Bitcoin (BTC) is starting a new week and a new month on a cautiously positive footing. We left behind a busy July, where macro factors provided significant volatility. At the end of the month, BTC price action managed to provide both a weekly and monthly candlestick supporting the bulls. So, what’s in store for Bitcoin and altcoins this week as we enter the last month of summer 2022? Here are the details…

Spot price snatches back Bitcoin bear market trendlines

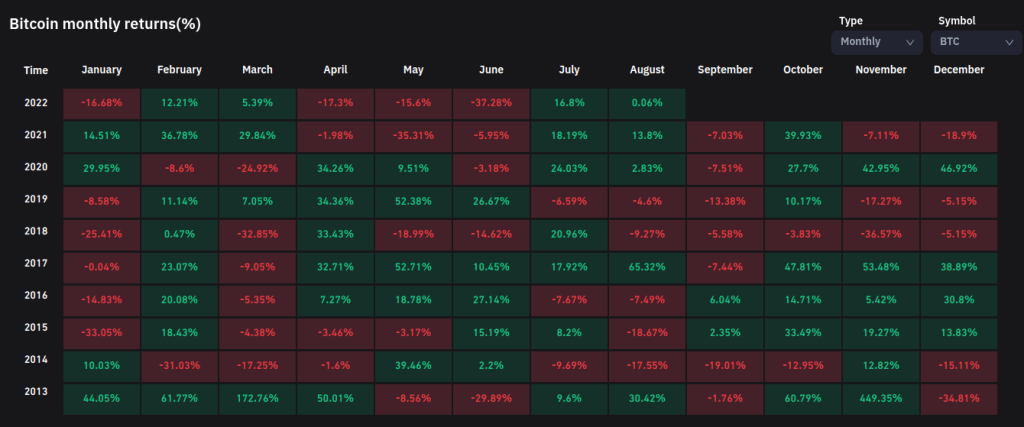

According to data from Coinglass, BTC/USD had seen a 40 percent loss in June. However, the pair managed to close last month with remarkable gains of 16.8 percent. These gains exceeded 20 percent at one point. Once solid foundations have been established, the question now arises as to whether and how long the party will continue. “The first green monthly close since March,” said popular trader and analyst Josh Rager. He also used the following phrases:

The monthly close closed above the all-time high of the last cycle, 2017. After that, the price gradually rises. Looks good so far. Even if this is a ‘bear market’ I am happy to buy at the bottom right now.

Others were more cautious. For example, trader and analyst Crypto Tony noted that recent local highs just above $24,000 are still acting as undisputed resistance for the day. He told his Twitter followers, “I expect a dump in this Bitcoin model. “I stay short while below the $24,000 supply zone that we rejected,” he said.

However, the weekly and monthly close sealed some key levels as support for Bitcoin. Specifically, the 200-week moving average has bounced back from resistance on the weekly chart. Blockchain infrastructure and cryptocurrency mining firm Blockware described the retracement of the 180-period exponential body moving average (EHMA) to just under $22,000 on the monthly chart as “bullish.” On the other hand, William Clemente drew attention to the 180-week EHMA. He stated that this could be a strong signal for breakouts.

Macro triggers calm down in August

The macro picture, which will begin in August, provides relief mixed with a sense of insecurity about how the rest of the year might go. In short time frames, US stocks have recovered from last month’s Fed-induced volatility. Thus, he ended July at a high level. Calls for a prolonged rally in equities are on the rise. According to experts, this could be good news for crypto markets with high correlation with exchanges.

Meanwhile, the popular Twitter account Game of Trades, which analyzes the state of commodities, stated that oil will soon lose ground. He predicted that this would have an obvious impact on US inflation. The Consumer Price Index (CPI), now at a four-year high, is responsible for Fed rate hikes that put risk assets under pressure. An approximate turn in inflation, and thus in Fed policy, could quickly change the charts. “Big sellers pitched for oil on Friday,” a post from the weekend read.

https://twitter.com/krugermacro/status/1553403794012065792

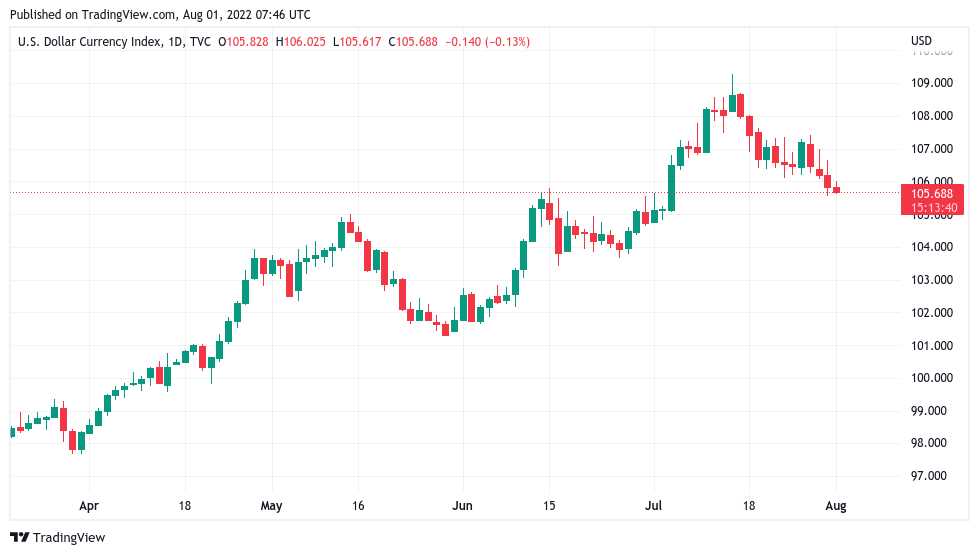

However, macro analyst Alex Kruger said that the energy crisis in Europe has not yet affected prices. So, the global picture is not that simple when it comes to commodities. Therefore, Kruger considers the current recovery for Bitcoin to be more of a “bear market rally” than an actual turnaround. Kruger said the status quo should affect the market “at least until the end of August”, with new Fed events. In order of importance, he listed the key rate decision for September, the September CPI, the Fed’s Jackson Hole summit on August 25 and the August 10 CPI pressure for July. Converting to US dollar strength, the US dollar index (DXY) is currently below 106, holding lows not seen in almost a month.

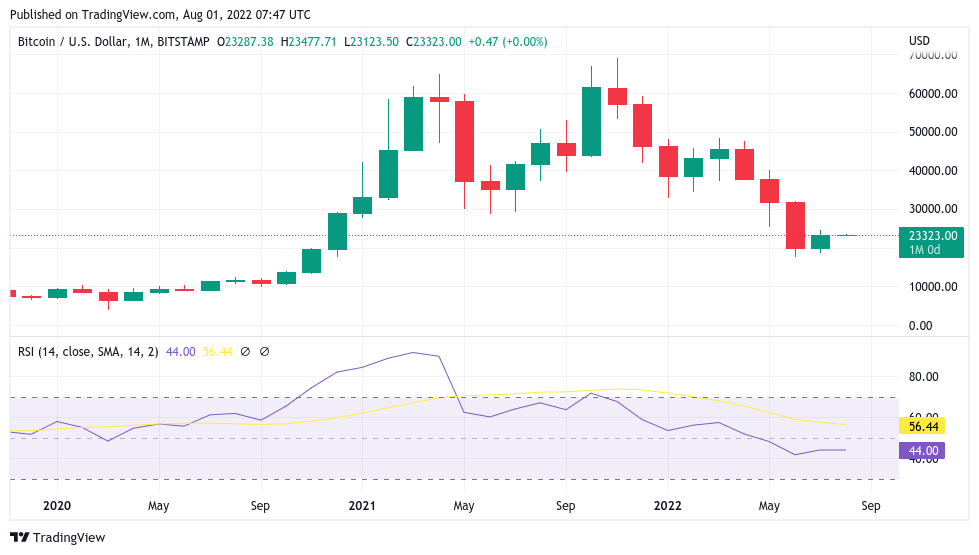

RSI raises questions about bottom price for Bitcoin

Returning to the on-chain signals, one of Bitcoin’s key fundamentals appeared to be recovering. However, this was not enough to convince the analyst Venturefounder that the BTC price was in the bottom. Focusing on a multi-year outlook and comparing BTC/USD across market cycles, the popular content creator argued that Bitcoin’s relative strength index (DXY) is still subdued after peaking in April 2021. The RSI measures how much BTC/USD is overbought or oversold at a given price.

The RSI saw the lowest data on record since May. Despite suggesting that Bitcoin is trading much lower than its fair value, the RSI has yet to regain the “bullish momentum” that characterized the run above $20,000 at the end of 2020. cryptocoin.comAs we reported, in April 2021, Bitcoin reached $58,000 before its price halved by the end of July.

“The only way to view July 2022 as the lowest cycle is if you view April 2021 as the highest cycle for that cycle,” Venturefounder said. “The RSI and its bullish momentum peaked in April 2021. It never recovered for the remainder of this cycle. Do you think we hit rock bottom?” used his statements. Another notable oversold period in the RSI came just after the March 2020 COVID-19 crash. This event significantly impacted the price strength as we entered the latest halving. Of course, BTC/USD has never looked back. It continued to record an all-time high after about six months.

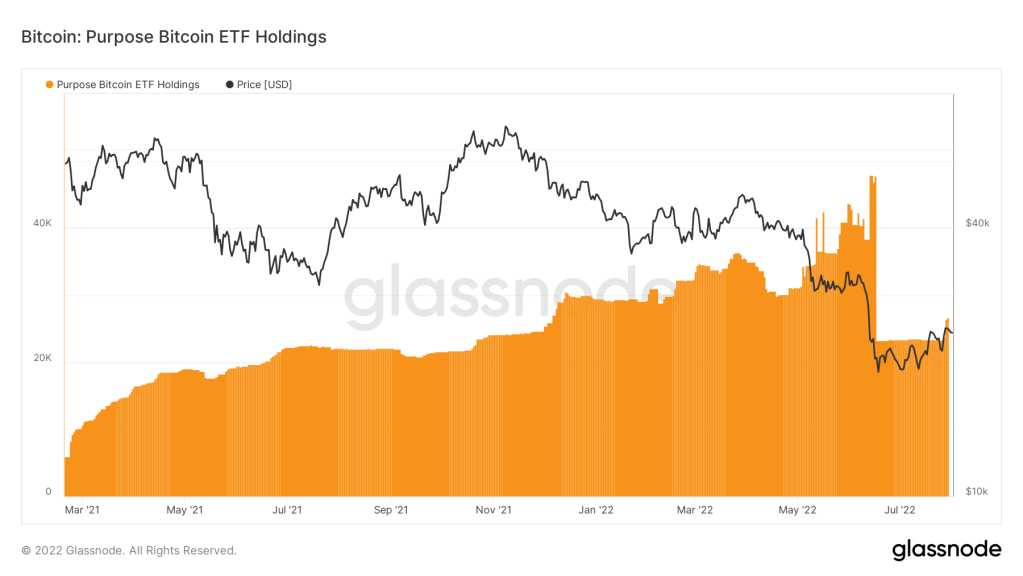

Purpose ETF finally adds BTC

Institutional Bitcoin participation is also being observed, as subtle signs of recovery appear in the statistics. The latest such signal comes from the world’s first Bitcoin exchange-traded fund (ETF), the Purpose Bitcoin ETF. After its assets suddenly dropped 50 percent in June, the product is finally adding BTC again. This shows that demand is no longer falling. Commentator Jan Wuestenfeld noted that the several weeks of sleep are over, noting that Purpose has added 2,600 BTC to its product. However, the value of assets under his management is well below its record.

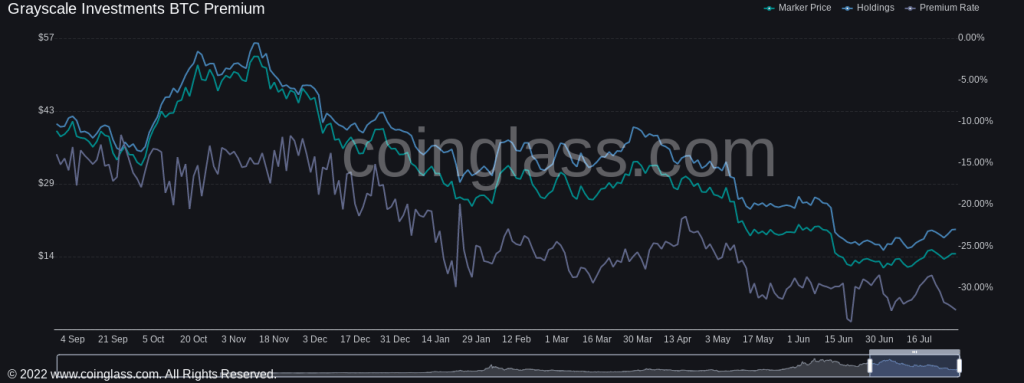

However, the recovery trend is far from ubiquitous. A look at the Grayscale Bitcoin Trust (GBTC) shows its trend of lack of demand. According to data from Coinglass, the fund’s spot price premium was actually at a discount for a long time. However, it now revolves around record lows of around 35 percent. Grayscale continues to take legal action against US regulators for not allowing Bitcoin ETF.

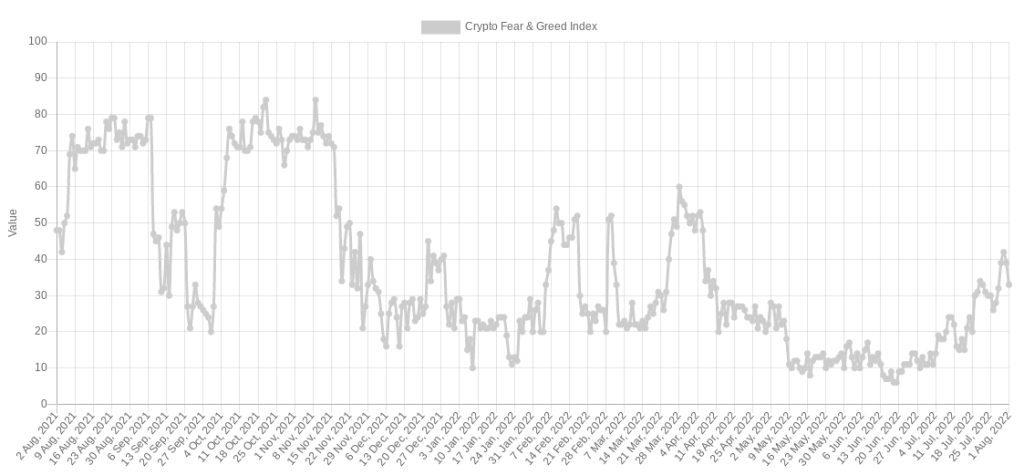

A new month, a new fear

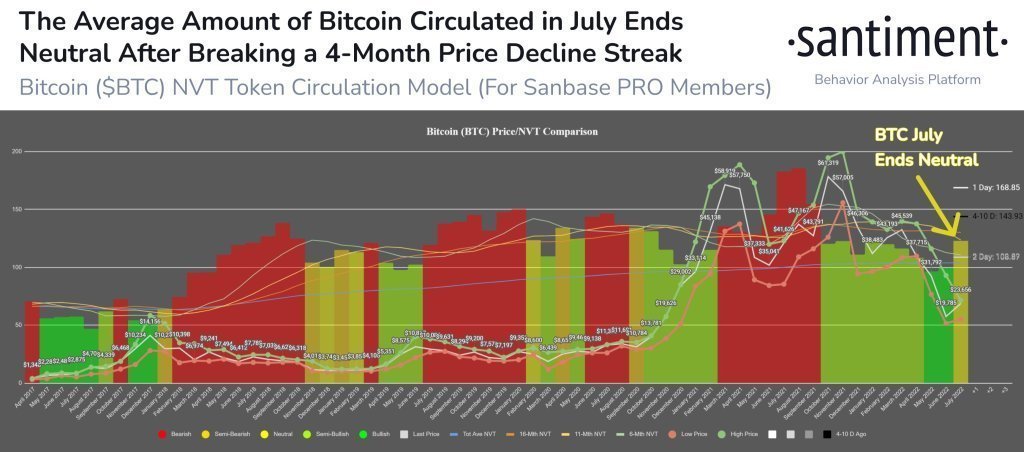

The sentiment in the crypto market has returned to the “fear” zone. Recent data on the Crypto Fear and Greed Index showed that “neutral” sentiment has not lasted a day. The index appears as 33/100 as of August 1. Still high compared to last month. However, it is well below the 42/100 highs seen a few days ago. But there is reason for optimism, according to research firm Santiment. The firm’s proprietary metric, which manages transaction volume for Bitcoin by overall network value, ended in its “neutral” zone in July.

The network transaction value (NVT) token circulation pattern took place at the latest monthly close after printing the bullish divergences in May and June. In a Twitter update on the latest figures, Santiment said, “Prices are rising and token circulation is falling slightly. “Now with a neutral signal, August could move in either direction,” he said.