The bulls have managed to erase weeks of losses. Therefore, Bitcoin (BTC) is starting an important week on a solid footing. The leading cryptocurrency closed the last weekly candle at $21,800. Now, it’s back on investors’ radar as a long-term bet. It looks like the long-running sideways price action has finally come to an end. Moreover, it is possible that volatility will be the main determinant in the upcoming period.

5 events expected to affect Bitcoin, SHIB and altcoins this week

In fact, only a few weeks in Bitcoin’s history have probably been as busy as this week. The Ethereum (ETH) Merge on September 15 is coming. In addition, the status of US inflation will be revealed with the announcement of the CPI data for August. With the release of CPI data, the strength of the dollar, the price of Bitcoin and the course of the future FED meeting will change. So how will all this affect BTC, SHIB and altcoins?

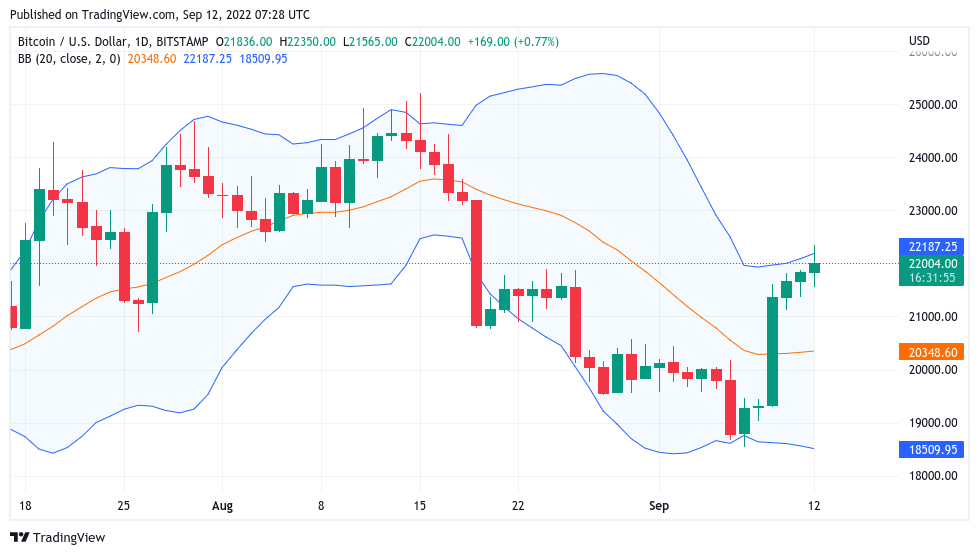

Recent rise in Bitcoin price increases short positions

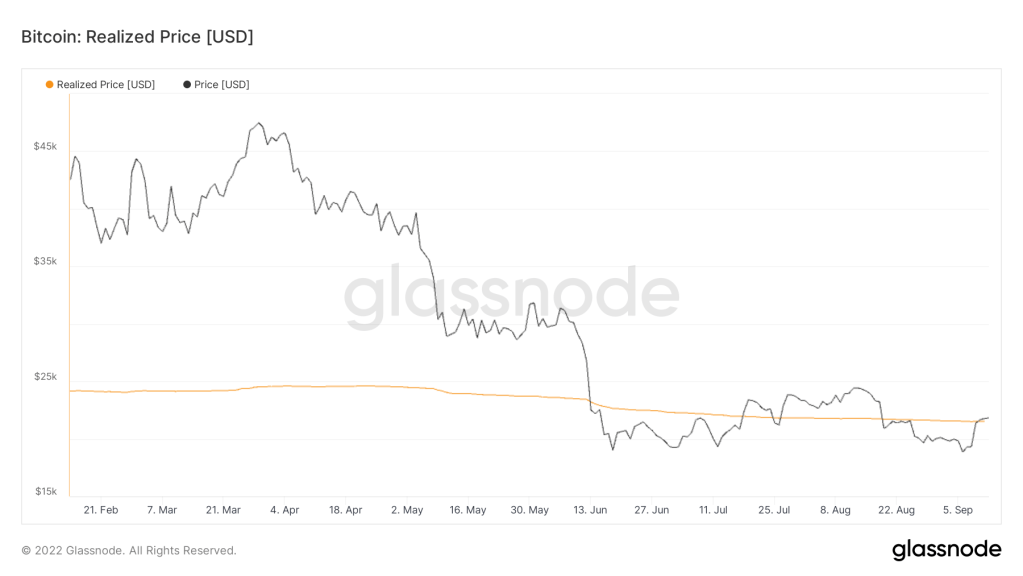

The latest weekly close has provided much-needed relief for Bitcoin bulls. According to the data, BTC has made a convincing gain after weeks of miserable performance. The $21,800 price tag at the close of September 11 provided a solid foundation for the new week. At the time of writing, this level forms a consolidation zone that coincides with an important trendline in the form of Bitcoin’s realized price. According to on-chain analytics firm Glassnode, the realized price is currently around $21,770.

BTC has yet to overcome the more significant bear market levels it lost as support last month. Chief among these levels is the 200-week moving average, which is currently around $23,330. However, the price hike up to $22,350 created an upside sentiment among investors. “$22,300 was just the upfront price,” wrote popular crypto analyst Capo. Later, he warned that the price would decline after hitting $23,000. Another analyst, Cheds, said that the Bollinger bands are widening and that BTC will move in a wider range.

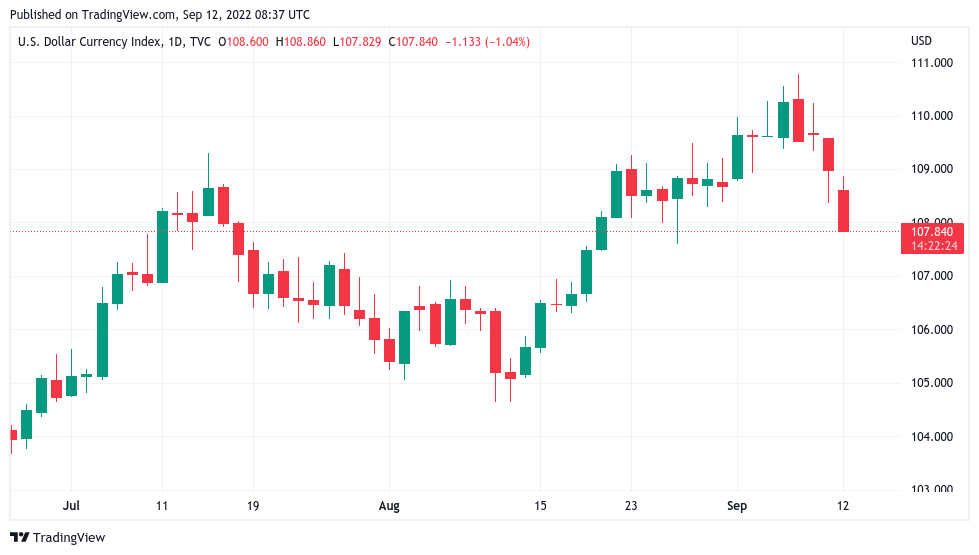

Dollar loses value as US CPI data approaches

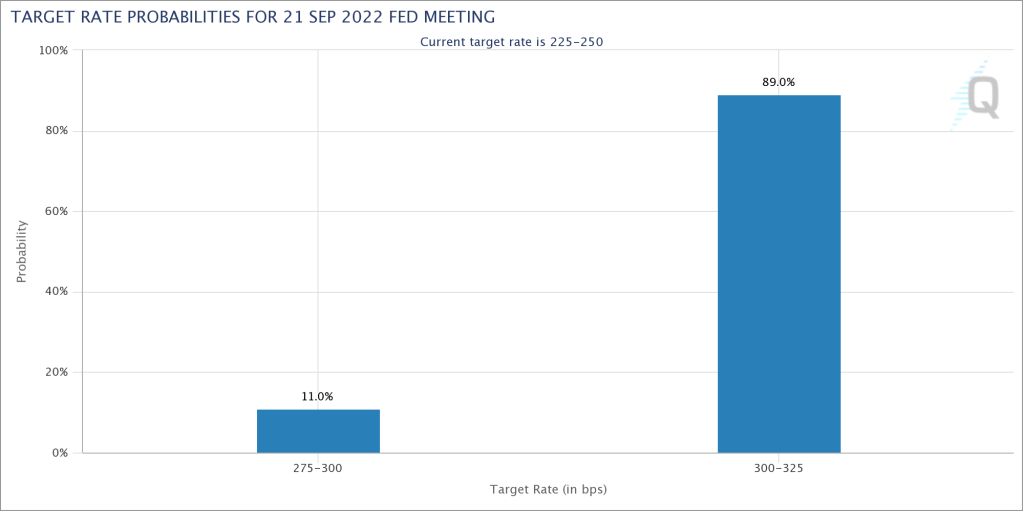

One of the two main developments of the week in BTC price action comes from a familiar source: the FED. CPI data for August will be released this week. Now investors want the CPI to show falling inflation after July formed a peak. If that is the case, it will be a boon for Bitcoin, SHIB and altcoins, which are suffering heavily at the hands of the rising US dollar. The Fed will still raise interest rates by 75 basis points at next week’s FOMC meeting, according to the FedWatch Tool.

That said, dollar watchers have reason to believe that the crypto’s return will solidify itself in the coming days. The US dollar index (DXY) has dropped nearly 2.7% in just four days after reaching its high in two decades. “The DXY chart gives me hope for Bitcoin despite the Merge,” said AlphaBTC creator and crypto analyst Mark Cullen. Phoenix Copper manager Donald Pond said the DXY chart is the most important indicator. He also underlined that DXY is in an uptrend despite the recent decline.

Ethereum Merge is coming

Ethereum Merge is released on September 15. After months of uncertainty, this event is finally coming true. cryptocoin.com As we reported, Merge will change the hashing algorithm by switching Ethereum from Proof-of-Work (PoW) to Proof-of-Stake (PoS). The hype around Merge continues to rise on social media and beyond. Now, analysts are wondering what will happen after the upgrade is released. This curiosity focuses specifically on whether the market will drop after the upgrade.

On September 10, trading platform Decentrader advised to be cautious and avoid only bullish prospects. He emphasized that there are many factors such as CPI that affect Bitcoin, SHIB and altcoins. He also said that there could be events, errors and an Ethereum fork that could go wrong with the upgrade. Thus, he stressed that the bullish sentiment and the Ethereum rally could come to an end. ETH has been bearish for the second day in a row at the time of writing. The leading altcoin hit $1,760 after hitting local highs of $1,790.

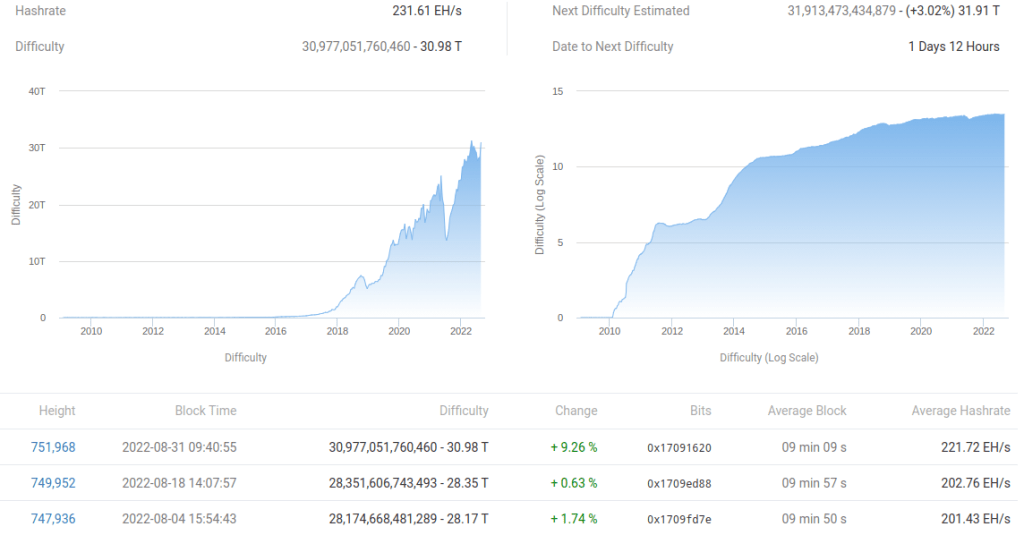

Bitcoin hash rate and mining difficulty make ATH

Bitcoin’s network fundamentals have shown nothing but a drop lately. Now, this trend points to new highs. Bitcoin mining difficulty and hash rate have reached or will reach new all-time highs in the next 48 hours as of September 12. According to estimates from BTC.com, the mining difficulty will increase by 3% at the next automatic recalibration. Thus, it will see unknown regions with a hash rate of 31.91 trillion.

This follows the 9.26% realignment two weeks ago. The adjustment two weeks ago is the biggest increase since 2021. It also gives a solid signal that miner competition is healthier than ever before. Since the last capitulation ended, miners have been racing for more hash power. This shows that we are approaching a new ATH in difficulty and hash rate. The hash rate is currently hovering just under 250 EH/s.

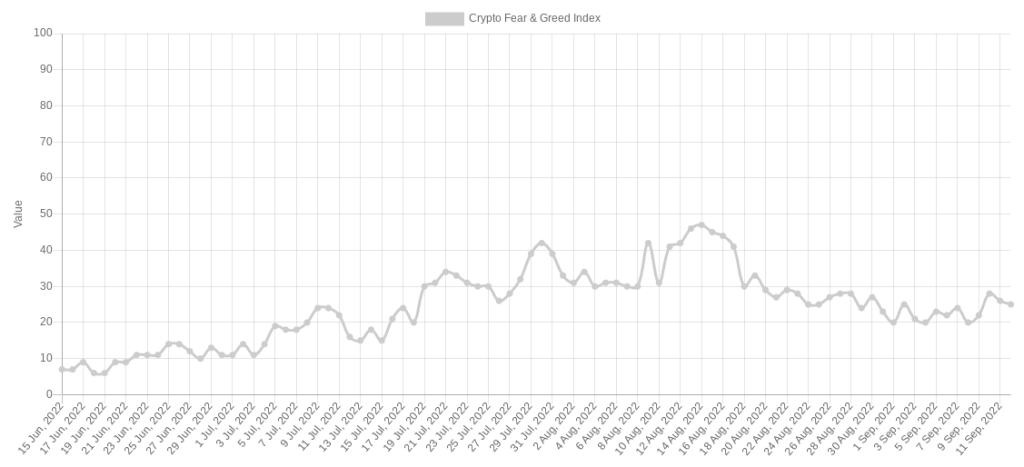

Extreme fear continues to dominate the market

As optimistic as the data and analysis may seem, there is not much change in the sentiment of the overall crypto market. Fear&Greed Index, which shows the market sentiment, had a short rise. He then returned to the “extreme fear” zone on September 12. Thus, it revealed that a definite change in sentiment among investors has not yet occurred. In fact, “extreme fear” has heavily gripped Bitcoin, SHIB, and altcoin investors in 2022. Most of 2022 was spent in this region.

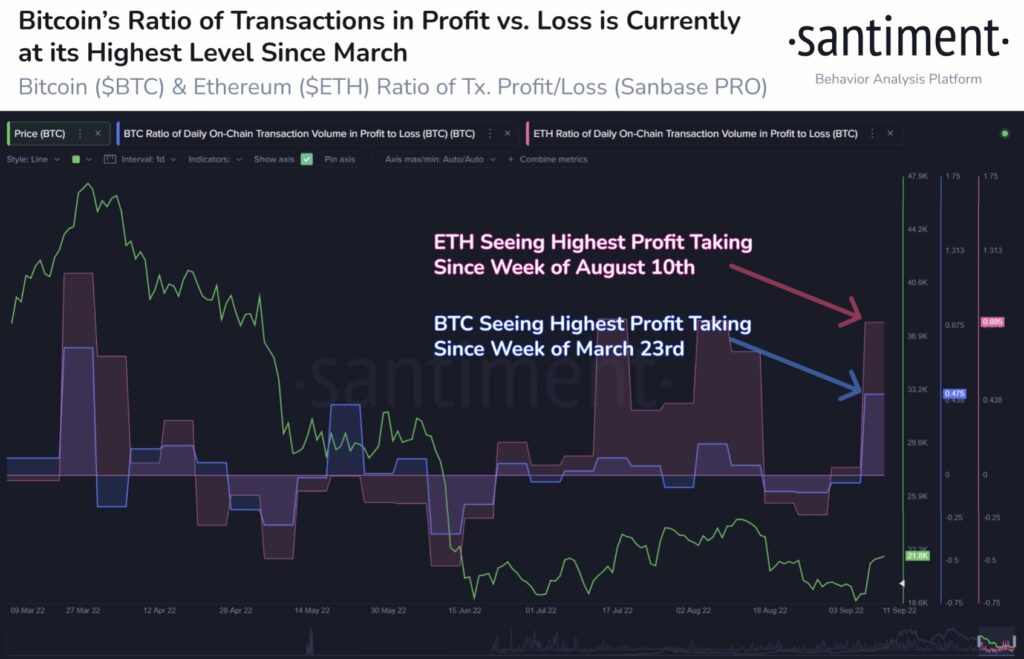

For crypto analytics platform Santiment, there were plenty of reasons to be cautious thanks to the profit-taking activity in both Bitcoin and Ethereum. Santiment summed up the situation by saying, “Bitcoin has risen above $22,000 for the first time in 3 weeks today.” He said investors’ profit/loss ratio is at its highest level since March. He then emphasized that many see this slight bounce as a trigger for trading again.