Cryptocurrency exchanges are sharing their reserves after the FTX crisis. However, the sum of the altcoins and assets in their accounts draws attention.

BTC and altcoins owned by exchanges

After the FTX crisis, cryptocurrency exchanges attracted attention. Several crypto exchanges made shares for their BTC and altcoins. Crypto exchanges continue to work very fast and intensely to publish their reserve data. But with most situations in the industry, there are some that are inconsistent.

FTX and Alameda have provided a lot of security to the FTT token. With all this, the process leading to bankruptcy accelerated. Crypto investor and analyst John Brown studied the reserves of various crypto exchanges. What he found was quite surprising, to say the least.

Bitfinex’s BTC+ETH accounts for 91% of the exchange’s reserves, while Coinbase accounts for 63%. But Binance is only 15%, KuCoin is 19%, Huobi is 22%. According to @john_j_brown. pic.twitter.com/p7KU04iHbu

— Wu Blockchain (@WuBlockchain) November 23, 2022

However, John Brown revealed that Bitfinex has the most Bitcoin and Ethereum reserves. For this, it is seen that CryptoQuant data is used. More than 90 percent of the reserve assets held on the exchange are assets in Bitcoin or ETH.

CMC gives different results

However, data from CoinMarketCap owned by Binance reports slightly different figures. In the newly launched foreign exchange reserves feature, CMC shared the reserves held by Bitfinex. It is stated that Bitfinex has reserves of 7.6 billion dollars. As a result, it was reported that 35 percent were own LEO tokens and only 58 percent were BTC and ETH.

Also, according to the data, Crypto.com revealed that it has 52 percent reserves in Bitcoin and ETH. However, CMC provided only 37 percent for BTC and ETH. It is also reported that SHIB from altcoins is almost 20 percent. The exchange’s own CRO token has been shaken by reports that its reserves are concentrated in illiquid tokens like the Shiba Inu. OKX ranked third with 45 percent for BTC and ETH reserves. CMC’s figures, on the other hand, reported 25 percent BTC, 20 percent ETH for OKX. Finally, OKX has a 48.5 percent USDT reserve.

Binance was the most inconsistent in terms of BTC and altcoins it owns.

The biggest discrepancy was seen on leading crypto exchange Binance. According to data provided by CryptoQuant, only 15 percent of its reserves are in BTC and ETH. Binance’s CMC reports that only 21.5 percent of its reserves are BTC and ETH. With all of this, Binance holds stablecoins BUSD and BNB, about 41.5 percent in reserves.

According to Changpeng Zhao, BUSD is independently issued by Paxos, a fully regulated stablecoin issuer.

One of the exchanges that announced their reserves on Coinbase

BTC and altcoins owned by Coinbase have just been released. November 23 (today) Coinbase CEO Brian Armstrong announced that they have 2 million BTC worth approximately $33 billion at current prices. Coinbase, on the other hand, does not have a local altcoin project. Because of this, analysts state that at least this exchange is less inconsistent.

If you see FUD out there – remember, our financials are public (we're a public company) https://t.co/ayzN0zaqgT

— Brian Armstrong (@brian_armstrong) November 22, 2022

Worried investors wondered what to do after what happened in FTX. On November 9, KuCoin announced that they will release the Merkle tree Proof of Reserv within a month. It also became one of the companies that announced that they would work in close cooperation with audit institutions to build trust and transparency in the sector. However, following the announcement, the crypto community fears that the exchange’s reserves are similar to the position that caused the FTX crisis.

Kucoin made statements about its BTC and altcoins

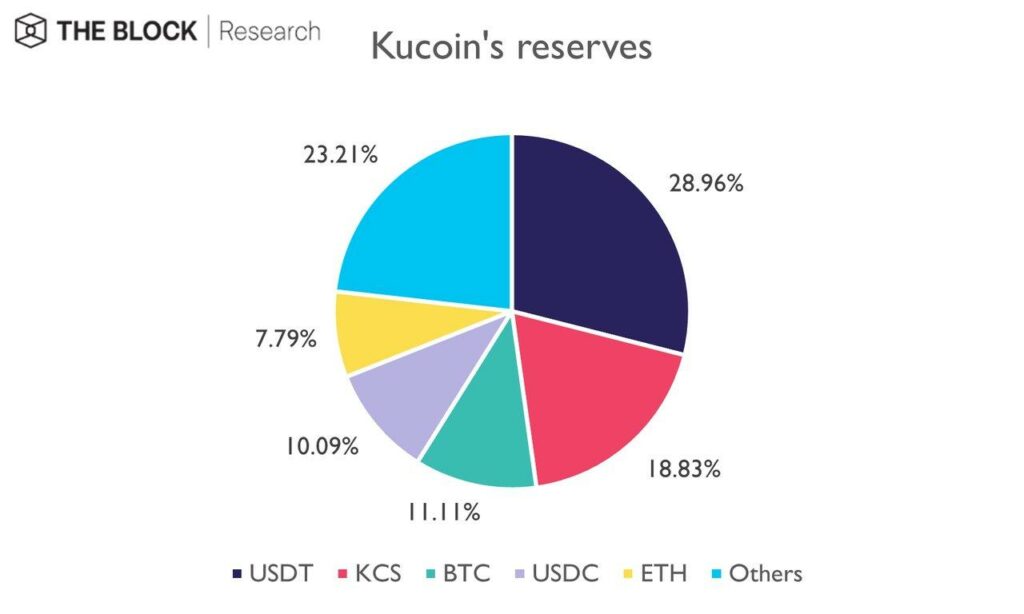

On Monday, The Block Research, the leading research platform on the crypto industry, wrote:

KuCoin holds about one-fifth of its reserves in its own exchange token, KCS. If this percentage starts to increase rapidly, it may be cause for concern, just as illiquid FTT makes up the bulk of FTX’s balance sheet.

However, KuCoin CEO Johnny Lyu recently made a statement. He said that KuCoin’s financials are in top shape and have eliminated any FUD targeting the exchange:

Since its launch in 2017, KuCoin has always adhered to long-term growth and risk-free business strategy. This has helped us get through bear cycles and market turbulence and continue to grow.

Since its launch in 2017, KuCoin has always adhered to a long-term growth and risk-free business strategy. This helped us go through bear cycles and market turbulence, and continue growth. https://t.co/YO9ZlHRWeL

— Johnny_KuCoin (@lyu_johnny) November 20, 2022