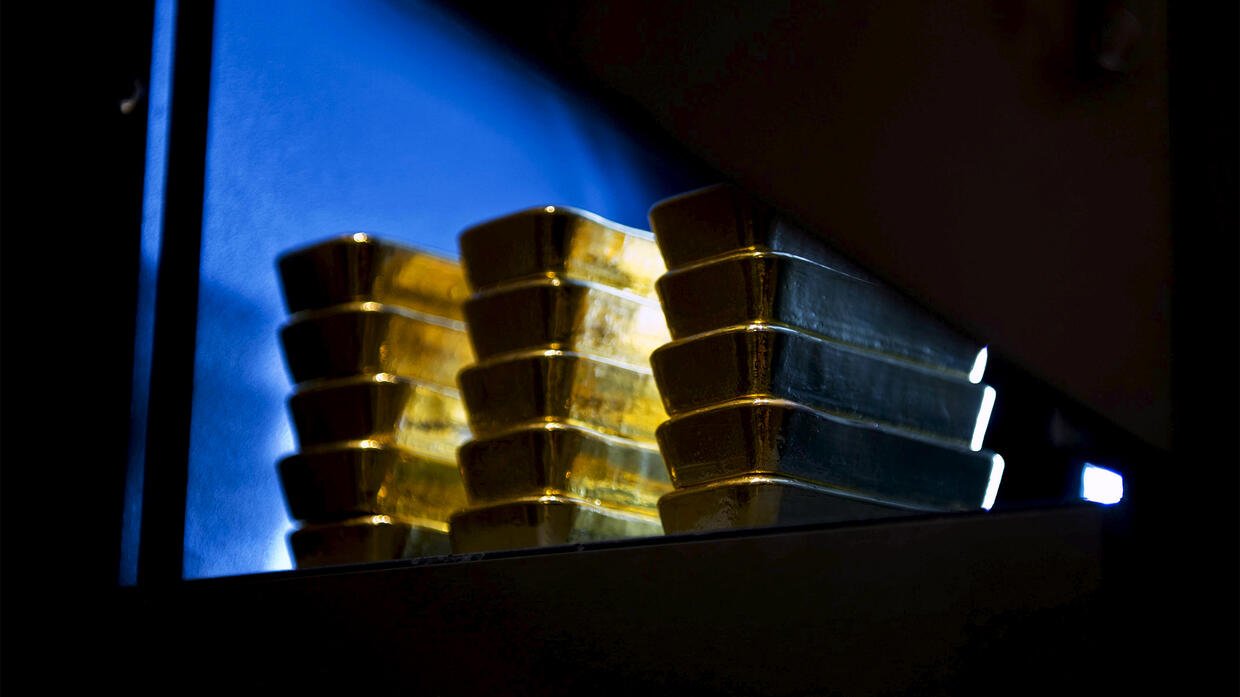

Gold prices are traded in the fall trend. While the Golden investors were worried about the FED meeting, new estimates came from analysts. Here are current gold price forecasts…

Analysts participating in the Reuters survey shared the 2021 and 2022 gold price forecasts!

According to Reuters’ latest survey, optimism in vaccine -based economic recovery caused market participants to reduce gold price forecasts for 2021 and next year. The survey, attended by 42 Analysts and Trader, gave an estimation of a median of $ 1,784 per ounce and $ 1,743 for 2022 on behalf of gold for gold.

This indicates sharp decreases in a similar survey three months ago, respectively, according to estimates of $ 1.925 and $ 1.908, respectively. According to the questionnaire, analysts estimate that silver will be $ 25.75 per ounce this year. In the previous survey, analysts pointed to 25.86 dollars. Most of the participants said that silver will perform better than Gold this year thanks to strong industrial consumption.

Karen Jones drew attention to the following levels by sharing gold estimates

Karen Jones, who is the head of the FICC Technical Analysis Research in Commerzbank, commented on the gold market. The analyst is waiting for the rise again because the gold price protects the $ 1,730/$ 23 region. Karen Jones shared gold predictions and drew attention to the following levels:

The 2019-2021 Support Line comes from $ 1,697. Gold’s Upper Movement fell from $ 1,800,64 in 55 -day MA. The more worrying is the fact that the counts of the Elliott wave become more negative and that it points to a withdrawal towards the $ 1,730/23 dollars. On condition that he stays there, we should try the upper side once again. Above the 55 -day MA, 200 -day MA $ 1,856,36, and the downward trend lies in $ 1,876. We suspect that this will hold the upper side for now. Lock support is around $ 1,697 and the lowest level of June 2020 is $ 1,670. If we stay upstairs here, we will assume that there is an inverse prejudice.