According to CoinMarketCap, Arbitrum coins are main layer-two Blockchains that use optimistic rollups for Ethereum. Due to their high capacity, they can handle up to 40,000 transactions per second using significantly less gas. In this article, let’s take a look at the best Arbitrum coins that should be on the radar for the rest of the year.

The best Arbitrum coins you should watch in 2022

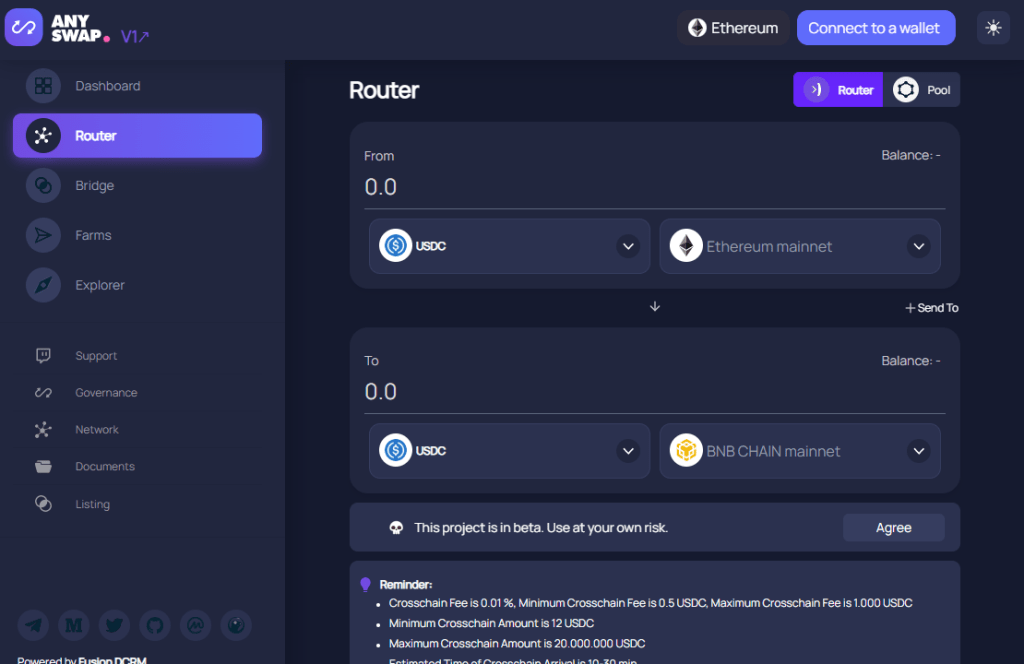

Anyswap (ANY)

AnySwap enables token exchange between various platforms as a fully distributed protocol. XRP, Litecoin, and Tether are just a few of the cryptocurrencies that integrate Anyswap, which is at 95%.

At the same time, thanks to Fusion’s Decentralized Control Rights Management (DRCM) technology, it can better control the flow of token transit between blockchains. Anyswap’s token allows users to exchange tokens instantly. Additionally, Anyswap traders are free to choose which coins to list on the Anyswap DEX.

Stargate Finance (STG)

Stargate is described as a liquidity transport protocol that runs operations at the core of Omnichain DeFi. A transmission sent on the source Blockchain is guaranteed at the destination. Transfers made through Stargate Finance have instant guaranteed certainty.

On the other hand, liquidity providers can also collect LP to earn STG token rewards. Additionally, they can use Stargate liquidity providers to collect LP token farming tokens in exchange for STG payments. STG holders also have the option to lock STG in exchange for Stargate’s management token and STG.

Frax Share (FXS)

Frax Share is the first stablecoin system based on a fractional algorithm. Currently implemented on Ethereum, Frax is open source, permissionless and runs entirely on Blockchain. The ultimate goal of the Frax protocol is to replace cryptocurrencies with a highly scalable, decentralized, algorithmic form of money, especially with a fixed supply like Bitcoin.

The following ideas are included in the protocol:

- Fractional-Algorithmic. Frax is a distinctive stablecoin that is partly algorithmic and partly backed by collateral.

- Decentralized and minimized management: Community emphasizing an algorithmic approach without active management.

- Fully on-chain oracles: Uniswap (time-weighted average prices for ETH, USDT and USDC) and Chainlink (USD price) oracles are used by Frax v1.

- Two tokens: Stablecoin FRAX has a narrow price target of $1 per token. Frax Shares (FXS), a management token that generates fees, seigniorage income and excess collateral value

MAGIC (MAGIC)

Thanks to MAGIC, MAGIC and NFTs, Treasure is the decentralized video game console that connects games and communities. Some of the infrastructures established on the platform:

- Marketplace: Trove is a gamified NFT platform on Arbitrum that accepts MAGIC and ETH as payment methods.

- Economy: Through a generalized economic architecture aimed at promoting resource sharing and cross-metaverse interactions, Bridgeworld powers the shared economy for Treasure.

The MAGIC token acts as the glue that holds together Treasure’s thriving gaming and NFT ecosystem. Moreover, the communities, metaverses and DeFi infrastructure created in Treasure support MAGIC. MAGIC specifically aims to make MAGIC increasingly rare as we weave an ever-expanding network of narrative bridges within the metaverse ecology of Treasure.

Celer Network (CELR)

Another Arbitrum coin Celer allows users to access tokens, DeFi, GameFi, NFTs, governance and more with one click on many Blockchains. Users of dApps powered by CELR enjoy the simplicity of a single-transaction interface from the Blockchain. Meanwhile, they can benefit from a rich multi-chain ecosystem.

Celer cBridge provides layer-2 aggregations for more than 110 tokens on 30+ Blockchains. Meanwhile, according to its website, cBridge processes nearly $8 billion in cross-chain asset transfer volume for more than 160,000 unique clients across 30+ blockchains. Users can also stake their assets and receive rewards when handing over transaction verification to “agents”.