The gold price fell as the US dollar rebounded on recession fears. The bond massacre triggered the rally in US interest rates, increasing the weight on gold. Market analyst Anil Panchal states that gold prices continue to be under pressure. According to market analyst Dhwani Mehta, gold markets are holding their position for the next drop in the middle of a dramatic week. We have compiled Anil Panchal and Dhwani Mehta’s analysis of gold price for our readers.

“US NFP report will be crucial for yellow metal”

Gold on the day as traders reacted to the latest risk aversion mood during full markets on Friday Anil Panchal, who stated that he continued to stand back around $ 1,873 with a decrease of 0.20, continues his analysis in the following direction. The metal’s declines could also be linked to anxiety ahead of the key US jobs report for April, given the latest Fed guidance and the market’s U-turn on Thursday.

Going forward, the Fed’s continued rejection of a larger rate hike cycle, as reported in Kriptokoin.com news, will continue in St. Louis Federal Reserve (FRED) data will be crucial for the US NFP gold report, given the recent rise in inflation expectations as illustrated by a 10-year break-even rate of inflation. Forecasts show that the US Non-Farm Employment (NFP) cap will ease from 431K to 391K, and the Unemployment Rate could drop from 3.6% to 3.5%.

Anil Panchal’s technical analysis of gold

gold prices from the 200-day EMA and the four-day EMA as traders prepare for the US NFP reversed the rebound of the monthly horizontal support at the beginning of the week. The latest pullback highlights the 21-day and 50-day EMAs at around $1,908 and $1,912, respectively, as the short-term key bearish MACD signals and the weak RSI form barriers around them.

Therefore, the precious metal looks more likely to drop further, with a focus on the 200-days EMA at $1,858 as key nearby support before January, an area around $1,850-53. If gold prices dip below $1,850, the bears could target $1,810 and $1,800 before following the annual low surrounding $1,780.

Alternatively, a clear upside break of $1,912 would need confirmation from the January-March 50.0% Fibonacci retracement to challenge the $1,960 resistance convergence, including the convergence of the March and 50% downtrend trendline.

“King dollar will remain the most important asset against gold”

“Gold price finding a foothold above $1,900 Dhwani Mehta continues his analysis in the following direction. The less hawkish Fed-led dollar sell-off turned out to be temporary as recession fears hit the market following the BoE’s warning and triggered massive risk-off flows to the safe-haven dollar.

The ‘Sell everything’ mode is back as bond markets plummet with equities. In uncertain economic times, in the face of the Ukraine crisis and China’s covid lockdowns, the king dollar will remain the most important asset against gold.

Important levels to watch for gold price

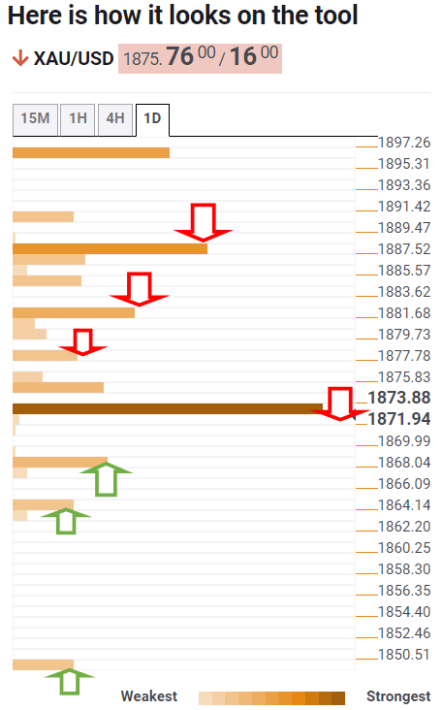

Technic Confluences Detector used by Dhwani Mehta allows the gold price to make a small jump and It shows that it is trying to recapture the critical resistance at $1,874, the intersection of the previous day, month and week lows.

SMA5 at $1,878 will one day be examined if the golden bulls flex their muscles on the way to recovery. Further higher, gold buyers will one day aim 23.6% Fibonacci at $1,881 above which a fresh upswing to $1,887 is at the door. This level is the intersection of the four-hour SMA50, one-day Fibonacci 38.2% and one-week Fibonacci 23.6%.

Alternatively, immediate support is seen at $1,869 one-week pivot point S1. The next downside target is predicted at $1,863 one-day pivot point S1. A sharp sell-off on a sustained breach of the latter cannot be ruled out towards the $1,850 demand area, where the one-month pivot point S1 coincides with the lower one-day Bollinger Band. The straw that will break the neck of the golden bulls is set at $1,835, which is SMA200 one day.