Anthony Scaramucci, the founder and former White House Communication Director of Skybridge Capital, continues to be one of Bitcoin’s most voice defenders. Earlier last year, he predicted that BTC would exceed $ 100,000 in 2024 due to the increasing demand for Bitcoin ETFs. Scaramucci announced that more than 50 %of its portfolio has allocated it to BTC. It also includes Altcoins in its crypto portfolio. So how did his portfolio perform at 2025?

Anthony Scaramucci’s crypto portfolio and performance

Scaramucci’s portfolio has gained mixed results so far in 2025. Since the beginning of the year, Bitcoin has gained a modest gain of 1.48 %despite macroeconomic winds. Leading crypto money is already traded around $ 96,900. However, Solana, which was preferred by Scaramucci and Skybridge Capital instead of Ethereum (ETH), experienced a slight decrease of 0.66 %.

BTC and Solana price graph from New Year’s Eve.

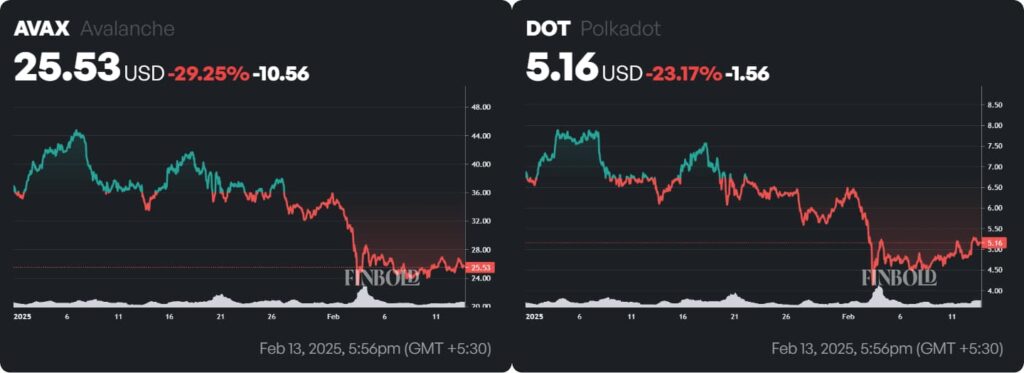

BTC and Solana price graph from New Year’s Eve.Bitcoin continues to be the biggest holding of Scaramucci, which is all over 50 %of its portfolio allocated to BTC. The famous billionaire also announced that he has invested in Solana (left), Avalanche (Avax) and Polkadot (DOT). Speaking at Bankless Podcast at the beginning of January, Scaramucci reiterated that he was the best choice among Layer Blockchains, citing Solana’s speed and low trading costs. Avalanche and Polkadot performed much worse. AVAX decreased by 29.28 %, while DOT lost 23.17 %.

Avax and DOT price graph from New Year’s Eve.

Avax and DOT price graph from New Year’s Eve.The decline in these assets concentrated after the Trump administration’s announcement of new customs tariffs on February 1st and triggered a large -scale sales wave in risky assets. The description of higher CPI data than expected also offered inflation fears and led to sharp corrections in the crypto market.

An Investment of $ 1,000: Where does it stand right now?

To put the performance of the portfolio on a perspective, an investment of $ 1,000, which is equally divided into assets at the beginning of 2025, is currently worth $ 870.93. Bitcoin’s earnings and Solana’s humiliation provide some stability, while the sharp losses in Avax and DOT lead down the overall performance, leading to a decrease of 12.91 %. The recovery ability of the portfolio will probably depend on the course of Bitcoin, the regulatory clarity of selected assets and the changing investor sensitivity. However, the performance of the portfolio so far serves as a sharp reminder of risks associated with concentrated crypto investments.