Bitcoin price continues to trade in a narrow range. According to crypto analyst Rakesh Upadhyay, this constitutes a possible short-term breakout for MATIC, HT, QNT and OCD. Crypto analyst James Obande states that BNB and ETH should be watched carefully. We have compiled the analysts’ altcoin analyzes for our readers.

MATIC, HT, QNT and OCD analysis

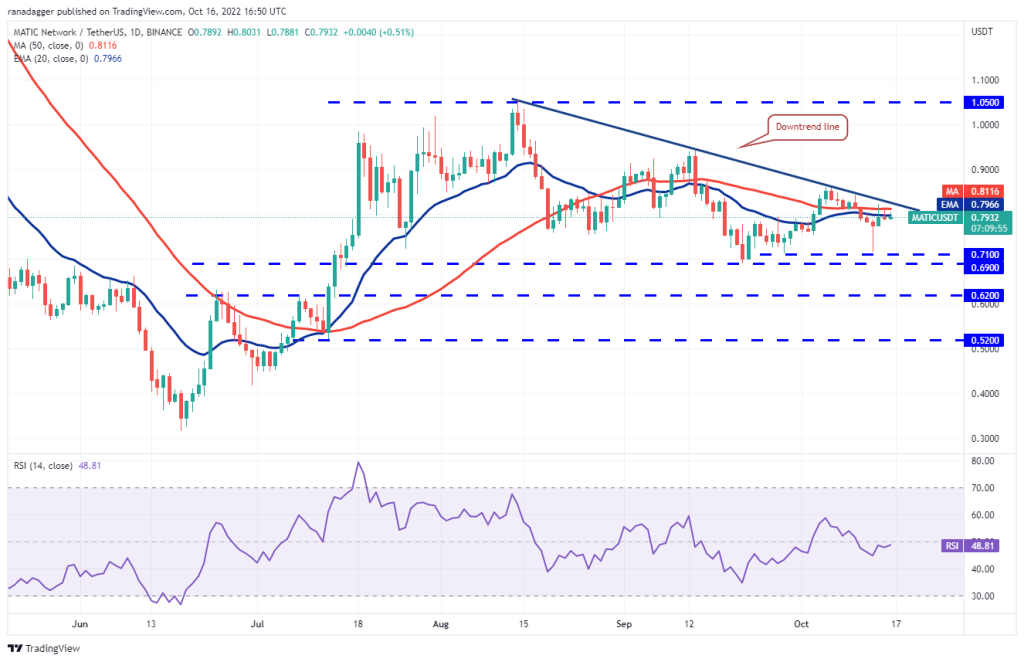

Polygon (MATIC)

MATIC has been trying to break above the downtrend line for the past few days. Although the bears successfully defended the general resistance, they were unable to keep the price low on October 13. This suggests that the bulls are buying the dips as they expect a higher move.

If the price rises above the downtrend line, it is possible that the short-term trend will turn in favor of the bulls. MATIC is likely to attempt a rally to $0.94 later. This level is likely to act as a strong barrier again. However, if the bulls surpass this, a MATIC rise to $1.05 is possible. Alternatively, if the price breaks down from the downtrend line once again, the bulls are likely to give up. Thus, MATIC is likely to drop to $0.69 later. The bears will need to push the price below this level to start a deeper correction at $0.62 and then $0.52.

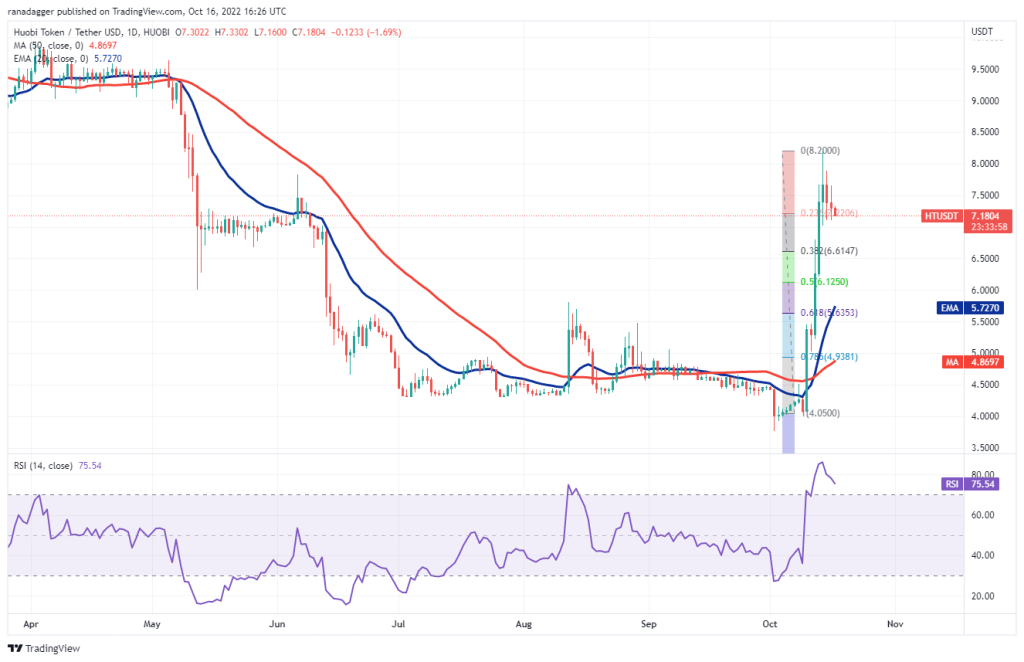

Huobi Token (HT)

HT started a strong upward move from $4.07 on October 10 to $8.20 on October 14, with a 101% move in five days. This indicates that the bulls are in control.

The sharp rally over the past few days has pushed the RSI into the overbought territory. This, in turn, is likely to have encouraged short-term traders to make profits. This started a correction that could reach the 38.2% Fibonacci retracement level of $6.61. If the price bounces back from this support, the bulls will try to continue the upward move, pushing HT above $8.20. If they are successful, it is possible for HT to rise to $10. Contrary to this assumption, if the price breaks below $6.64, HT is likely to drop to the 50% retracement level of $6.12 and then the 61.8% retracement level of $5.63. A deeper drop delays the start of the next leg of the upward move.

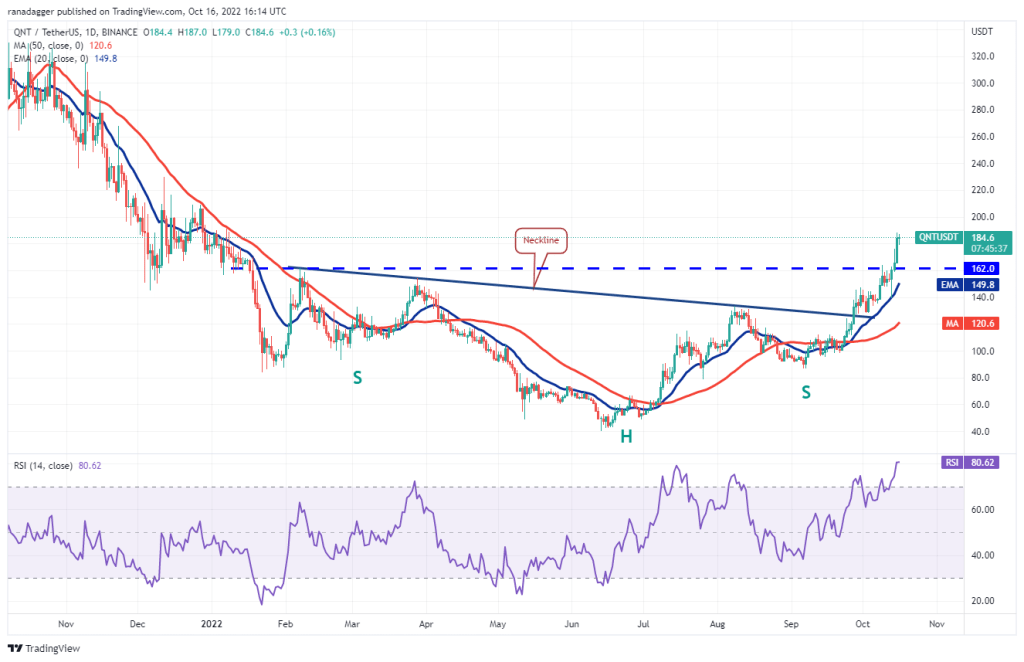

Quant (QNT)

QNT climbed above the overhead resistance at $162. It also continued to rise, showing sustained demand from the bulls.

The rising 20-day EMA ($149) points to the advantage for buyers. However, the RSI in the overbought zone indicates a possible minor correction or consolidation in the near term. Buyers are expected to defend the dip to the $162 breakout level. If the price bounces back from this level, it is possible for QNT to rise to $200. It is likely to attempt a rally to the target target at $230 later. This positive view will be invalidated in the short term if the price drops and dips below the 20-day EMA. QNT is likely to drop to the 50-day SMA ($120) later.

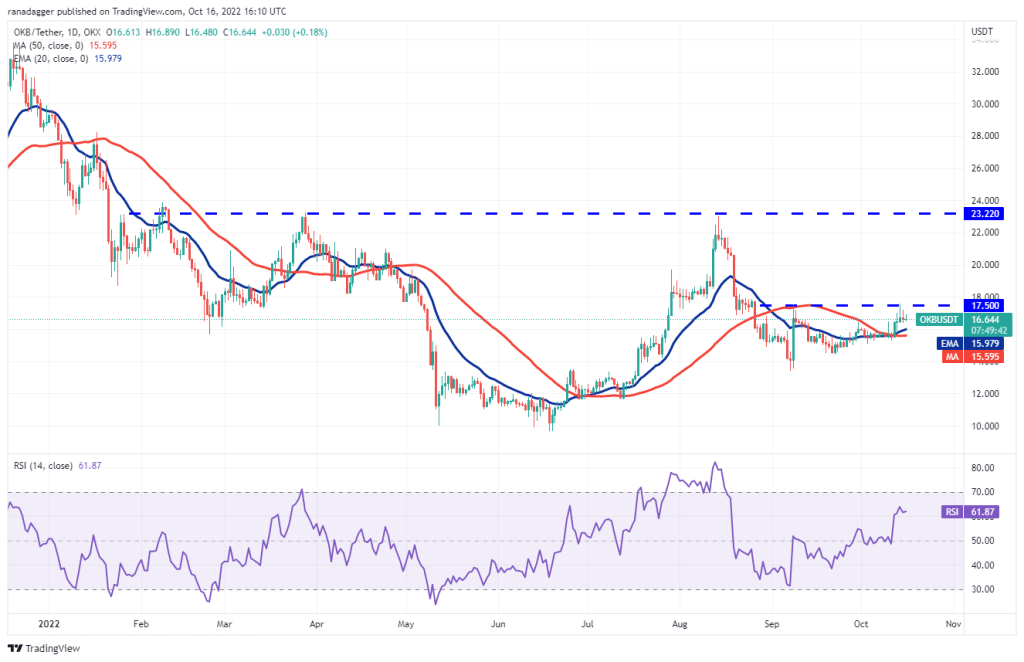

OCD (OCD)

OCD has been trading above the moving averages for the past few days. Also, the RSI jumps into the positive territory, giving buyers an advantage.

OKB is facing stiff resistance at the overhead resistance at $17.50. However, one small positive is that the bulls have left no ground for the bears. This indicates that the bulls are waiting for the OCD to break above the overall resistance. If this happens, OKB is likely to rally to $20 and then $23.22. An initial support on the downside is at $16.39. If the price drops and breaks below this level, a slide to the moving averages and then $15 is possible for OKB.

Analysis of leading altcoin Ethereum (ETH) and Binance Coin (BNB)

Ethereum (ETH)

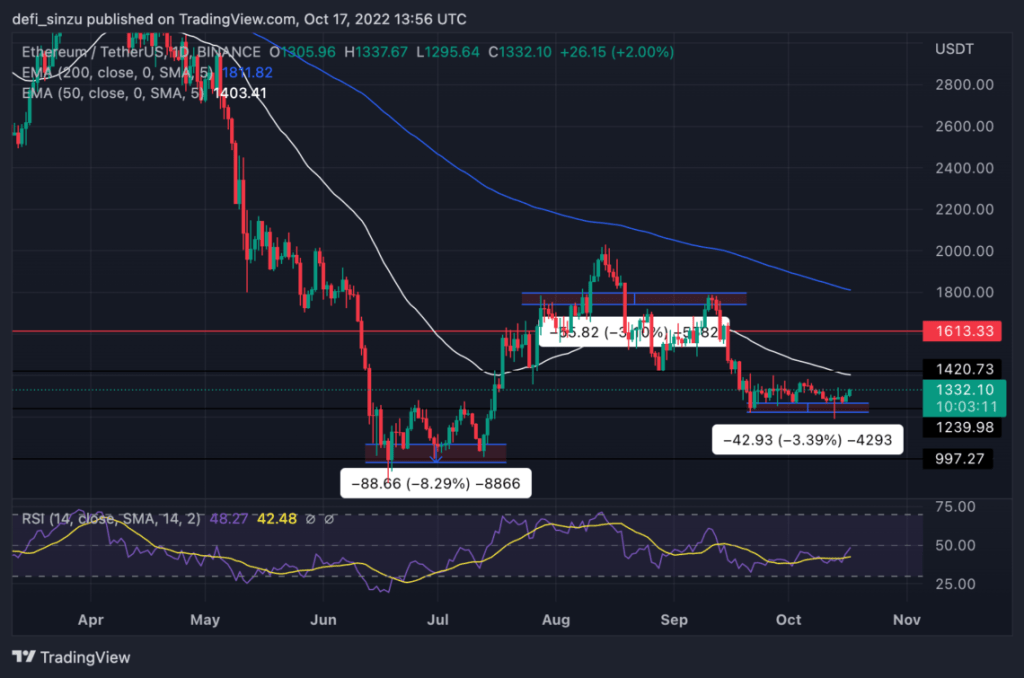

cryptocoin.com As you follow, the altcoin has outperformed BTC in recent months, rising from $1,000 to $2,024. However, in recent weeks, it has failed to sustain its upward trend. So, after the successful realization of “Ethereum Merge, it has become its own shadow.

ETH price was rejected at $2,030. Moreover, it continued its downward trend. ETH price was rejected when the price tried to flip $1,400. The altcoin slumped into a $1,270 zone that acts as key support. ETH is trading below the 50 and 200 Exponential Moving Average (EMA) on the daily time frame. If ETH maintains its bearish structure, it is possible to retest $1,000 as a demand zone. For the price to look safe, ETH needs to turn the $1,400 support.

Binance Coin (BNB)

BNB was rejected at the $300 resistance. It is currently trading at $270. BNB lost its bullish structure despite showing strength. The altcoin dropped to $268 as it bounced to reclaim the support zone at $270. BNB must rise to the $280-290 zone for the price to stay safe.

BNB’s price is trading below the 50 and 200 Exponential Moving Averages (EMA) at $272. Also, $280 and $300 are acting as resistance for BNB price.