Bitcoin (BTC) made the lowest weekly close since July. Now the market is facing “huge” macro announcements. The latest inflation data from the US showed that inflation did not fall at the expected rates. After these data, losses that lasted for days emerged. As a result, Bitcoin, SHIB and altcoins and other risk assets failed to recover.

The biggest cryptocurrency has yet to turn $20,000 into convincing support. Now we have entered the third week of September and the danger is that this level will act as resistance once again. Bulls have a lot to worry about. In the coming days, the FED will announce a new rate hike decision. This is something that will affect the cryptocurrency market far beyond mere sentiment.

5 developments that will affect BTC, SHIB and altcoins this week

In addition, the results of Ethereum Merge continue to have an impact. Also, the SEC-destroyed crypto exchange Mt. Bitcoin refunds to creditors continue at Gox. Both these developments add another potential cloud to the Bitcoin price landscape. So what are the top 5 events that will affect BTC, SHIB and altcoins this week?

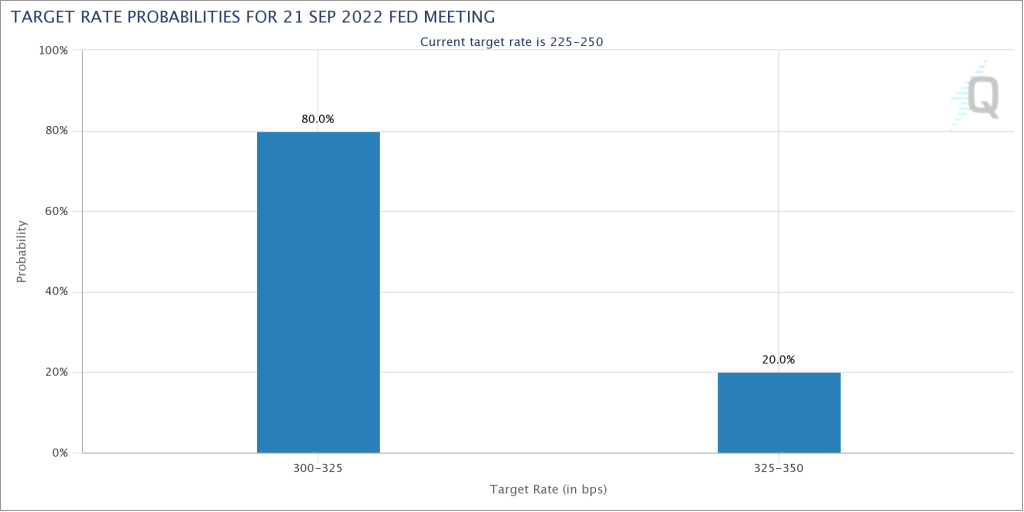

Fed’s new rate decision this week

The main event of the week is the Fed’s decision on key interest rates. After August’s CPI data came in “higher” than expected, the Fed will be under pressure to respond. Therefore, the market is pricing in a minimum increase of 75 basis points for the rate decision. There is also a group that is betting 100 basis points according to the CME FedWatch Tool as of Sept. If a 100-point increase comes in, it will be the Fed’s biggest increase since the early 1980s.

The Committee (FOMC) will meet on September 20-21 and will issue a statement confirming the interest rate hike and FED support. The Fed’s rate hikes mean a drop in risk assets like stocks and cryptocurrencies. Meanwhile, Bitcoin stock correlation is very high right now. Therefore, a high interest rate hike is likely to trigger a crash in BTC, SHIB and altcoin prices.

Bitcoin price drops after weak weekly close

Last week, the headwinds supporting the Bitcoin price disappeared. This resulted in BTC price action falling in the same way. Bitcoin has lost over $2,000 in a single weekly candle, according to TradingView data. Thus, it closed below $20,000, the lowest level since July. The close was followed by a sharp drop below $19,000.

The reasons behind the bearish mood are clear. First, Ethereum Merge became a “sell the news” event. Macroeconomic factors also contributed to the decline. Now, analysts expect the downtrend to continue, at least until the Fed rate announcement passes. cryptocoin.com As we reported, some analysts warn that the price of Bitcoin may fall as low as $ 15,000 after the interest rate hike. If that happens, SHIB and altcoins will also experience new lows.

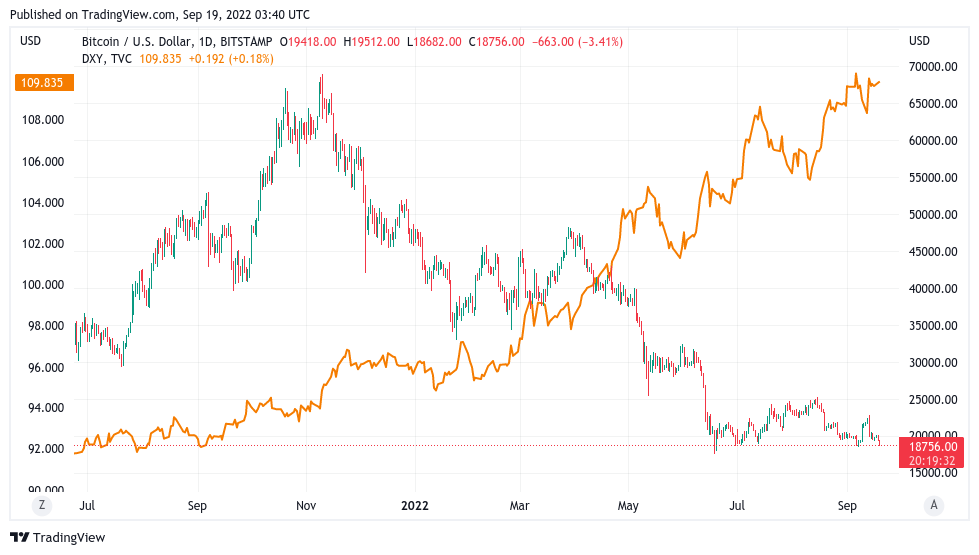

US dollar drops below 10-year high

Meanwhile, the US dollar, which is eagerly awaiting a potential macro high, has rebounded from post-CPI losses. The US dollar index (DXY), a classic indicator for crypto, is currently just under 110 and has been consolidating for several days. The index hit 110.78, its highest level since 2002, earlier this month. Meanwhile, the inverse correlation between DXY and BTC/USD continues. So the rise of one means the fall for the other.

Ethereum drops after Merge

In the week after the much-lauded Merge, Ethereum (ETH) suffers a huge drop in the wake of the hype. ETH/USD is down 25% over the past week, likely to tip its market dominance in Bitcoin’s favor. Currently, the pair is trading below $1,300, its lowest level since July 16. However, analysts and traders expect further declines. “Ethereum is failing to hold critical support,” warned crypto analyst Svenson. Meanwhile, Analyst Matthew Hyland set a target of $1,000 for ETH, adding that $1,250 “should remain a support.”

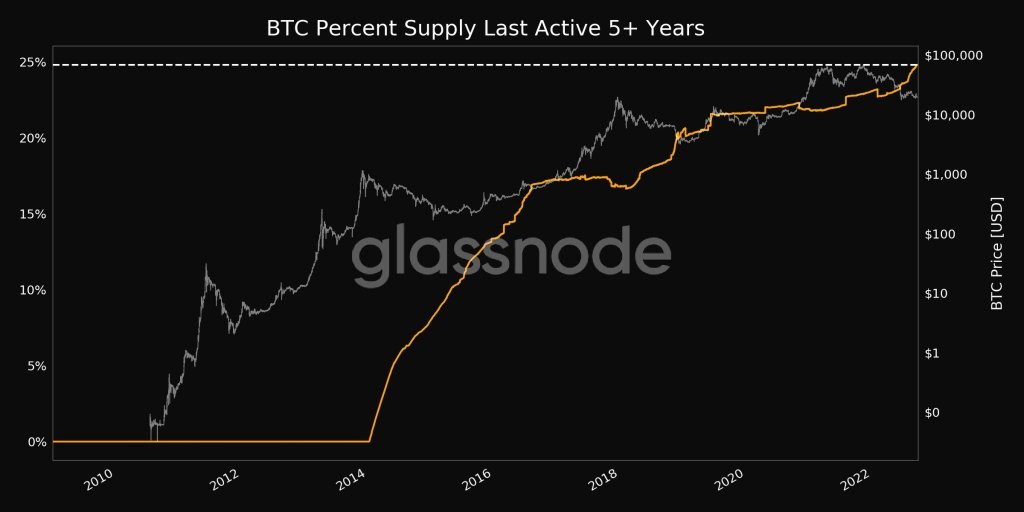

The dormant BTC supply continues to age

Recent price volatility has led to an increase in on-chain activity. However, those who HODL their BTC holdings remain adamant. According to analytics firm Glassnode, there has been an increase in wallets holding Bitcoin over a period of at least five years. The firm confirmed that the BTC supply, last active on or before September 2017, reached an all-time high of 24.8%.