Bitcoin (BTC) hit its highest weekly close since mid-June. Then, the new week started with a bang. Will BTC continue to rise?

5 things that will affect Bitcoin, SHIB and altcoins

After a volatile weekend, Bitcoin managed to limit losses to the later parts of the weekend. Thus, it paved the way for producing a solid green candle on the weekly timeframes. We are going through a period that is likely to take shape as the last “quiet” week of summer. In the absence of major macro market drivers, including the Fed, the bulls have time on their hands. The increase in BTC’s mining difficulty has occurred twice in a row. Therefore, fundamentals remain strong in Bitcoin. In the derivatives markets, it is accompanied by higher price levels. However, there are encouraging signs along with the bullish data. Hodlers are now asking whether the uptrend will continue. we too cryptocoin.comAs a result, we have compiled the events that will affect BTC, SHIB and altcoins this week.

Bitcoin embraces volatility after its rise

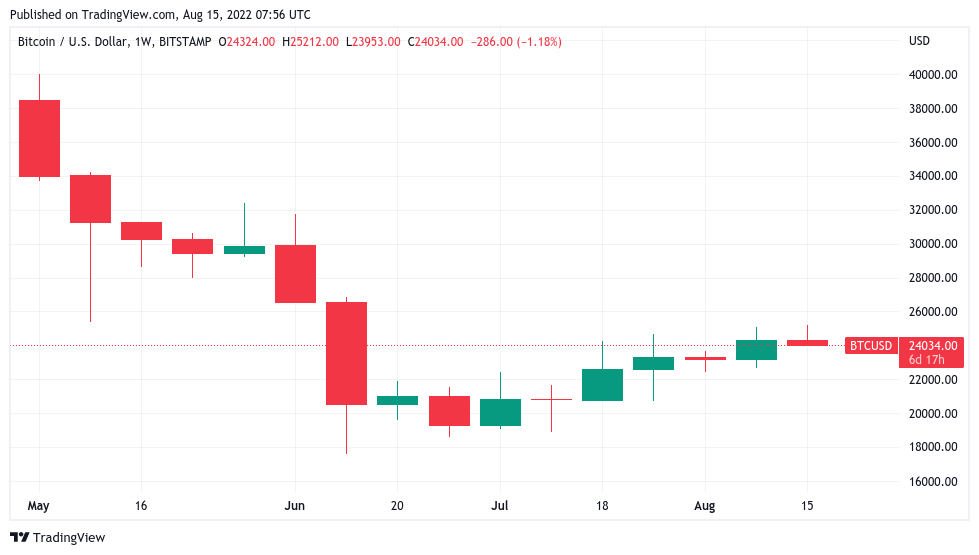

The August 14 weekly close of around $24,300 was the best price for BTC/USD in two months. The weekly chart shows a steady rise that continues to take shape after June lows. Additionally, last week’s candle closed around $1,100, or 4.8%. An impressive move in 2022, the gains sparked overnight volatility on the first Wall Street trading day of the week. BTC/USD hit $25,200 on exchanges. It then retraced significantly below the weekly close. If the unpredictability persists, the possibility of a decline is clear, according to the on-chain tracking resource ‘Materials Indicators’. After the close, the weekly chart started to signal “downside momentum”. Also, daily timeframes were flat relative to proprietary trading instruments. The indicator’s creator, Material Scientist, described this week as “the last week of the bear rally” in its comments.

BTC price

BTC priceAnother analyst, Peter Schiff, said that the $10,000 level is still within the possibilities. However, fellow trader and analyst Rekt Capital has been calm about Bitcoin price action over the long term. He said that a spot price below $25,000 should return the cost average (DCA) dollar back to Bitcoin. Rekt Capital spoke to its Twitter followers over the weekend. “To be successful in crypto, you need a dollar-cost averaging strategy, an investment thesis, a vision and patience,” the analyst said.

Macroeconomic indicators stay on the knife

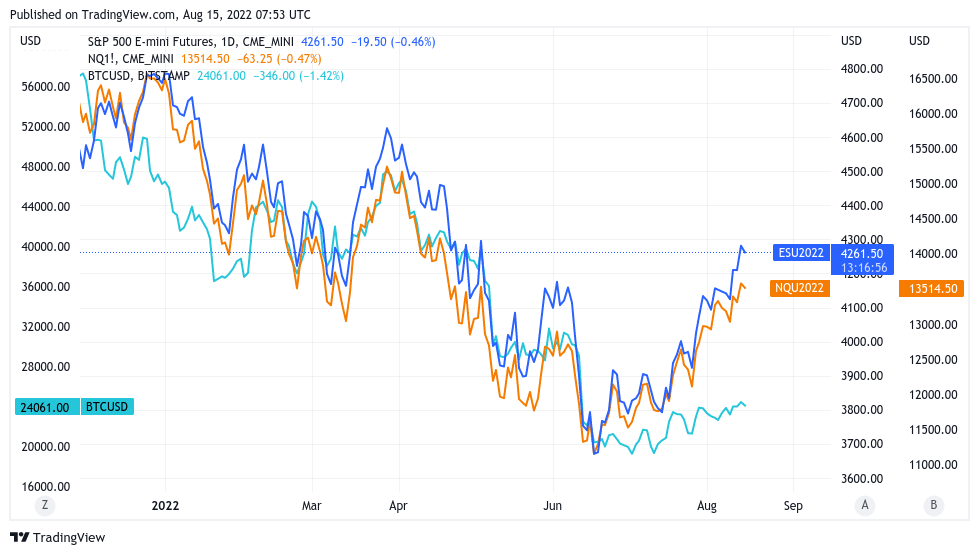

Last week, the crypto market was heavily influenced by the US inflation data. Now, the next five trading days look relatively calm from a macro perspective. FED is quiet, there are unexpected events that could affect market performance only in Europe or Asia. However, according to a popular analyst, the likelihood of crypto continuing knee-jerk responses to macro triggers beyond inflation is possible less than what many think. Filbfilb has released a new market update for its trading package. Accordingly, he stated that the correlation between BTC and traditional markets has decreased. Filbfilb added that Bitcoin has not rallied strongly since the June low of $17,600.

Correlation of Bitcoin and traditional markets

Correlation of Bitcoin and traditional marketsAccording to him, the spot price would have to be above $30,000 if there was correlation. The analyst adds that even though traditional market correlation is declining, attention should be paid to the Fed. Geopolitical factors such as the Russia-Ukraine war, tensions over Taiwan and the impending European energy crisis pose further risk factors. Filbfilb concludes that the macro market situation therefore remains “on the knife”. Meanwhile, the expectation of a sudden interest rate cut amid disappointing economic data from China is upsetting the trend of the day. “The economic data for July is very worrying,” Greater China economist Raymond Yeung said in response to Bloomberg. Also, Lex Moskovski, CEO of Moskovski Capital, predicts that all central banks will lower interest rates rather than raise them.

Funding rates are healthy despite reaching $25,000

Looking at the impact of the current spot price action on trading habits, it seems that conditions could be further upside down. Philip Swift, co-founder of DecenTrader, highlighted negative funding rates while analyzing derivatives markets. The rates indicate that the downtrend among Traders is gradually increasing. In fact, these ratios often form the basis of further gains. This is because the market is waiting for the downside and not overly betting on the realization of gains. This allows short positions to be “squeezed” by smarter money. Bitcoin, along with crypto markets in general, has a habit of doing the opposite of what the majority expect. Swift says that the negative funding rate has historically triggered a rally in Bitcoin.

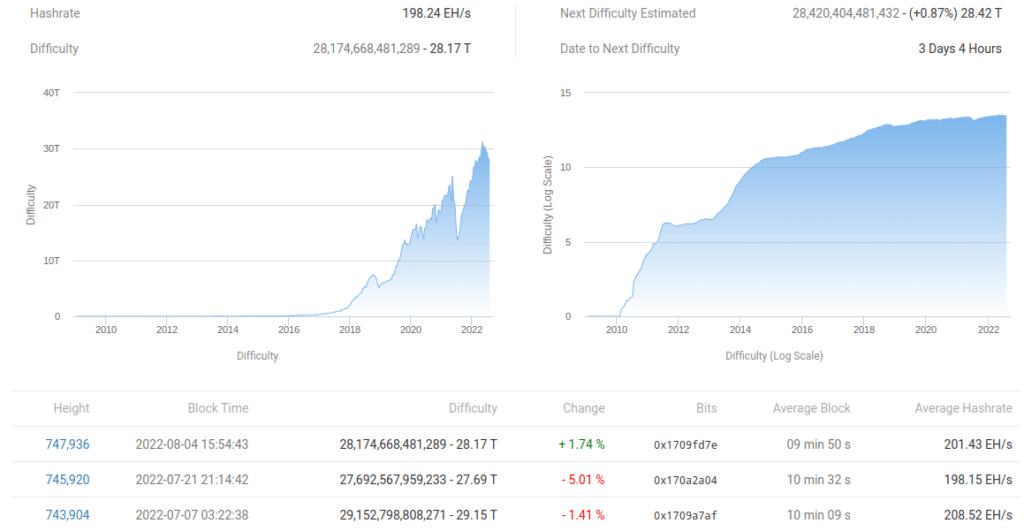

Difficulty from a second flat rise

Meanwhile, for Bitcoin network fundamentals, a slow recovery is healthier than a higher rally. The latest data from statistics source BTC.com shows that miners are gradually returning to their past activity levels. Miner difficulty will increase for the second consecutive time in this week’s automatic recalibration, after months of slump. The 0.9% increase estimate reveals that, albeit modestly, competition among miners is still increasing. Additionally, hash rate estimates, an expression of the processing power devoted to mining, remain stable below 200 exahash per second (EH/s).

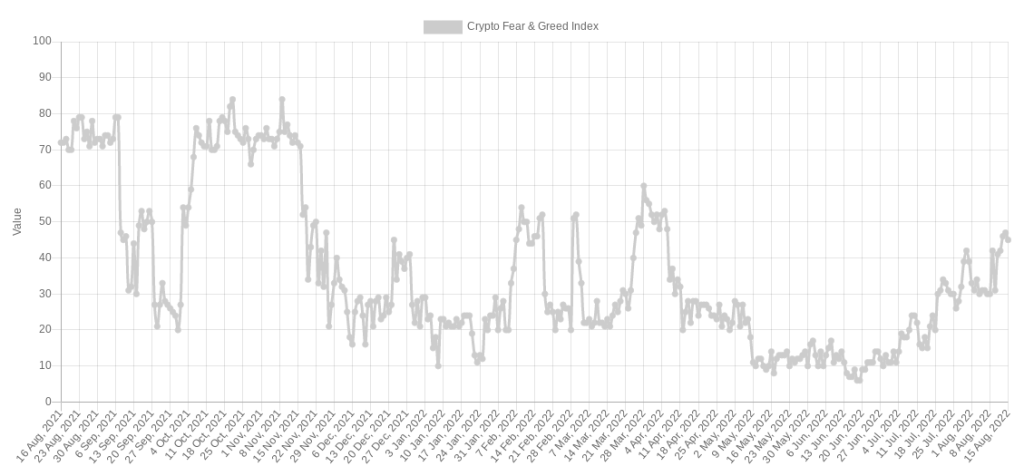

Fear and Greed Index hits 4-month high

For Bitcoin spot price action, it’s good to look at two-month highs. But it isn’t the only aspect of the market that has reclaimed some serious loss ground this week. Fear is at its lowest level since April, according to the Crypto Fear and Greed Index sentiment indicator. The most recent data establishes a score defined as “normal” from a range of mood factors. It also shows that he is tracking down all the losses he caused in the Terra collapse and beyond. Over the weekend, the index reached 47/100. This is the best score since April 6th. In other words, investors can return to greed mode by getting rid of investment reservations.