China’s Contradictory Stance on Blockchain and Cryptocurrency

In the complex landscape of finance, China presents a paradox: while the government firmly rejects cryptocurrency, it enthusiastically embraces blockchain technology. This dual stance is evident as Beijing implements stringent bans on crypto trading while simultaneously investing in the infrastructure necessary to support blockchain innovation.

As Hong Kong steps forward with regulated cryptocurrency markets, industry insiders suggest that a loophole may be emerging. If China permits its investors to acquire U.S. stocks through the Qualified Domestic Institutional Investor (QDII) program, why shouldn’t the same apply to Bitcoin? According to an expert speaking at Consensus Hong Kong, the underlying issue is one of control, and it appears that Beijing may have discovered a method to maintain it.

Chinese investors currently have two primary avenues for purchasing and trading foreign stocks. The first is the QDII program, which allows select investors to buy U.S. ETFs using Renminbi (RMB). The second involves the Shanghai-Hong Kong and Shenzhen-Hong Kong Connect programs, which enable Chinese investors to trade Hong Kong stocks through mainland securities firms, with all transactions settled in RMB.

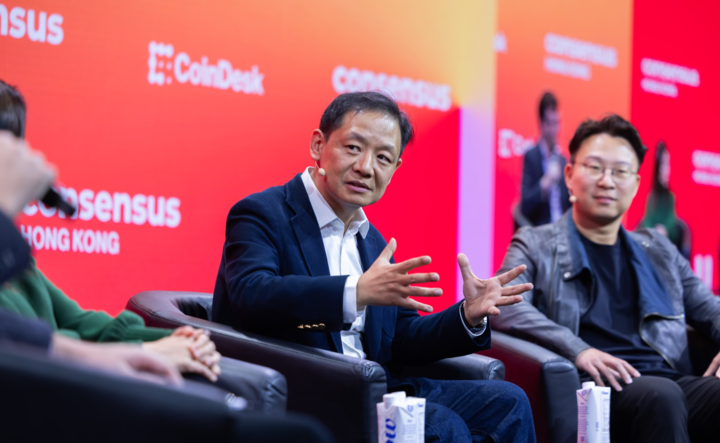

“The key [with these systems] is that capital never flows freely out of China,” stated Yifan He, CEO of Red Date Technology, during his presentation at Consensus Hong Kong. He elaborated that if this principle applies to the stock market, it could very well extend to cryptocurrency as well.

He pointed out that the primary regulatory challenge is not the cryptocurrency itself, but rather the stringent capital controls that are designed to ensure that funds do not move freely across China’s borders. These controls serve to prevent excessive currency fluctuations and mitigate the risk of capital flight, thereby safeguarding the stability and value of the RMB.

This regulatory framework is also a significant reason why Hong Kong’s crypto ETFs, which allow for in-kind redemptions, have not been permitted on the mainland.

“What’s the difference between a Hong Kong-regulated stock and a Hong Kong-regulated crypto asset?” He continued, emphasizing that if a system exists for purchasing and trading in RMB without allowing money to leave China, then it could simply be viewed as another regulated investment product.

However, this model would not enable Chinese investors to self-custody their cryptocurrencies. Instead, purchases would be held by an intermediary, such as a licensed securities firm. “They buy crypto directly, but it’s not like they’re holding it themselves,” He clarified. “The security company in the middle actually holds it for you.”

This intermediary model aligns seamlessly with China’s existing approach to stock and ETF investments. Just as mainland investors can trade U.S. ETFs through the QDII program without ever taking direct custody of the assets, they could gain exposure to cryptocurrencies without owning the underlying tokens—effectively ensuring that no funds cross international borders.

For a nation boasting 200 million retail investors and an economy in dire need of stimulation, the potential for regulated crypto access via Hong Kong’s sandbox could present Beijing with a carefully calculated compromise.

Distinguishing Blockchain from Cryptocurrency

China has consistently championed blockchain technology while adopting a cautious stance toward cryptocurrency. “We don’t allow guns in China, but we can still make steel,” He remarked, using this analogy to illustrate the distinction. “The technology itself is not regulated, enabling the development of various applications. However, when specific applications evoke regulatory scrutiny, that’s where the line is drawn.”

Based on his discussions with financial regulators, He suggested that a shift may be on the horizon. “I see some signals from financial regulators,” he noted. “They’re beginning to engage in discussions about Bitcoin, indicating a need for more research and understanding of digital assets.”

Could this signal a path toward broader acceptance? Two years ago, He would have deemed it improbable, stating there was “zero chance.” Today, he is more optimistic, estimating that there is now over a 50% chance of significant adoption within the next three years.

“And you can take those odds to Polymarket,” he concluded, leaving the audience to ponder the evolving landscape of cryptocurrency in China.