FED’s FOMC meeting will take place on September 21 and will determine the monetary policy of the United States. Meanwhile, Bitcoin and altcoin prices are also focused on the meeting. Bitcoin is falling because of its correlation with stock markets. Therefore, the entire cryptocurrency market is also going down. However, there are some altcoins that are giving bullish signals in the short term despite the bearish outlook.

Bitcoin S&P 500 correlation increases crash risk

The S&P 500 and the Nasdaq index suffered their worst weekly performances since June. Behind this, investors are worried about the FED meeting that will take place on September 21. Many investors expect the Fed to continue its aggressive monetary policy to keep inflation down. They are also concerned that this could lead to a recession in the US. Meanwhile, Bitcoin (BTC) continues to act in correlation with the S&P 500.

The leading cryptocurrency has dropped more than 9% this week, taking altcoin prices with it. However, if the Bitcoin S&P 500 correlation continues, the cryptocurrency market is likely to suffer more. Goldman Sachs strategist Sharon Bell warns that aggressive rate hikes could trigger a 26% drop in the S&P 500. A collapse in the stock market will take BTC and altcoins with it due to correlation.

What are the forecasts for this week’s Fed rate decision?

cryptocoin.com As we reported, most investors expect the FED to raise interest rates by 75 basis points at its next meeting between September 20 and September 21. However, the FedWatch Tool shows an 18% probability of a 100 basis point rate hike. This uncertainty will leave investors nervous. If the Fed’s rate hike is in line with market expectations, certain cryptocurrencies will attract buyers. Now let’s take a look at altcoin projects that are giving a bullish signal in the near term.

4 altcoins to watch this week

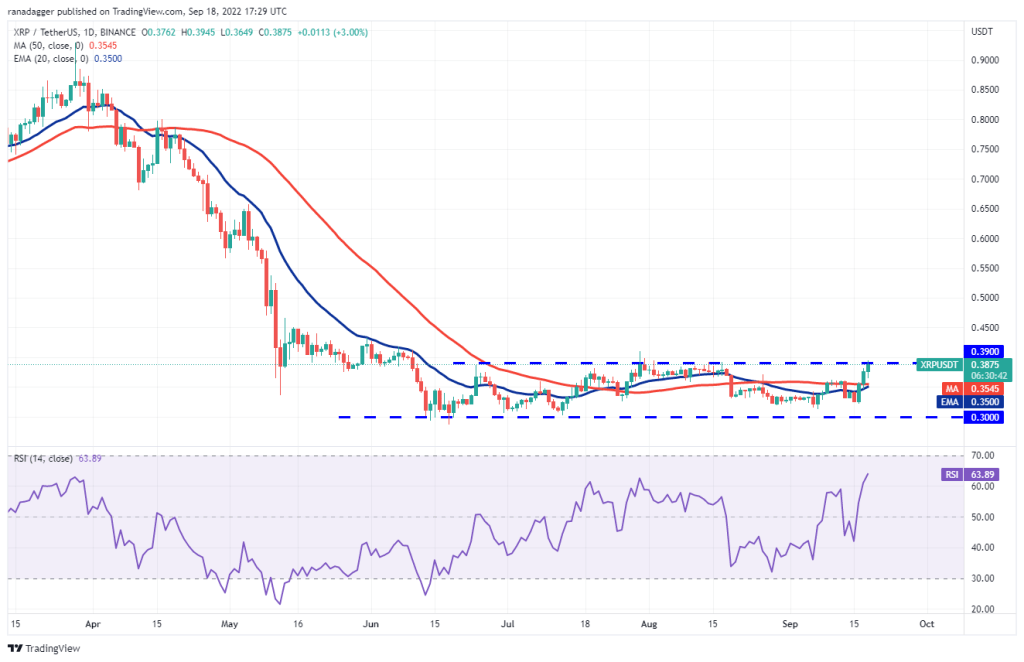

Ripple (XRP)

Ripple (XRP) has been moving in a range between $0.30 and $0.39 for days. Now Ripple price has reached the resistance point of the range. If the bulls break this hurdle, it will mark the start of a new uptrend. In a range, traders usually buy near the support and sell near the resistance. If the price drops sharply from the current level and reaches below the moving averages, the altcoin will extend its consolidation for a few more days.

Although the moving averages crossed each other, the RSI jumped into the positive territory. This shows that the bulls have slight strength. If buyers hold and sustain the price above $0.39, the pair will rally to $0.48. In fact, XRP rose sharply from $0.32 to $0.39. Thus, it showed the strong buying of the bulls. The 20-EMA is bullish with the RSI in the positive territory, which indicates the path of least resistance is up. Initial resistance on the upside lies at 0.39 and 0.41. Conversion of 0.39 to support will support the upside rally.

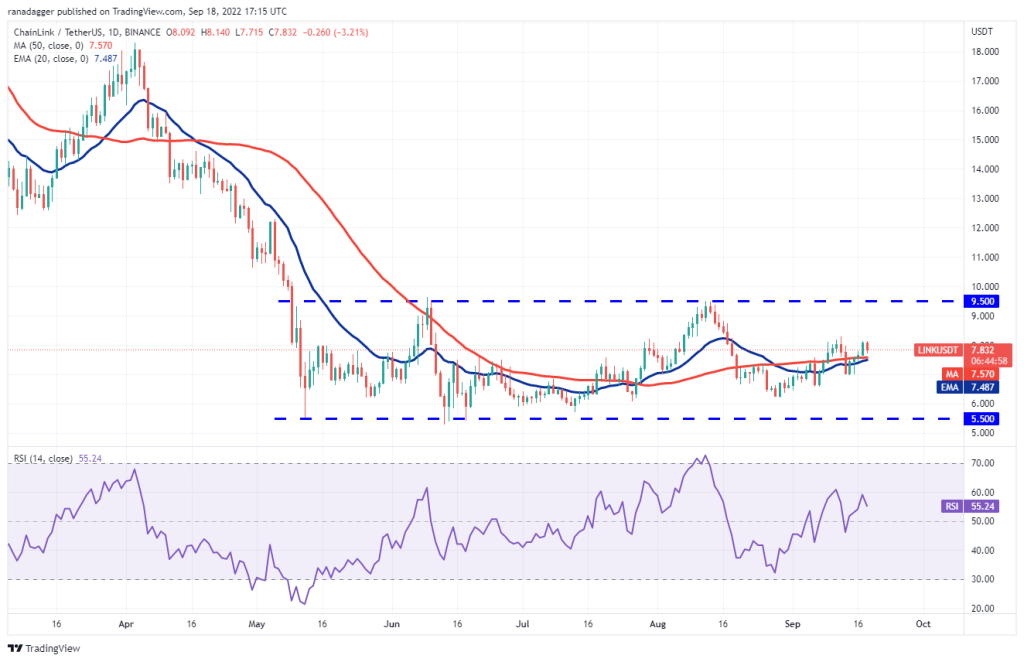

Chainlink (LINK)

Chainlink (LINK) has been stuck in a wide range between $5.50 and $9.50 for the past few weeks. This shows that buyers are trying to create a bottom. The bulls pushed the price above the moving averages and the RSI jumped into the positive territory, showing that the positive momentum could recover. There is a minor resistance at $8.30. If the bulls push the price above this, the altcoin could rally to the stiff resistance at $9.50. This level will likely attract aggressive selling by the bears. However, if the bulls break through the barrier, it will indicate the start of a new uptrend.

The moving averages are an important support to watch on the downside because if they give up, the selling pressure will increase. This risks a drop to $7.00 and then to $6.20. Buyers are trying to defend the moving averages on the 4-hour chart. This will start a recovery towards the overhead resistance at $8.20. If the price rises above this overhead resistance, the pair will rally to $9.00. If the bulls fail to push the price above $8.20, the advantage will turn in favor of the sellers. If that happens, LINK will drop to $7.50, then $7.

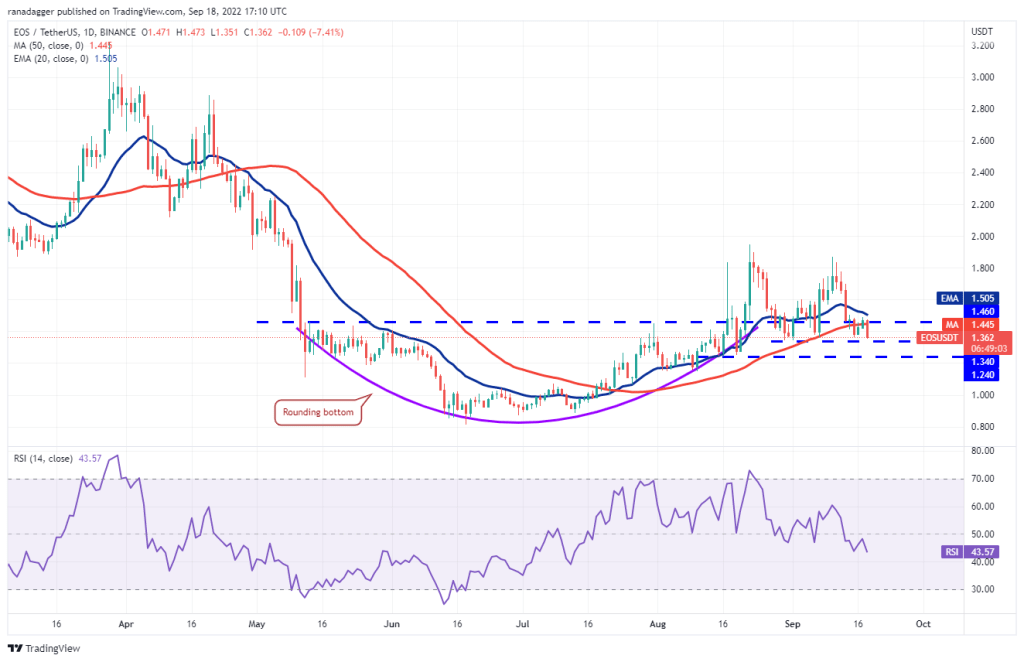

EOS (EOS)

The bears pulled EOS below the 50-day SMA of $1.44 on Sept. 15. However, they failed to break the support at $1.34. This shows that the bulls are buying on the dips and attempting to form a low around $1.34. A minor downside was that the bulls faced a strong resistance at $1.50 at the 20-day EMA. This shows that the bears are not giving up and are trying to take control. This struggle between bulls and bears is likely to be resolved with a strong breakout.

If the price breaks above the 20-day EMA, the bullish momentum will increase. As a result, the altcoin will rise to $1.86. Alternatively, if the price drops below $1.34, EOS price will drop to $1.24. A break below this support will take the pair to $1.00. Currently, the bears are trying to further strengthen their advantage by pulling the price below the strong support at $1.34. However, the bulls defended the $1.34 level three times and will try again. A rise is possible if the price bounces back from $1.34.

Tezos (XTZ)

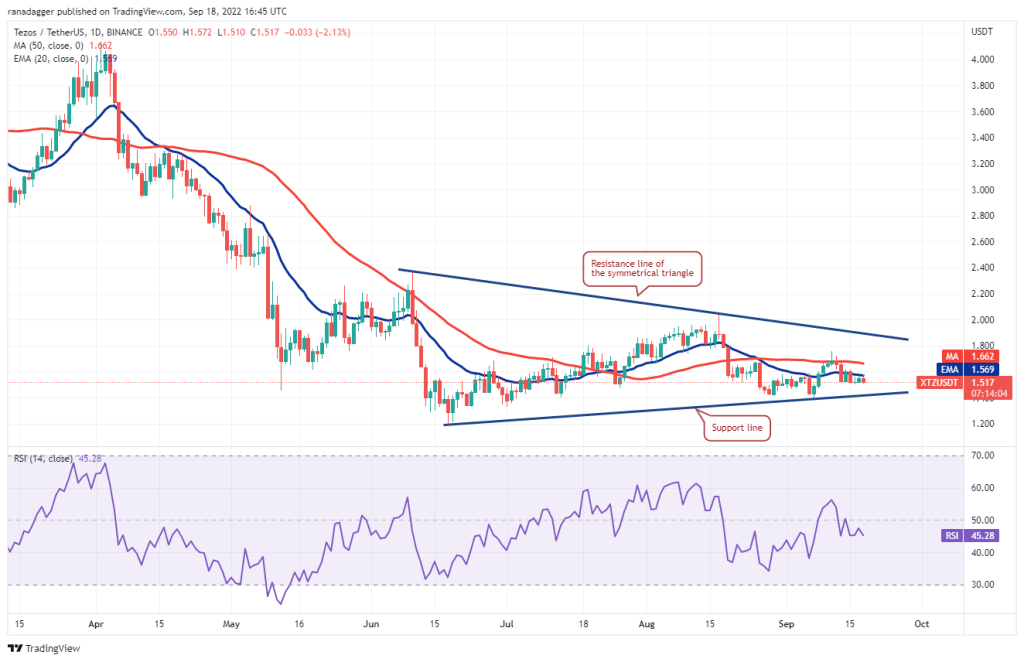

Tezos (XTZ) broke below the 20-day EMA of $1.57 on Sept. 13, but the bears failed to push the price towards the support line of the symmetrical triangle. This indicates that buyers are accumulating on the dips. This increases the probability of recovery in the short term. If XTZ breaks above the 20-day EMA, the price will rise above the 50-day SMA to $1.66. This level acted as a strong resistance in the previous two situations; therefore, it is an important level to consider. If the bulls break this hurdle, an attempt to rally towards the resistance line of the double triangle will be possible.

A break above the triangle will signal a potential trend change. The altcoin will then rally to $2.00 and then to $2.36. Meanwhile, the bears are likely to have other plans. They will try to stop the recovery in the moving averages. If XTZ breaks below the $1.50 to $1.40 support zone, the June low of $1.20 will be revisited. Keeping the support at $1.50 will be critical for the bullish thesis in the coming days.