Bitcoin (BTC) starts the second week of May 2022 with a downward movement. After falling to around $33,000, the biggest cryptocurrency is putting fear into market participants old and new. While calls for capitulation continue, there is still no agreement on how much BTC/USD can or should drop to make a credible long-term bottom. So, what will affect the market movements of cryptocurrencies consisting of coins such as Bitcoin, SHIB, DOGE in the coming days?

Six-week red close for Bitcoin

Weekly close of $34,000 on May 8 meant that BTC/USD delivered its sixth consecutive weekly red candle. . According to the data, this has not been seen for nearly eight years – the last event was in August 2014. At that time, as now, Bitcoin was in its second year of its four-year halving cycle and saw its first burst at just over $1,000 in November 2013.

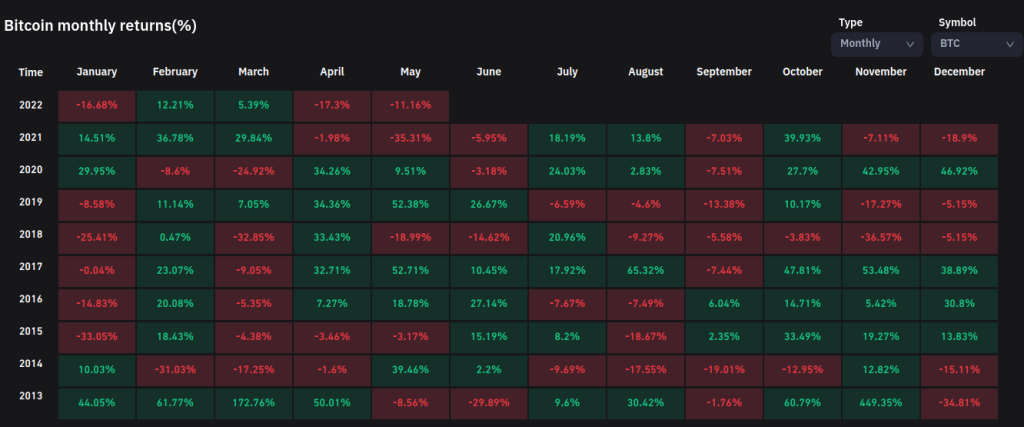

Meanwhile, macro conditions have dispelled any hope of a late rise among the majority of analysts who expect central banks worldwide that financial tightening will keep risky assets like crypto in tight control. According to data from Coinglass, the worst historically recorded May was actually last year, when the pair lost 35.3 percent.

However, according to experts, the chances of a comeback after April’s performance seem slim. For the four years in a row before 2022, Bitcoin reverse saw a gain of at least 32 percent in April. This year, however, it broke a record with a 17.3 percent loss, as we also reported on Kriptokoin.com .

BTC drops to the 100-week moving average

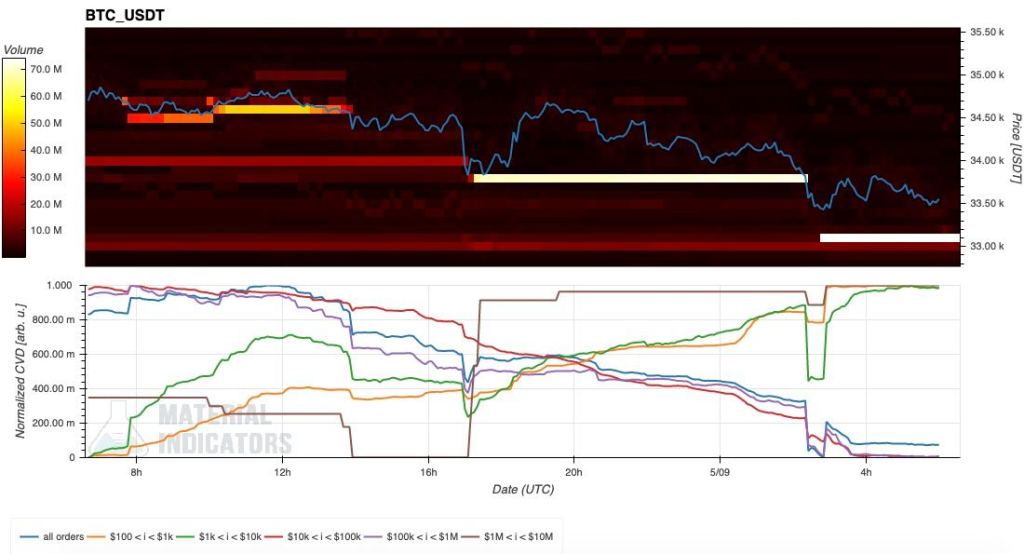

The analysts’ advice when it comes to short-term Bitcoin price action is pretty much the same: Be careful. After the weekly close, BTC/USD continued to drop to $30,000 at the time of writing. According to experts, he wants to test $33,000 and the January low of $31,800 in the next stage. On-chain analytics resource Material Indicators shared a chart showing bid support disappearing from the Binance order book to its Twitter followers and used the phrases “don’t try to catch this knife” meaning “don’t buy a falling stock”.

The May 8 order book shows a massive bid wall of $33,000. Another buy wall around $33,800, which was quickly traded by the market, showed the correctness of the sell-side pressure in the current environment. Last week’s weekly candle showed that Bitcoin fell below its 100-week moving average (WMA) for the first time since March 2020.

Twitter account Blockchain Backer wrote in part of its latest update, “Both previous times, the 200-week moving average in 2014 and 2018 led to capitulation. Today’s graph is different from those two times, and these two times were very similar.” Still, Blockchain Backer added that it expects a “big dive” tomorrow after the latest weakness.

Bitcoin closes the week below the 100-week moving average.

Both previous times led to capitulation to 200-week moving average in 2014 and 2018.

Today's chart has many differences from those two times, and those two times were very similar to each other.

Big dive in tomorrow! pic.twitter.com/0NLF0K0Y0U

— Blockchain Backer (@BCBacker) May 9, 2022

Bitcoin, SHIB affected by macro developments: CPI inflation narrative

Bitcoin’s devastation in the first week of May was overwhelmingly thanks to broader macro weakness firmly entrenched in global markets. Stocks are particularly problematic in this regard, as crypto’s continued correlation with these indices is straining investors. Things peaked last week after tightening approvals from the Fed as the S&P 500 closed its first five-week decline since 2011. Now, amid the ongoing Russia-Ukraine conflict and the associated financial pressures, another power will return.

“We expect inflation to peak this summer between 6%-7% and to recede to 3%-4% next year with no recession. … We may have spotted the first signs of peaking inflation already, in lower three-month than y/y rises of several price and wage measures.” – @yardeni pic.twitter.com/4mXXxFvmIN

— Carl Quintanilla (@carlquintanilla) May 8, 2022

According to experts, it is already the highest in the USA since the early 1980s Inflation will only get worse, thanks to trade disruption and sanctions against Russia. Consumer price index (CPI) data for April will be released this week, and the numbers are likely to reflect the scale of geopolitical turmoil more than ever before. US President Joe Biden will speak on inflation on May 10, before the CPI pressure on May 11. CPI tended to trigger any short-term BTC price volatility.

Bulk Bitcoin sales begin?

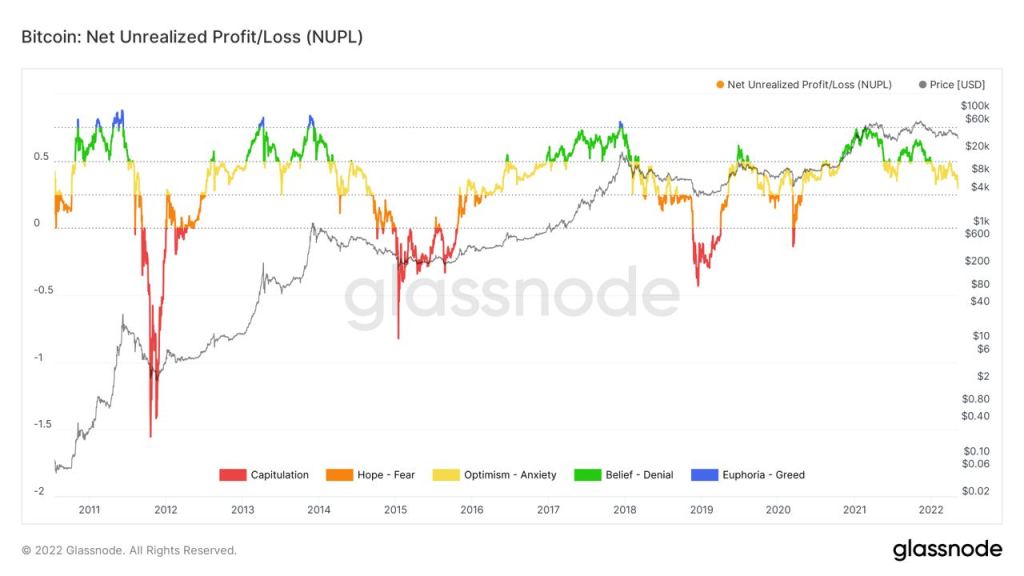

While investors are panicking to sell their Bitcoins, the data on “capitulation”, which means mass selling, show that the will to start can be strong. Currently, more than 40 percent of the Bitcoin supply is held at a loss, which is the highest rate since April 2020, right after the COVID-19 crash. It was then that a real capitulation took place, as evidenced, first of all, by the price. The capitulation was validated by analyzing unrealized profits and losses among hodlers at the time, as defined by on-chain analytics firm Glassnode. After just nine days, the firm’s unrealized net profit/loss metric has moved out of the “capitulation” zone.

Overall sentiment collapses in BTC, SHIB, ETH market

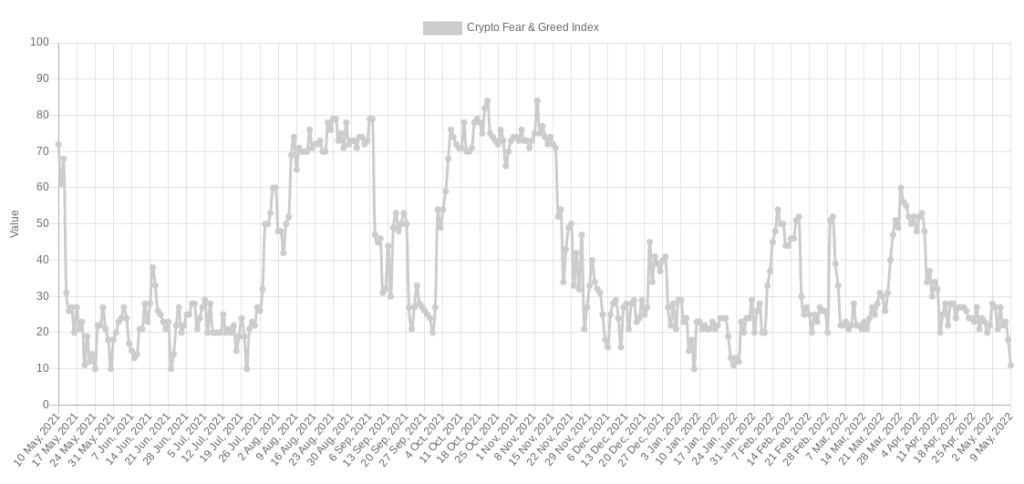

As of May 9, the classic sentiment indicator Crypto Fear and Greed Index, “ extreme fear”, as well as historically bottoming levels: 11 out of 100. The index has halved its value in just two days. The traditional financial market equivalent, the Fear and Greed Index, started to diverge from cryptos like SHIB, BTC, holding steady at 30/100, or “fear,” on May 9 even after last week’s turmoil. Research firm Santiment commented on the situation:

In general, we generally prefer to see such signs of capitulation as weak hands leaving the field are what are needed for a truly remarkable leap.