Bitcoin (BTC) is making a comeback this week as a sudden surge challenged weekly highs. Contrary to the last weekly closes, the May 29 candle has managed to limit the downward movement and immediately reverse with the start of the new week. However, Bitcoin has now recorded nine consecutive weekly red candles, something that has never been seen before in its history. So, what are the factors that can move the market in the coming days? Here are the details…

Can BTC avoid the 10-week red?

Bitcoin is breaking tradition this week, thanks to an unexpected U-turn overnight on May 30. The trigger came from news that China is planning to open up the economy by loosening some of the recent COVID-19 restrictions. Still, Bitcoin outperformed stocks before European trading took off. While he remains cautious as the weekly close is still in the red, Bitcoin could still end its nine-week streak this week as long as the next Sunday’s close is at least $29,500.

For some, the overnight move alone was enough to make the short-term outlook noticeably more positive. Jordan Lindsey, founder of JCL Capital, told his Twitter followers, “Bitcoin is on the verge of a mega bullish signal. “I don’t think it’s time to be greedy looking for bottoms,” he said. Trader Crypto Tony noted that Bitcoin is still in a familiar trading range and needs to clear some key levels before it is considered to be on a solid trajectory. That’s $31,000 for him, now that’s not far off. Meanwhile, popular trading account TMV Crypto has marked overnight lows as key support to keep moving forward.

Trader and analyst Crypto Ed added in a Twitter thread published that day, “I’m not sure if we should be too optimistic on BTC + ETH.” Citing weak weekend volumes supporting the jump, he suggested that higher levels have yet to have the bid interest needed to solidify themselves as new support. Meanwhile, a CME futures gap remaining at $29,000 from Friday provides further bearish target.

Analyst: The recovery in equities “bear market rally”

While the United States markets were closed on May 30 for a public holiday, it’s up to Europe and Asia to set the mood for the day. With the World Economic Forum over, crypto holders can take a breather as we head into the new month before another US Fed meeting in mid-June. Asian stocks’ return to form after eight weeks of losses was the main macro focus of the day.

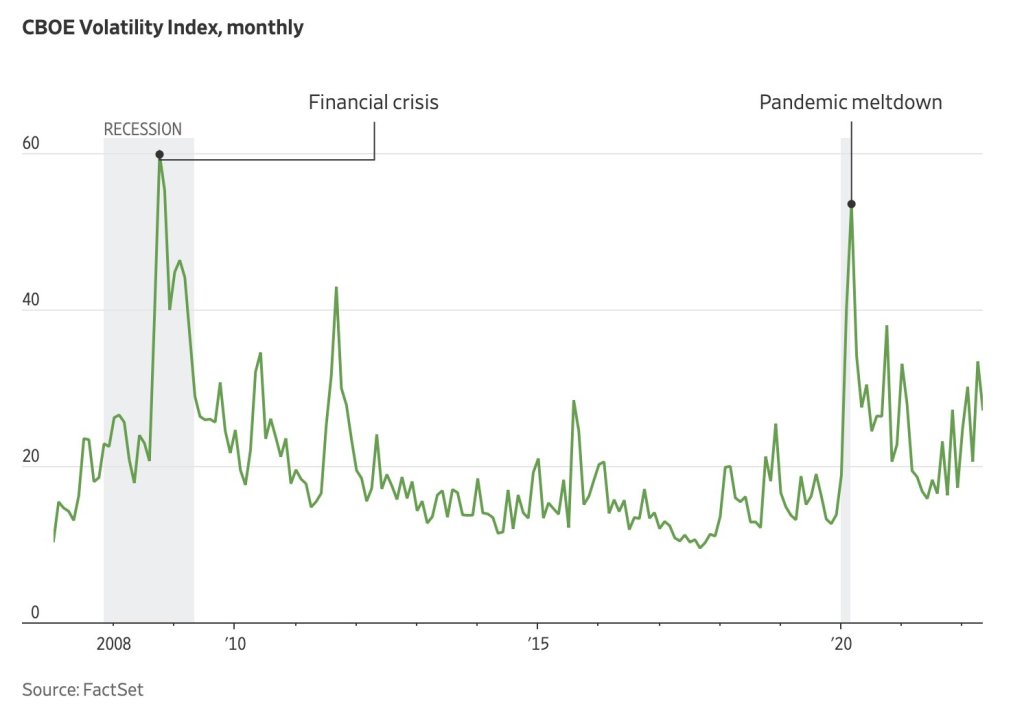

After failing to capitalize on a similar rally in the US last week, Bitcoin now appears to be taking advantage of the mood, but commentators say it’s still a sign of a general trend reversal. They warn that there is no indicator. Quantitative tightening from the Fed and other central banks has not only put stock traders down, but fueled talk of a massive recession, along with the price economies are paying.

Citigroup Australia’s head of investment specialists Mahjabeen Zaman told Bloomberg, “We are in the middle of a bear market rally. “I think it will depend on the trading range as the market tries to figure out how soon a recession will come or how quickly inflation will drop,” he said. Tightening is expected this week, with June 1 thought to be the date when the Fed began cutting its balance sheet, which is now at a record $8.9 trillion.

Peaking dollar is finally starting to fall

Over the past week, the US dollar has tested support levels. As Kriptokoin.com , after hitting levels not seen since December 2002, the US dollar index (DXY) is finally returning to normal levels and even challenging the uptrend of the year. This trend could prove promising for risk assets if the trend continues, especially since inverse correlation has worked in Bitcoin’s favor in the past. “This could only be the beginning of the 2022 bull run,” said an analyst named Crypto Rover, noting the Bitcoin-DXY inverse correlation. However, Crypto Ed is not convinced that the good times will return due to weakness in the dollar. “DXY is on a back However, at 101.49, DXY was at its lowest level since April 25.

BTC is approaching a “cyclical bottom”

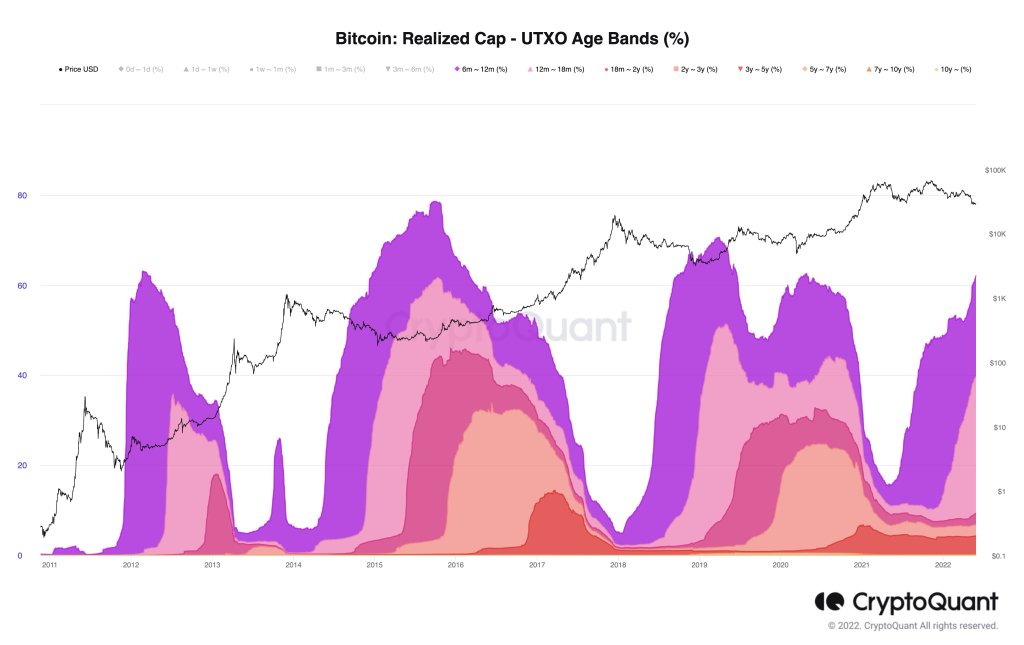

Not everyone is bearish among Bitcoin analysts and one of them is CryptoQuant CEO Ki YoungJ. Sharing the latest data from Bitcoin’s realized cap distribution, Ki actually argued that BTC/USD is currently in a phase similar to March 2020. The realized cap reflects the price at which each Bitcoin last moved and can be broken down into age groups. These, in turn, show the ratio of the BTC supply that last moved a certain amount of time ago, forming the realized upper limit.

Currently, 62 percent of the realized cap includes unspent transaction output (UTXOs) from six months or more. For Ki, this means floor space for BTC price historically and most importantly as happened in the March 2020 COVID-19 crash. “UTXOs over 6 months old now receive 62 percent of the realized cap. In the big sale in March 2020, this indicator also reached 62 percent,” he says.

CryptoQuant previously reported that UTXO data relates to the size of Bitcoin investor holdings, but drew more conservative conclusions. It turned out last week that the largest Bitcoin whales are continuing to distribute their holdings on-chain, while the smaller whales are likely to bolster the market and prevent a March 2020-style waterfall.

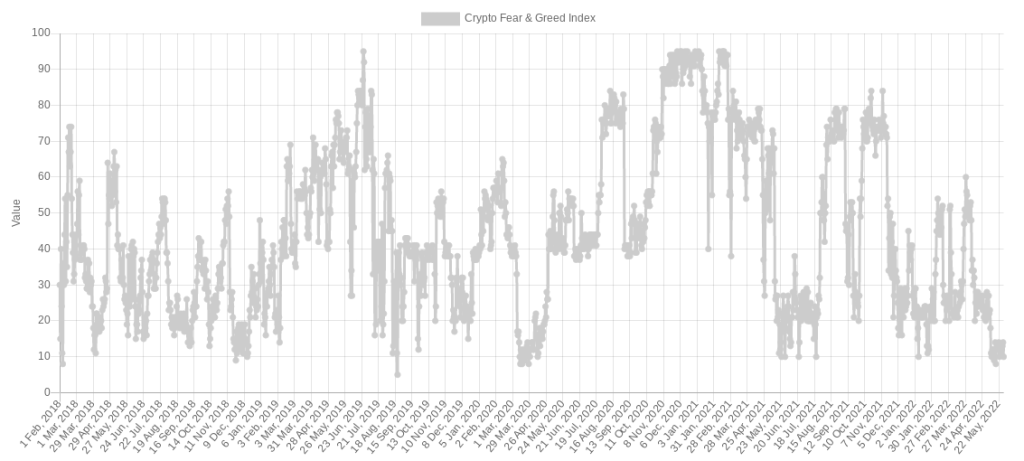

Sentiment points to “long-term buying opportunity”

It takes a lot of price action to turn sentiment green in the current environment. This is more commonly true for both Bitcoin and crypto, as investors endure more than six months of virtually unchecked negativity. That’s the case this week as well – despite the overnight rally, sentiment remains firmly in the “extreme fear” zone across Bitcoin and altcoins.

The Crypto Fear and Greed Index is just 10/100 as of May 30, a score that has accompanied intergenerational price dips in previous years. May 2022 has been a particularly challenging time for sentiment, with Fear & Greed only reaching 8/100 earlier in the month, a level seen in March 2020 and last seen in March 2020. Analyst Scott Melker added that regardless of what might happen next, the sentiment presents a “long-term buying opportunity.”