Bitcoin (BTC) starts the second week of September. They are still trying to consolidate $20,000 as support as the bears take control this week. The biggest cryptocurrency emerges from a sideways weekend with a weekly close at almost exactly $20,000. But the struggle at this important psychological level is already underway. Expectations were even more bearish for this month. Because September has historically not been a good month for BTC, SHIB and altcoins.

But so far, there is little evidence that September will be any different from most of this year. BTC fell 1.5% in September 2022 and while losses are modest, there are plenty of potential catalysts on the horizon. Macroeconomic turmoil remains the main determinant in much of the world. Also, the emphasis is increasingly shifting to Europe as the energy crisis unfolds and the euro hits two-year lows against the dollar.

7 things that will affect BTC, SHIB and altcoins this week

However, macro BTC price dip signals have been flowing in recent weeks. This leaves a handful of analysts quietly unsure of the outlook. cryptocoin.comAs a result, we have compiled 7 developments that are likely to impact BTC, SHIB, and altcoins this week.

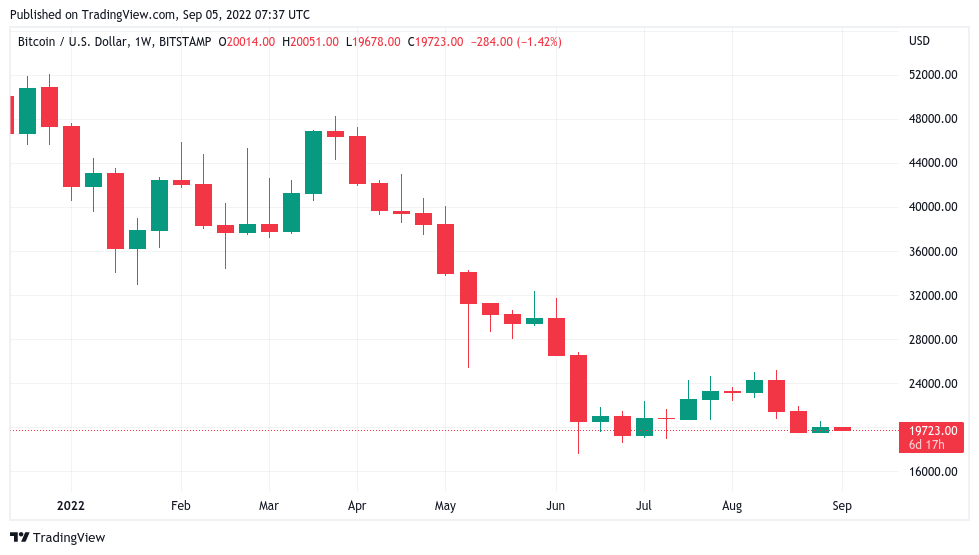

BTC just sealed $20,000 weekly close

This weekend has been an easy one for Bitcoin bulls. Because the lack of volatility caused volatility around $20,000 for two days. The absence of general direction meant that current price forecasts remained intact. Meanwhile, even the weekly close continued to drop the market forecast. This came in at almost exactly $20,000 on Bitstamp, according to TradingView data. Then, in the first hours of the new week, downward price pressure took over SHIB and Bitcoin.

However, there are traders waiting for a retest of the June lows near $17,600. These analysts saw little reason to change their perspective. Popular analyst Capo reiterated his forecast of a short squeeze at $23,000. He then said he expects a return of $16,000 as a potential base. Meanwhile, fellow trader Cheds confirmed that BTC “continues the range” after jumping from low ranges to weekly closes.

European energy crisis scares crypto markets

On September 13, US CPI data for August will be released. In other words, the FED will be in the background in Macro markets this week. However, events in Europe are already providing a new stage for volatility. Therefore, BTC, SHIB and altcoin investors cannot be listened to. As of September 5, the euro fell below $0.99. Thus, it started trading at its lowest level against the US dollar since September 2002.

The weakness emerged after Russia suspended its largest gas pipeline to the EU. It seems that this energy crisis will continue to affect the euro and general macro markets this week as well. The scale of the crisis is so great that even PlanB, creator of Stock-to-Flow Bitcoin price patterns, suggested that the opportunity to buy at the bottom should come after the basics. Let’s also mention that this suggestion came even though Bitcoin was close to two-year lows. PlanB said:

“People who have to choose between food and gas should not buy Bitcoin”

US dollar hits 20-year highs

As last week, the US dollar remains strong against BTC, SHIB and altcoins. The US dollar index (DXY) traded at two-year highs throughout 2022. September was no exception to this trend. However, DXY passed 110 this week for the first time since June 2002. Accordingly, the euro was just one of the currencies that suffered from the bull run of the dollar. For this reason, many analysts are expecting a drop in cryptocurrencies this week.

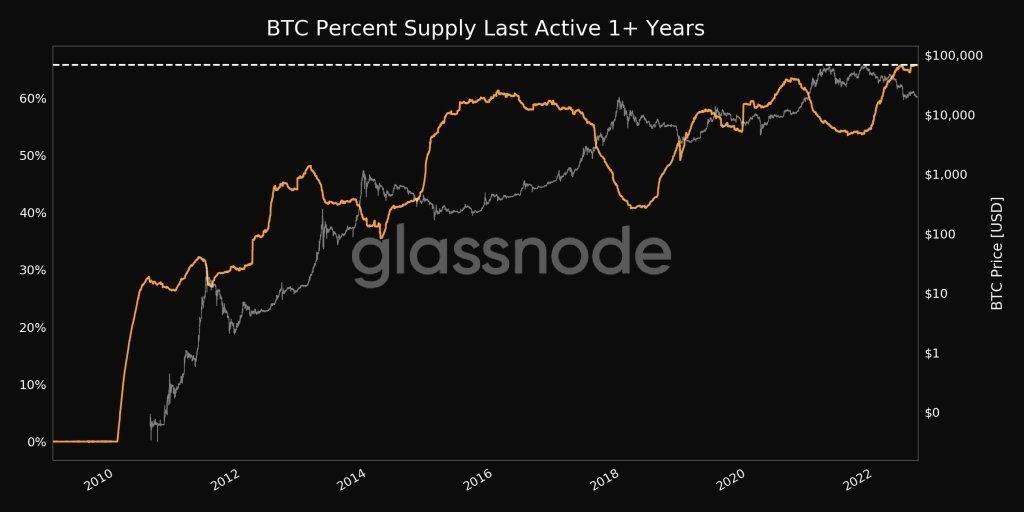

Hodlers are getting stronger

In classic bear market fashion, long-term holders kneel to weather the BTC price storm. They even break local records in the process. Remarkable data came this week from on-chain analytics firm Glassnode. Glassnode confirms that even cryptos bought just a year ago are becoming more and more dormant. That is, buyers refuse to surrender despite unrealized losses. The percentage of BTC supply that has been stable in his wallet for a year or more has reached 65.78%, making ATH.

The number of HODLers is increasing markedly. At the same time, as an integral measure, the amount of cryptocurrencies held or generally cut from circulation is on the rise. These cryptos have reached their highest level in almost two years. Hodled or lost coins now total 7,464,791 Bitcoins. Meanwhile, other monitoring resource Whalemap stated that the Bitcoin spot price has fallen below the crypto price realized in one to two years. BTC realized price is currently located at $21,600.

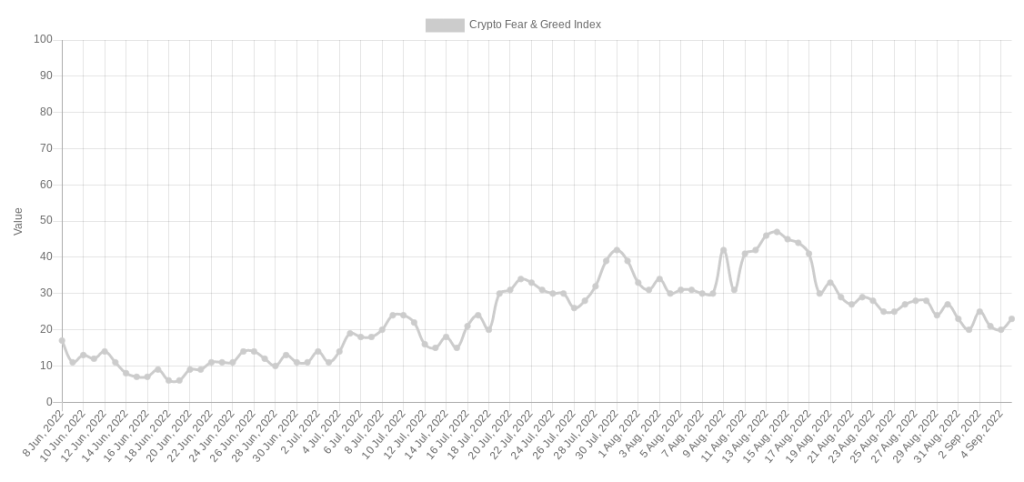

Market sentiment returns to six-week bottom

The crypto market seems to have completely reversed the bullish phase that started in the second half of July. Fear reigns among BTC, SHIB and altcoin investors. Crypto Fear & Greed has dropped to the 20/100 index this weekend. So it’s firmly back in the “extreme fear” territory. In the last three weeks alone, the index has fallen by more than half. Thus, it points to the stress and fear experienced by market participants. The 20/100 score was last revealed on July 18.

Ethereum Merge Bellatrix upgrade is coming

Ethereum Merge has been pricing the market for a long time. ETH has made huge gains due to this catalyst, while the Bitcoin price has fallen in recent months. Now comes Bellatrix, the first leg of the Merge upgrade. The Bellatrix upgrade will take place on September 6th. A series of upgrades will follow after Bellatrix. Eventually, on September 15, Ethereum will transition to PoS. Merge looks set to continue as an important catalyst for Ethereum and related altcoin projects.

ECB rate decision

Amid the energy crisis, the European Central Bank (ECB) will meet this week. The ECB is expected to raise interest rates this week to rein in inflation throughout the union. Market experts predict that the bank will increase by 0.50 basis points. If that happens, the total interest rate on the ECB will have risen to 1. The question of whether this move by the ECB will be enough to rein in inflation and increase the strength of the euro against the dollar remains unclear.