Bitcoin (BTC) opened above $30,000 this week as the bulls avoided serious losses at the weekly close. So what will affect cryptocurrencies such as Bitcoin, SHIB, ETH this week? Here are five factors…

Bitcoin price “fall” still on the table

In a refreshing contrast to recent weeks, Bitcoin managed to show strength after the weekly close to May 23. Kriptokoin.com despite breaking the record for the eighth consecutive weekly red candle, the lack of frustration allowed BTC/USD to hold $30,000 instead. According to analyst Michaël van de Poppe, this trend was already evident over the weekend.

Still good on #Bitcoin.

Great breakout at the $29.3K area, resulting in a run towards $30.2K, which became resistance (as disclosed in the previous tweet).

Consolidation now.

Break would mean $31.1K and potentially $32.8K + #altcoin momentum. pic.twitter.com/Ia9svBR3Lf

— Michaël van de Poppe (@CryptoMichNL) May 22, 2022

Stocks correlation and monetary tightening them Given the overall picture it was pushing down, no one was sure that Bitcoin would continue on the upside. Popular Twitter trader Nebraskan Gooner told his followers on May 23, “My preferred scenario for Bitcoin is seeing a nuclear bomb for $22,000 before the big jump near $40,000.”

Late last week, Filbfilb said it’s time to acknowledge that the biggest cryptocurrency is in a bear market. “If we lose the current support at $28,670, the last support before new lows sits at $26.512,” he said. Meanwhile, popular Twitter account IncomeSharks argued this week that, regardless of the strength of $30,000, there should be relief before any possible series return.

Highlight of the week for BTC, SHIB, ETH and the overall crypto market: WEF

World Economic Forum since the start of the COVID-19 pandemic’ s first personal annual meeting, macro trigger of the week. As the economic elite convenes in Davos, Switzerland, from May 22-26, markets are preparing for potential volatility following their upcoming announcement. For Bitcoin users, the event is considered stressful as the industry tries to gauge sentiment between traditional finance weights.

A month ago, WEF released a video arguing that Bitcoin should change its PoW algorithm to PoS for environmental purposes. The boom of the stablecoin TerraUSD (UST) this month has driven the cryptocurrency even further into the financial institution’s target points. The head of the European Central Bank, Christine Lagarde, claimed that cryptocurrencies like SHIB, BTC “have no value” and perhaps paradoxically require regulation.

On the other hand, Oslo Freedom Forum, which will be held from 23-25 May in Oslo, Norway, describes itself as “a global meeting of activists united to stand against tyranny”. Speaking at the event, it is comprised of some of Bitcoin’s best-known names, including economist Lyn Alden, Strike CEO Jack Mallers, and Elizabeth Stark, co-founder and CEO of Lightning Labs.

What does a decrease in mining difficulty indicate?

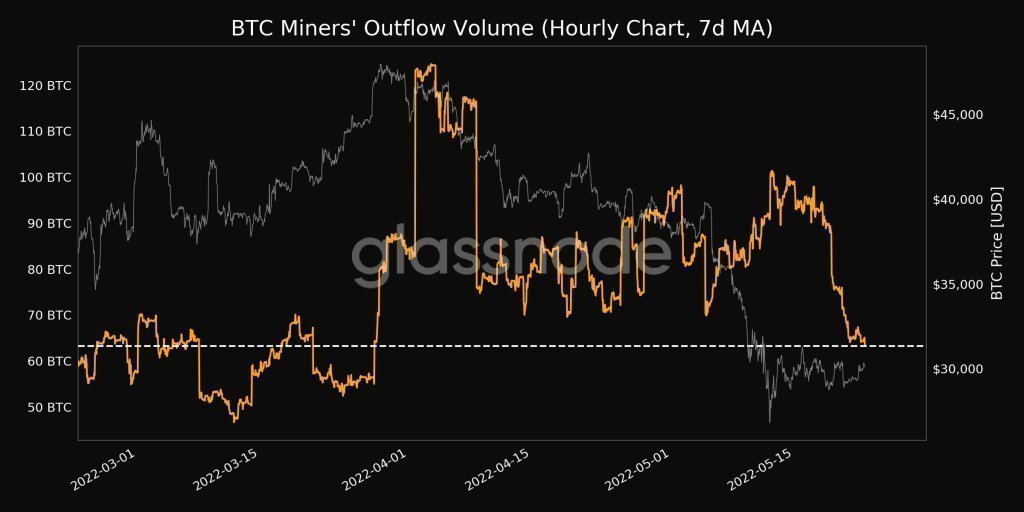

Large Bitcoin price drops can have significant consequences. Reflecting the changing dynamics among miners, difficulty will decrease by about 3.3 percent at the next automatic recalibration this week. While this drop is modest compared to others, the change will still be the largest since July 2021.

Despite potential profitability pressure based on predictive data, miners are showing no signs of capitulation and are still keeping their BTC sales to a minimum, according to the latest figures from on-chain analytics platform Glassnode. Meanwhile, Bitcoin’s mining hash rate hit an all-time high with an estimated 233 exahash per second (EH/s) as of May 23.

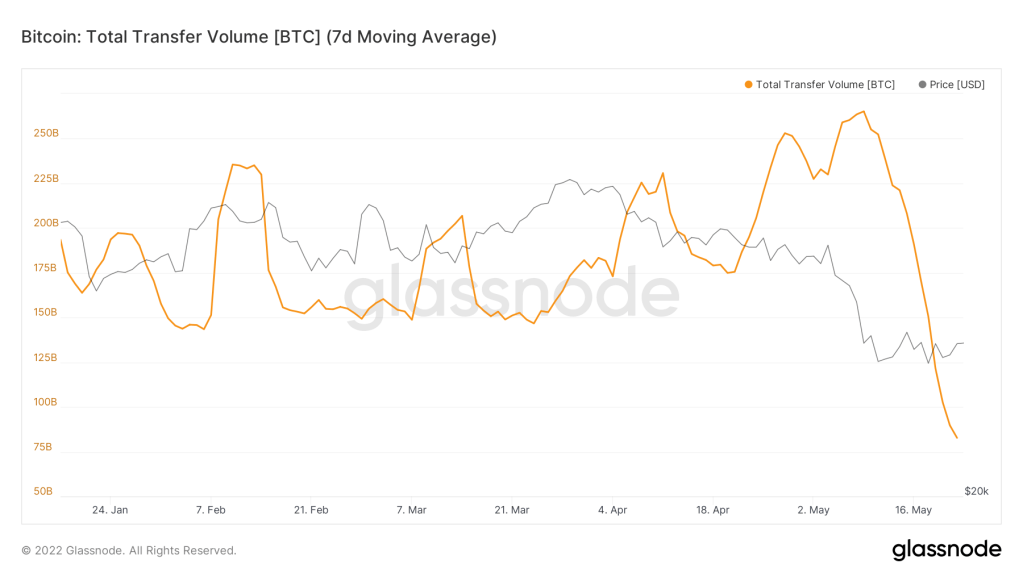

On-chain volume hits several-month lows

Bitcoin has been boring for the mainstream consumer base throughout 2022 thanks to price action, but it’s available now Even investor participation is declining. On-chain data shows volumes are falling steadily, with the notable exception of the post-LUNA panic. Glassnode, which tracks seven-day moving average trading volumes on the network, recorded a nine-month low on May 23.

The moving average started to decline rapidly from May 9 and fell by 70 percent on May 22. CryptoQuant’s Ki Young highlighted the lack of interest among individual buyers, while fellow analyst Willy Woo argued that it is the big players that really dominate the market fluctuations. Market sentiment for

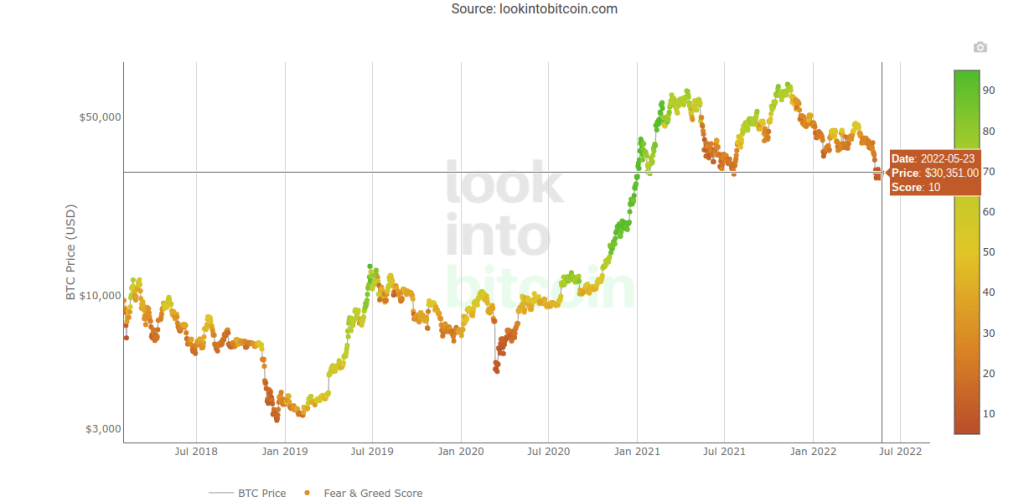

SHIB, BTC and cryptocurrencies is bottoming out

According to the Crypto Fear and Greed Index, the classic sentiment indicator, most of the market is poised for a new low. At around 10 out of 100, the index has returned to the lower segment of the “extreme fear” region historically seen in price dips. Analyzing sentiment on the highly correlated S&P 500, trader, entrepreneur, and investor Bob Loukas shed some light on how this could be a copycat model for Bitcoin. Meanwhile, last week, popular trader and analyst Rekt Capital argued that a more substantial price change would be necessary to change the mood significantly.