Over the past week, the value of the cryptocurrency market has increased for two weeks in a row. On Wednesday, a large increase in investors’ purchases emerged. This gave the market much needed support. In fact, the broader crypto market was in the deep red on Wednesday. However, this was the last drop before a four-day rally. The markets’ reaction to US economic indicators drove the broader crypto market higher during the week.

5 cryptocurrencies with the potential to rise this week

This week, the US economic calendar is on the calmer side. Traders will have to wait until Thursday and Friday for fundamental statistics to give direction. FOMC members will also remain silent this week. However, uncertainty and crypto winter continues. But technical indicators highlight a number of cryptocurrencies that are giving bullish signals. cryptocoin.comwe have prepared for you.

Bitcoin (BTC)

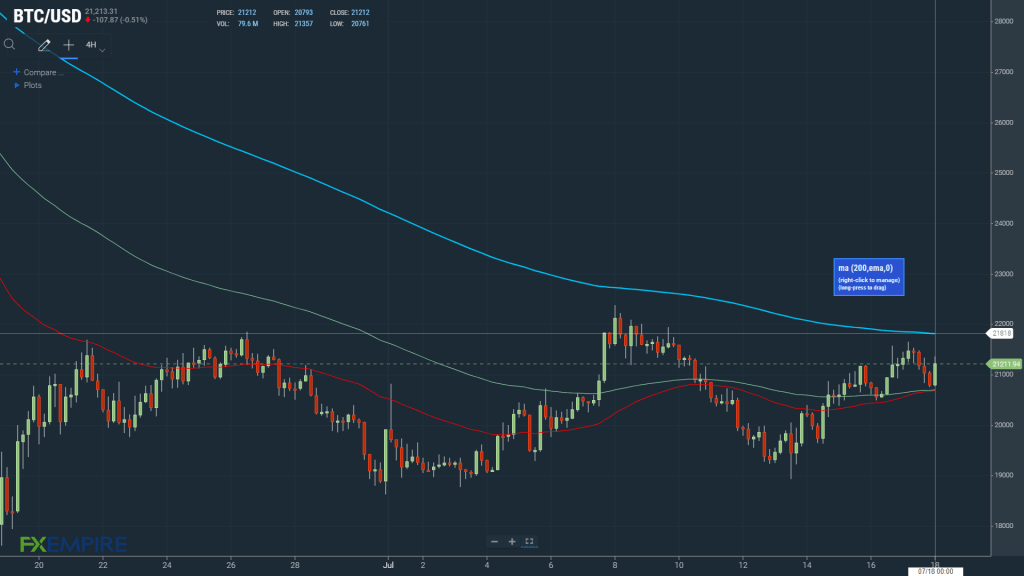

Last week, Bitcoin dropped 0.26%, closing the week at $20,793. The volatile market plunged the BTC price as low as $18,919 on Wednesday. However, the leading cryptocurrency hit a weekly high of $21,658 on Sunday. Accordingly, staying away from below $18,000 and $17,601 was key. However, BTC also failed to return to $22,000, which it last visited on July 8 and June 16. The Bitcoin Fear and Greed Index lies deep in the “Extreme Fear” zone. It locked in profits early to avoid the risk of investors falling below $20,000. Therefore, a BTC exit seems unlikely. However, a BTC move towards $22,000 is possible to change the sentiment. So the bulls can aim for a rise towards $25,000. At the time of writing, Bitcoin is up 2.39% on the day to $21,289.

Looking at the 4-hour chart and the EMAs, the signal was bullish. BTC has moved towards the 200-days EMA, currently at $21,847. The 50-day EMA converged at the 100-day EMA and the 100-day EMA narrowed to the 200-day EMA, both taking their place as positive BTC indicators. A bullish break of the 50-day EMA over the 100-day EMA could bring the price to $22,000 for the bulls to run to $25,000. However, a failed uptrend would cause BTC to drop below $20,000 before any meaningful recovery.

Ethereum (ETH)

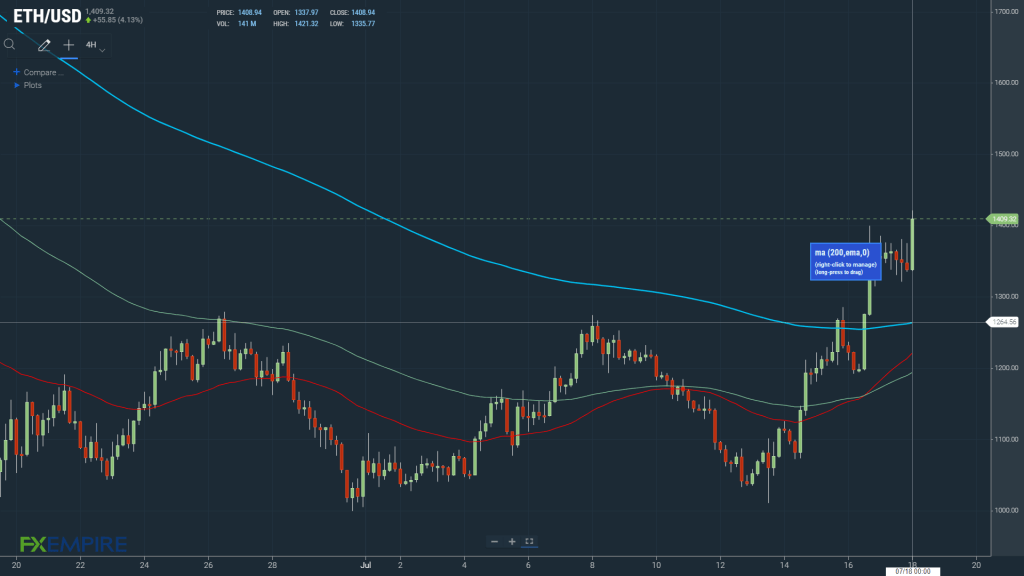

Ethereum made a big rally last week. It closed the week at $1,338 with a total increase of 14.7%. In fact, Ether, like Bitcoin, started the week with a bearish trend. This downtrend caused the price to drop to $1,010 on Wednesday. However, ETH started to rise after that and hit $1,400 on Saturday. The market sentiment towards the US economy and the FED was one of the main reasons for the price increase. However, the leading altcoin also draws attention with its Merge upgrade. For Ethereum, price volatility is unlikely to be alleviated. But updates on Merge will continue to be the main driver for the price. The developers plan to do the upgrade in September. However, a delay announcement has the potential to cause the price to visit lows again.

Looking at the 4-hour chart and the EMAs, the signal was bullish. Ethereum has now broken out of the 200-day EMA at $1,265 to target a return to $1,500. The 50-day EMA has narrowed to the 200-day EMA. Also, the 100-day EMA has closed the 200-day EMA, both positive ETH indicators. A bullish break of the 50-days EMA over the 200-days EMA would support a break from $1,500 for a rebound from the June high to $1,972. However, a reversal over the 50-day EMA is also possible. If this happens, the coin will see the test support at $ 1,000 again.

Lido DAO (LDO)

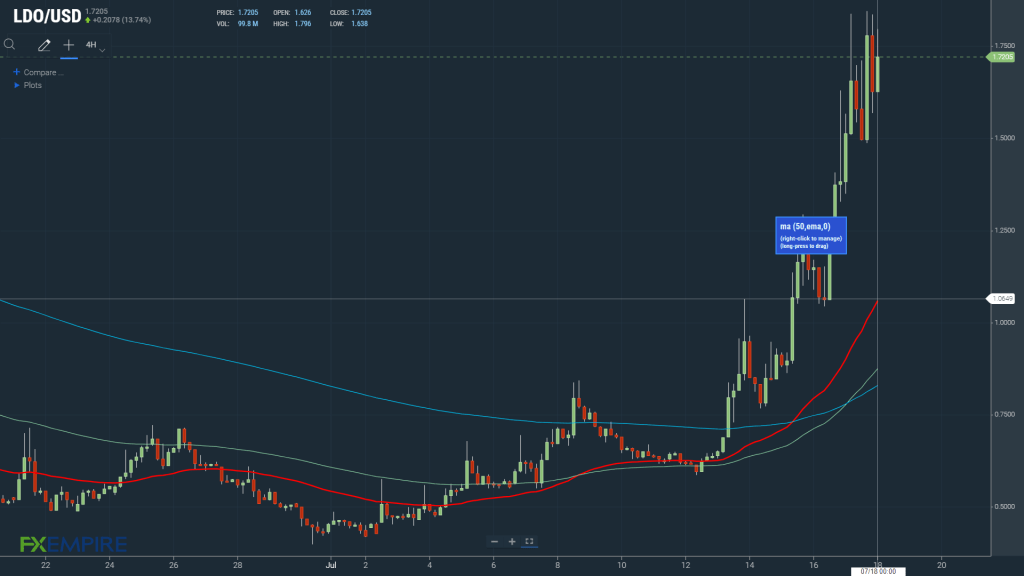

Last week, LDO was up 155%, closing the week at $1.6. A bearish start to the week resulted in the price dropping to $0.57 on Tuesday. However, the price quickly recovered and hit $1,832 on Sunday. LDO was hit by US inflation and hawkish Fed speech having only a slight impact midweek. Thus, it has had five bullish sessions in the past week. Progress towards the ETH Merge upgrade continued to be the key driver for LDO. According to Dune Analytics, investors staking Ether are on the rise. Therefore, it is possible for LDO price to continue higher towards $2.0. At the time of writing, LDO was up 5.16% to trade at $1.72.

Looking at the 4-hour chart and the EMAs, the signal was bullish. LDO is targeting a return to $2.00. For this, it continued to move away from the 50-day EMA currently at $1.06. The 50-day EMA has moved away from the 100-day EMA and the 100-day EMA has diverged from the 200-day EMA, both of which are positive indicators of LDO. Further expansion of the 100-days EMA from the 200-days EMA will support the continued uptrend to $2.00. However, LDO must not fall below $1.50 to support the current uptrend.

Polygon (MATIC)

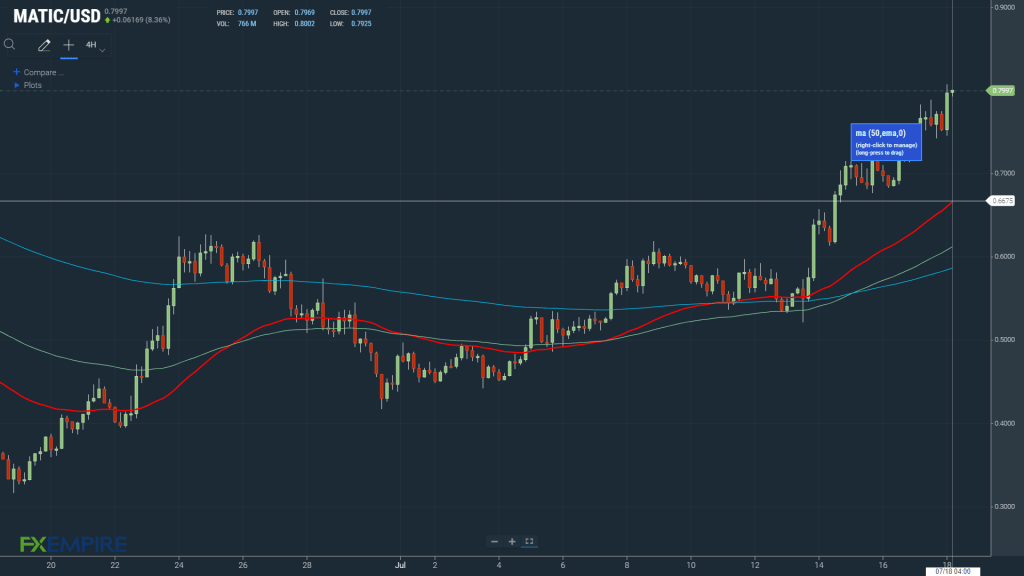

Last week, MATIC gained 31.8% and closed the week at $0.7525. The coin succumbed to the mainstream market earlier in the week. However, it rose on the support of the broader market trend during the second half of the week. Behind Polygon’s remarkable rise was his partnership with Walt Disney. Accordingly, Disney has selected Polygon to join the 2022 Disney Accelerator. In the coming week, MATIC will continue to find strong support, although downside risks remain. It is possible for a broad-based crypto sale to test investor support. However, technical indicators point to a bullish trend formation that should support MATIC’s return to $1.00. At the time of writing, the altcoin is changing hands at $ 0.80, up 6.27%.

Looking at the 4-hour chart and the EMAs, the signal was bullish. MATIC moved from the 50-day EMA currently at $0.6675 to target a return to $1.00. The 50-day EMA has moved away from the 100-day EMA and the 100-day EMA has diverged from the 200-day EMA, both of which are positive MATIC indicators. Further expansion of the 100-day EMA from the 200-day EMA will support the ongoing run to $1.00. However, MATIC will need to break below $0.70 to continue bullish.

Left (LEFT)

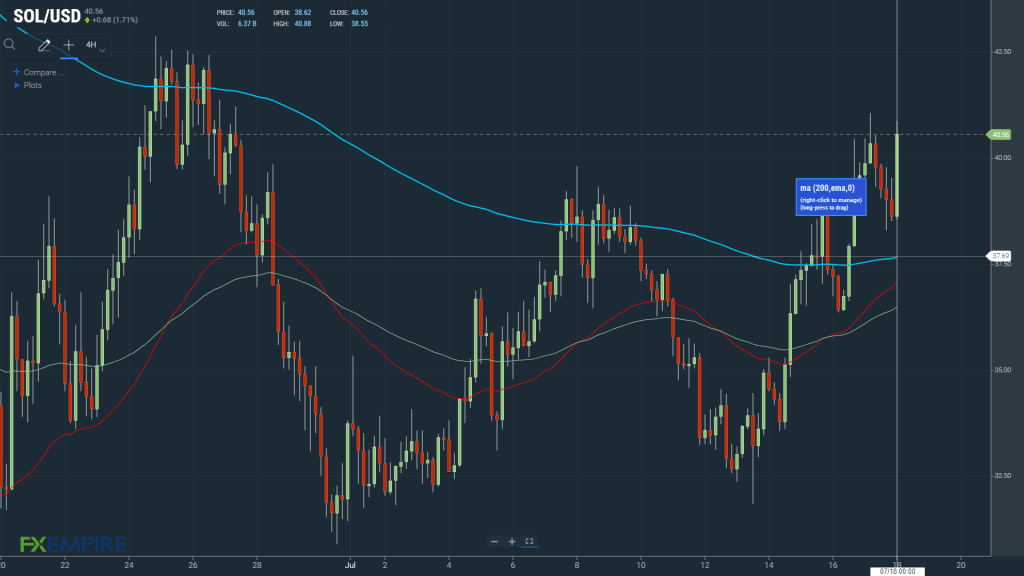

Last week, SOL was up 5.35%, closing the week at $38.62. Sunday’s bearish session left SOL below $40 with a relatively modest weekly gain. Below $30 and the multi-year low of $25.84 are key for the coin. Accordingly, SOL is well above the aforementioned levels, but cannot hold the important level of $40. The altcoin followed the broader crypto market throughout the week with news that Solana Mobile is inviting pre-orders for the SAGA phone. New updates on the phone and NFT market may support the price rise. This week, SOL will likely continue to monitor Bitcoin and the broader crypto market. However, technical indicators point to a bullish trend formation for the SOL towards $50. At the time of writing, Solana was up 5.02% at $40.56.

Looking at the 4-hour chart and the EMAs, the signal was bullish. Solana has now broken out of the 200-day EMA at $37.69. The 50-day EMA has moved away from the 100-day EMA and narrowed to the 200-day EMA, both of which are positive indicators of the SOL. A bullish break of the 50-day EMA over the 200-day EMA will cause the bulls to target $45 to break out to $50. However, a drop in the 200-day EMA will result in the cryptocurrency falling below $35.