Bitcoin (BTC) is starting a new week above $20,000. However, it is breaking a new bearish record as an important support level has not been reached. After a quiet weekend punctuated by a brief rally to $22,000, BTC/USD has returned to the Friday closing price of the CME futures markets. So, what could happen in the coming days? Here are the factors that can affect the BTC and altcoin space…

What do traders expect for Bitcoin price in July?

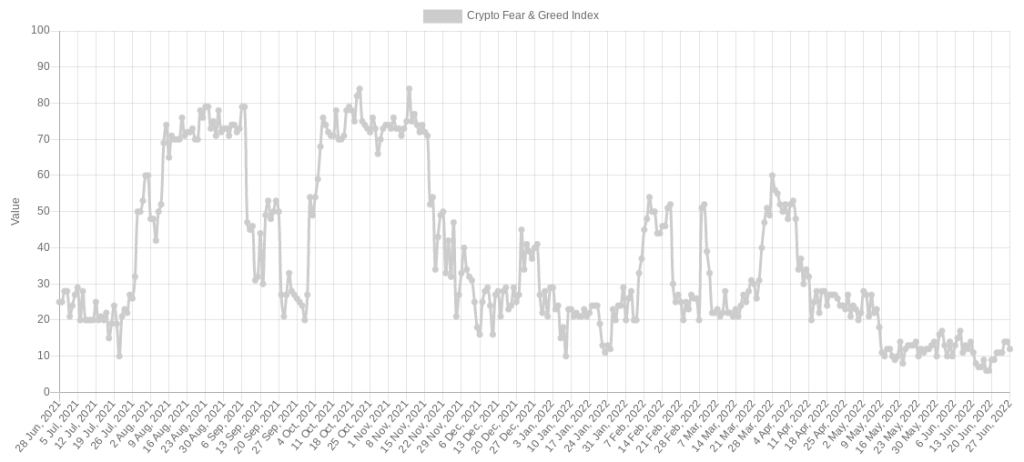

The general sentiment among Bitcoin traders this week can be described as “apathetic”. The weekend data shows that BTC/USD is far from where anyone wants it to be. With the 200-week key moving average (WMA) out of reach; There is a precious little bullish sentiment there, as evidenced by the “extreme fear” of the Crypto Fear and Greed Index.

Venturefounder, an analyst at CryptoQuant, said, “He thinks BTC will face capitulation in the next 6 months. He states that the cycle will bottom out between $14-21,000 and most of 2023, the price will be around $28-40k. Until the next halving, the price will be 40 thousand dollars again. Venturefounder’s thesis is indicative of a broader belief that the bottom for Bitcoin is not yet at the bottom and that any relief move is just that. On the way to lower levels, distractions draw capital from market newcomers and weak hands.

Expectations are that the first week of July could provide the next major bout of volatility in crypto and risk assets. “Not much will happen in Bitcoin overnight, but I am currently expecting a rather slow week due to the lack of catalysts,” said popular trader Crypto Tony. However, he thinks July will be volatile due to the upcoming catalysts. For Arthur Hayes, the former CEO of derivatives giant BitMEX, the first week of next month will be a time when macro stars will once again punish hodlers. In a blog post in early June, Hayes marked the US Fed’s ultra-high rate hike and balance sheet cut as the backdrop for a risk-asset nightmare.

How normal is this bear market?

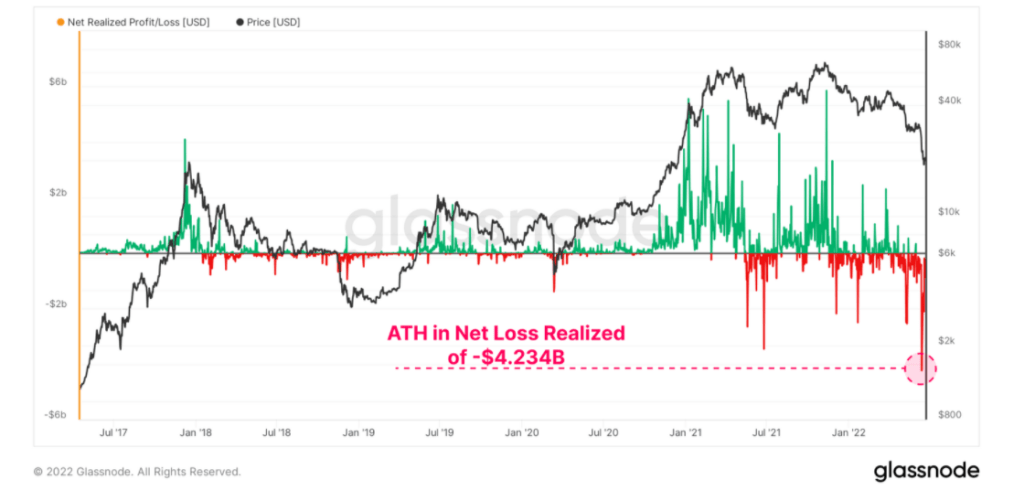

While some panic is selling their BTC, analysts are trying to show that there is nothing unusual in the scope of the Bitcoin bear market so far. Among them are ten chain analytics firms Glassnode, which are calling for calm for BTC. Glassnode uses the following phrases:

Bear market lows have historically been established with BTC drops between 75 percent and 84 percent from ATH, lasting 260 days in 2019-20 and 410 days in 2015. With the current drop reaching 73.3% below November 2021 ATH and taking anywhere between 227 days and 435 days, this bear market is now strictly within the historical norm and size.

It is not Bitcoin itself that highlights the current situation, but the reactions of investors to price changes. Despite losses remaining within historical norms, BTC’s sales at a loss surpassed previous records. “The recent price drop towards the $20,000 region was punctuated by the largest daily USD-denominated loss in history,” Glassnode said. Investors were collectively locked in losses of $4.2 billion in a single day. In terms of BTC, this is the third-largest loss in Bitcoin history.

BTC risks first monthly close below 200WMA

With three days left until the end of June, things look either alarming or “interesting” for Bitcoin, depending on one’s perspective. With the bear market in full swing, BTC/USD remains below a key trendline that supported it during previous macro lows. The 200-week moving average (WMA), which has never fallen in value, is currently at $22,430. In previous bear markets, Bitcoin maintained 200WMA as support. But this time, the level turns into resistance. That’s why the creator of the stock-to-flow price model, PlanB, described the end of the month as “interesting” as it would mark the first monthly close below the 200WMA.

This is getting interesting! If BTC does not close June above 200WMA ($22K) that would be the first monthly close below 200WMA ever. 4 days to go .. 🤞 pic.twitter.com/YtshVcIpks

— PlanB (@100trillionUSD) June 26, 2022

A chart on June 26 shows the correlation between Bitcoin’s 200WMA and its distance from block halving events; they describe four-year cycles that include the bear market paradigms mentioned earlier. Meanwhile, Checkmate, an on-chain analyst at Glassnode, pointed out the unusual bearish characteristics that currently characterize BTC price. In addition to being below 200WMA, BTC/USD is also below its actual price, and the Mayer Multiple metric is deep in the “buy” zone. The Mayer Multiple shows how much below the 200-day moving average the price is and thus how likely a buy at a given level is to generate asymmetrical returns.

Bitcoin dominance drops from multi-month high

Altcoins; It was suffering more than Bitcoin because of the confusion from multiple major projects, including Terra and Celsius. But now the situation is changing. Bitcoin dominance has reversed after this year’s rally. It has led to suggestions that altcoins could be the place to be in the short term. Twitter account BTCfuel therefore points out that the advantages currently lie in altcoins. After hitting an 11-month high of 48.36 percent on June 11, Bitcoin’s share of the total crypto market cap has slumped to 43 percent.

For veteran trader Peter Brandt, Bitcoin’s relative strength against alternatives may be more important than the bulls’ eye. “This chart could be a big narrative,” he argued about market cap dominance data. Others, meanwhile, are confident that it is not time for altcoins to shine meaningfully forward. According to Venturefounder, holding BTC is still your best bet. “Normally, more altcoins flow from BTC to bear market,” trading group Decentrader said in separate comments on the latest dominance action.

Bitcoin is going mainstream again

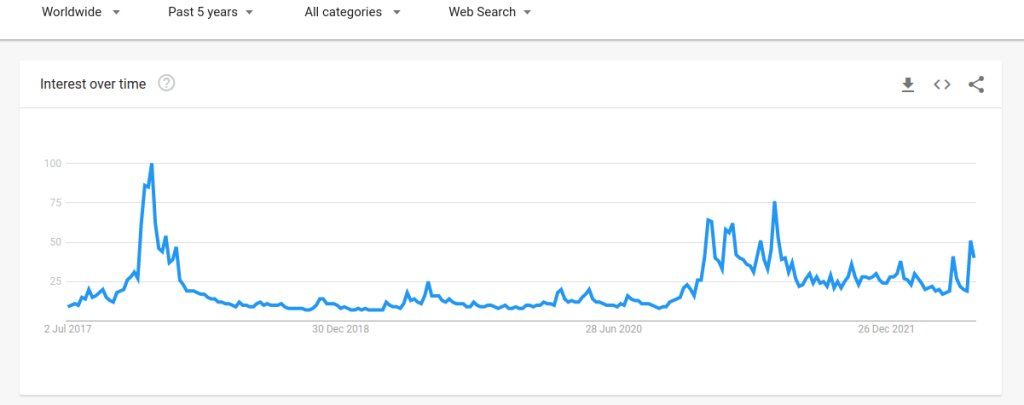

Bitcoin is more popular among mainstream internet users than at any other time in a year. But is this something worth celebrating? Data from Google Trends confirms that more people are researching “Bitcoin” on Google this month than at any point since May 2021.

However, as it stands now, BTC price action is targeting long-term lows rather than highs. This suggests that it was bearish events that triggered mainstream interest. By comparison, last November’s all-time high looks low when it comes to search interest. Because of this, search activity for phrases like “Bitcoin is dead” has increased. This was noted by social media users as a possible sign that the market is in the ‘capture’ stage.