The shock wave that started with the release of the US CPI data was like a light breeze for the crypto market. Now we have started a new week and the market has managed to increase its value two weeks in a row. Bitcoin has finally reached the strength it needs so much today. Macroeconomic conditions such as inflation pressure and the strengthening of the dollar seem to be easing the pressure on crypto. While investors are relieved, there is a drop-or-go situation for BTC miners right now. At least that’s what the on-chain data says.

Events that will affect Bitcoin, SHIB and altcoins this week

However, investors and analysts continue to argue about where the bottom of Bitcoin will be. This question remains important as SHIB and altcoins are also directly tied to the BTC price. So what’s ahead? 5 events that will affect the prices of Bitcoin, SHIB and altcoins, cryptocoin.comwe have prepared for you.

Bitcoin is approaching a key resistance level

In the latest weekly close, BTC erased most of its last minute gains. The leading cryptocurrency, which produced a red candlestick, was again disappointing for its investors. What happened after that was the exact opposite of the decline. BTC managed to rally around $1,400 overnight. As those familiar with cryptocurrency charts will know, this all posed a familiar challenge. Bitcoin is approaching its 200-week moving average. This moving average represents the resistance trendline between $22,000 and $22,600. This level, which was an important support in the past bear markets, has now turned into a critical resistance. That’s why analysts see this level as a major area of interest. If BTC closes above this level, the bulls will try to push the price higher.

Ethereum prepares to challenge $1,500

It is possible that altcoins will be the driving force that will push the Bitcoin price above $ 22,600. As it is known, altcoins usually follow the rise and fall of Bitcoin. This time, however, investors are questioning whether BTC will follow the leading altcoin Ethereum. Ethereum has announced that the Merge upgrade will be completed soon. After that, the ETH price performed notably, gaining 25% over the past week. At the time of writing, Ether was preparing to challenge $1,500 for the first time since June 12. Some analysts agree that the rise of Ethereum will create bullish pressure on BTC. However, there are analysts who do not think so.

The dollar is finally losing strength

Discussions such as US CPI data, global inflation and the FED’s rate hike seem to have cooled, at least for now. Asian markets are on the rise as China recovers from the market scars caused by Covid-19. However, the US dollar has entered consolidation as global equity markets remain under pressure. The dollar strength index (DXY) hit its highest level in the last 20 years last week and equalized with the euro. Now it has finally started to move downwards. The decline in this indicator, which is inversely proportional to crypto asset prices, could lead to positive consequences for the prices of Bitcoin, SHIB and altcoins.

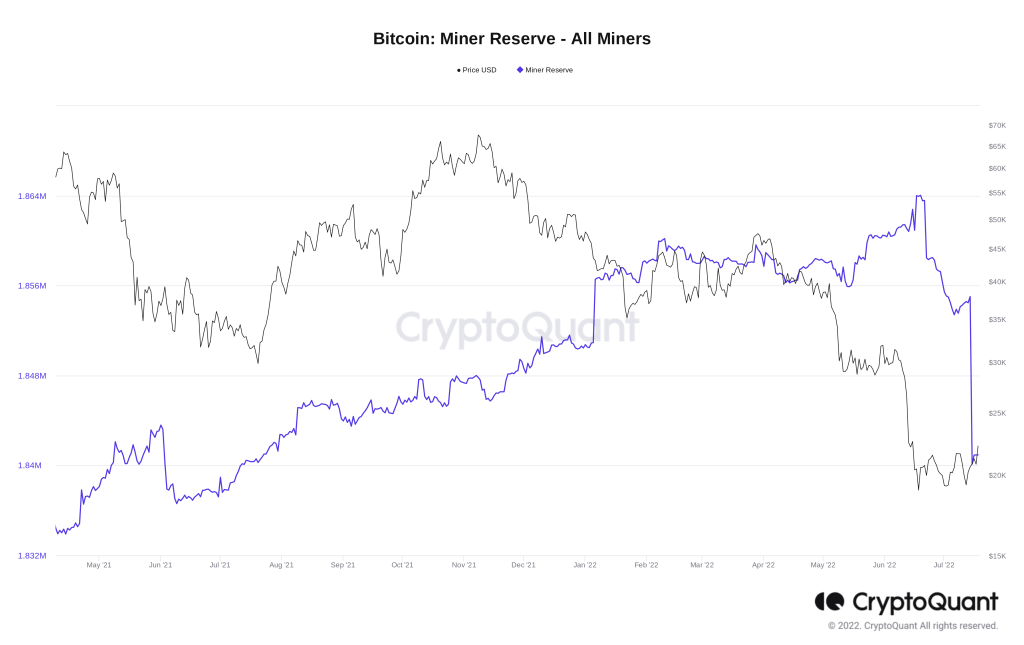

Miners sold 14,000 Bitcoins

There is strong hope among investors that the trend is changing. However, on-chain data reveals negative data that Bitcoin miners are selling their assets. According to data from CryptoQuant, miners have sold a significant amount of BTC from their wallets in the last 4 days. As a result, miners’ BTC reserves hit the lowest level to date since July 2021. More than 14,000 BTC has been sold in recent days. Thus, the total reserves of miners dropped to 1.84 million BTC. This also marked a low point for BTC price.

This very rare event could fuel BTC price

Finally, the price analysis revealed a rather rare event. Accordingly, this rare event on the Bitcoin chart has generated strength for a historic trend reversal. Commenting on the BTC/USD chart from the beginning of Bitcoin’s life, Stockmoney Lizards revealed the event. Lizards said that Bitcoin’s relative strength index (RSI) is currently at appropriately low levels. He then noted that the RSI combined with the one-day chart trendline touch that fueled the biggest BTC rises.